On October 29, Hoang Anh Gia Lai Joint Stock Company (stock code: HAG), chaired by Mr. Doan Nguyen Duc (known as Bau Duc), announced a resolution to list the shares of its subsidiaries and launch significant investment projects in the agricultural sector.

Accordingly, HAG plans to list the shares of Hung Thang Loi LLC in 2026 and Gia Suc Lo Pang JSC in 2027. The company stated that these subsidiaries are currently selecting consulting firms to appraise their enterprise value, develop issuance plans, choose suitable stock exchanges, and finalize the listing roadmap.

As of September 30, Hoang Anh Gia Lai holds 98.78% of the charter capital in Hung Thang Loi Gia Lai, a company operating in Gia Lai specializing in planting services, and 99.91% of the capital in Gia Suc Lo Pang, also based in Gia Lai, focusing on cultivation and livestock farming.

Beyond the listing plans, HAG is strengthening its agricultural segment by expanding its coffee and durian cultivation areas. In 2025, the company will plant 2,000 hectares of Arabica coffee and subsequently invest in an additional 1,000 hectares, bringing the total coffee area to 3,000 hectares by year-end.

From 2026 to 2027, the annual new planting area is expected to reach 3,500 hectares, increasing HAG’s total coffee area to 10,000 hectares by the end of 2027, with 70% Arabica and 30% Robusta.

HAG plans to list the shares of Hung Thang Loi LLC in 2026 and Gia Suc Lo Pang JSC in 2027.

Regarding durian, HAG currently owns 2,000 hectares and plans to plant an additional 1,000 hectares in 2026 and 2027, increasing the total area to 3,000 hectares by the end of 2027.

HAG’s Board of Directors also approved the construction of two large-scale coffee processing plants in Laos (1,500 tons/day capacity) and Vietnam (700 tons/day capacity), utilizing advanced technology to produce high-quality green coffee beans, leveraging geographical and soil advantages.

Finally, Hoang Anh Gia Lai approved the investment in a cold storage system for durian freezing, with a total warehouse area of 20,000 m², and three durian processing plants in Laos and Vietnam.

These projects are expected to contribute to HAG’s goal of achieving a profit of VND 5,000 billion by 2028.

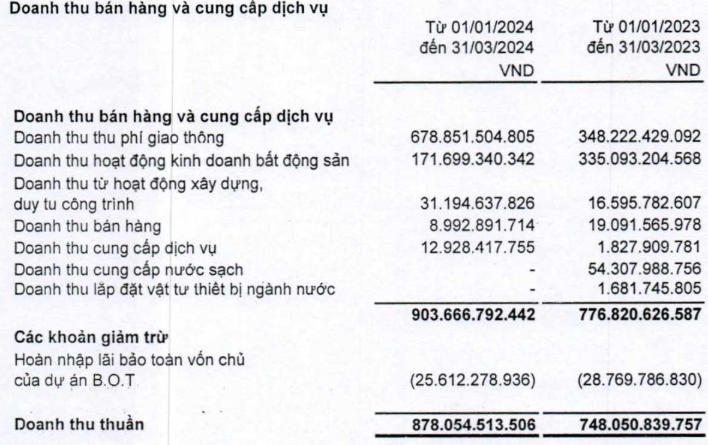

In Q3 this year, HAG reported revenue of VND 1,905 billion, an increase of VND 442 billion compared to the same period last year. After deducting expenses, Hoang Anh Gia Lai’s net profit reached VND 432 billion, a 23% increase compared to Q3 2024.

For the first nine months of the year, Hoang Anh Gia Lai achieved revenue of VND 5,628 billion, a 32% increase compared to the same period in 2024. Net profit reached VND 1,311 billion, up from VND 851 billion in the same period last year.

The company’s revenue primarily comes from fruit sales, totaling over VND 4,400 billion. This is followed by merchandise sales, contributing over VND 1,000 billion. Notably, pork sales revenue from the beginning of the year to date reached only VND 173 billion, compared to VND 845 billion in 2024.

Bầu Đức’s Bold 2-Year Plan: Annual IPOs, 7,000 Hectares of New Coffee Plantations, and Massive Factory Investments

On October 28th, the Board of Directors of Hoang Anh Gia Lai Joint Stock Company passed a resolution approving the plan to list its subsidiaries on the stock exchange.

Ea Pöck Coffee Delisted Due to Loss of Public Company Status

Over 9.4 million shares of Ea Pök Coffee Joint Stock Company (UPCoM: EPC) will be delisted from the UPCoM market starting October 24th, as the company no longer meets the criteria for a public company.