SIP reports steady growth in revenue from utility services and real estate sales, driving an increase in profits.

Source: VietstockFinance

|

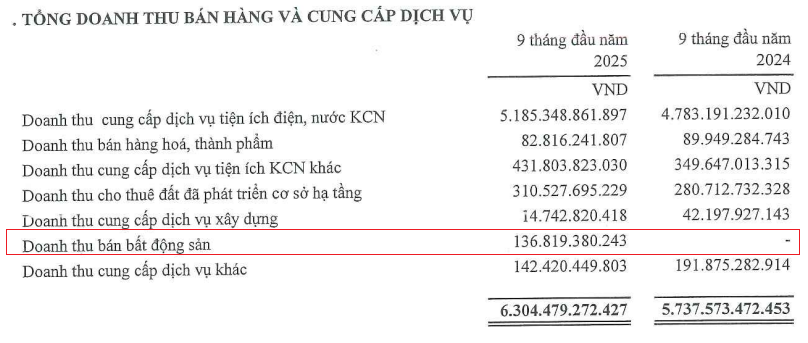

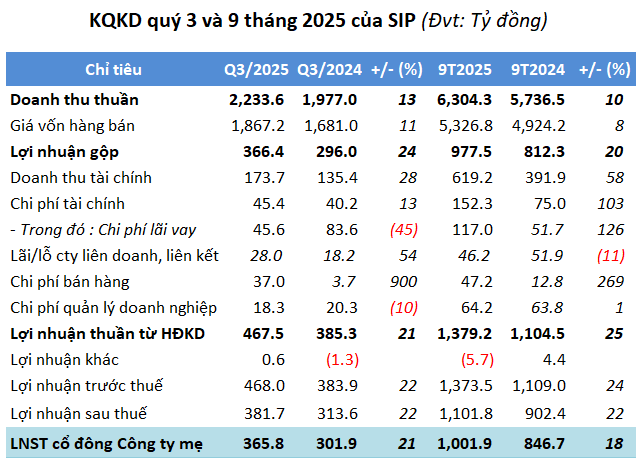

In the first nine months, net revenue exceeded 6,304 billion VND, marking a 10% increase. Of this, 82% stemmed from utility services in industrial zones (IZs), rising 8% year-on-year, while real estate sales generated nearly 137 billion VND. After-tax profit surpassed 1.1 trillion VND, up 22%.

|

Revenue Structure of SIP in 9M/2025

Source: SIP

|

For 2025, SIP set a cautious business plan with consolidated revenue of 5,657 billion VND and after-tax profit of nearly 833 billion VND, down 33% and 35% respectively from the previous year. After three quarters, SIP has already surpassed these targets by 11% and 32%.

This year, the company plans to lease 45 hectares of IZ land, primarily in Phuoc Dong IZ (30 hectares), with the remainder distributed across Dong Nam, Le Minh Xuan, and Loc An – Binh Son IZs. Additionally, nearly 25,900 square meters of factory space are expected to be leased.

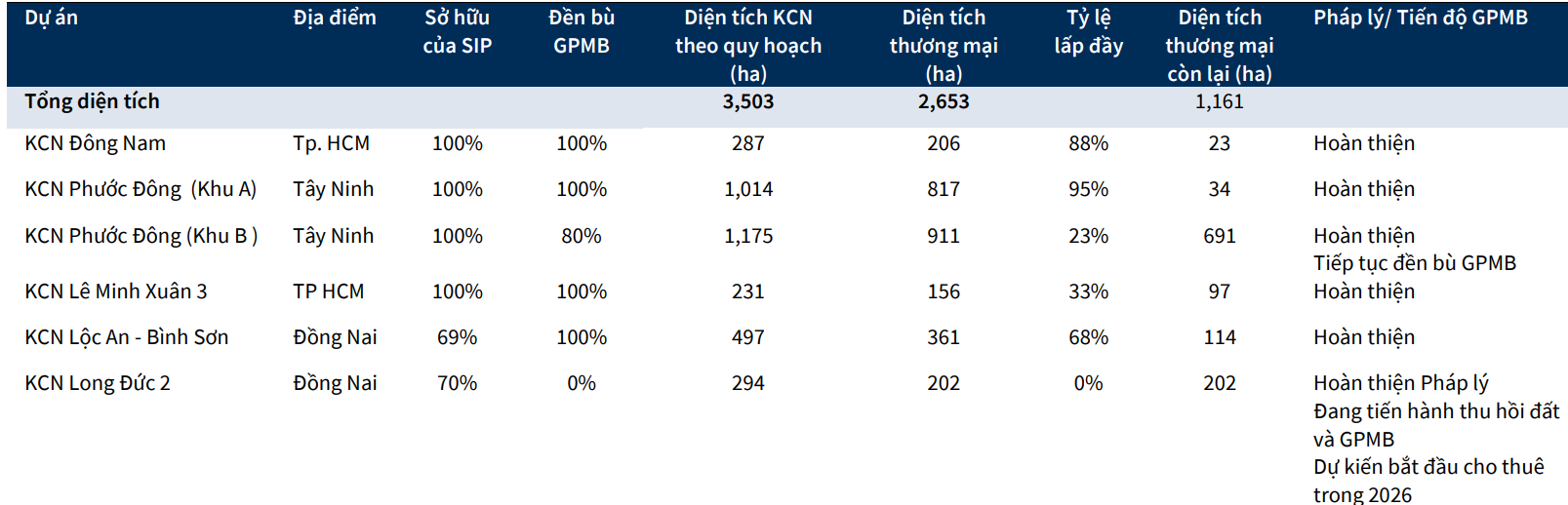

According to KB Securities Vietnam (KBSV), SIP holds a substantial IZ land fund of nearly 1,200 hectares with completed legal procedures, achieving a 78% land clearance rate. KBSV forecasts a slowdown in SIP‘s IZ land leasing in 2025 and 2026F, estimating 50 hectares and 60 hectares, respectively.

|

IZ Land Fund of SIP

Source: KBSV

|

SIP‘s total assets at the end of Q3 exceeded 28.4 trillion VND, a 13% increase from the beginning of the year. Bank deposits totaled nearly 5.4 trillion VND, accounting for 19% of total capital. Inventory stood at over 291 billion VND, down 10%.

Construction in progress rose slightly to over 2,332 billion VND, primarily allocated to the Phuoc Dong Boi Loi IZ-Urban-Service project (over 1 trillion VND), Le Minh Xuan 3 IZ (729 billion VND), Loc An – Binh Son IZ (245 billion VND), Dong Nam IZ (215 billion VND), and Thanh Phuoc Port (91 billion VND).

Liabilities reached over 22.7 trillion VND, up 12% from the start of the year. The majority, nearly 13.4 trillion VND (59% of total liabilities), comprises customer prepayments and unearned revenue, mainly from land and factory leasing deposits. Financial debt increased by 28% to nearly 4.6 trillion VND, representing 20% of total liabilities.

– 11:38 31/10/2025

Northern Beer Industry Leader Revives Golden Era, Achieving Highest Profits in 5 Years

Following the post-COVID-19 slowdown, Hanoi Beer-Alcohol-Beverage Joint Stock Corporation (Habeco, HOSE: BHN) is regaining its growth momentum, with revenue, profit, and gross margins all returning to peak levels. Beyond its robust recovery in the beer segment, Habeco has also made a notable mark with nearly VND 5,000 billion in cash deposits.

FPT Retail Surpasses 36 Trillion VND in Revenue After 9 Months

On October 29, 2025, FPT Digital Retail Joint Stock Company (FPT Retail, HOSE: FRT) announced its consolidated business results for the first nine months of 2025, reporting a revenue of VND 36,170 billion and pre-tax profit of VND 804 billion.