Illustrative image

Once a key export for Vietnam’s seafood industry, pangasius is showing signs of slowing growth. Despite a 9% increase in export turnover in the first nine months of 2025 (reaching nearly $1.6 billion), this growth lags behind the overall seafood sector’s 15.5% increase, according to VASEP data.

This slowdown is evident in September’s 5% growth compared to the same period last year, with declines in key markets like the US (-23%), EU (-1%), and Brazil (-16%). Price competition in China and anti-dumping tax risks in the US continue to impact this sector.

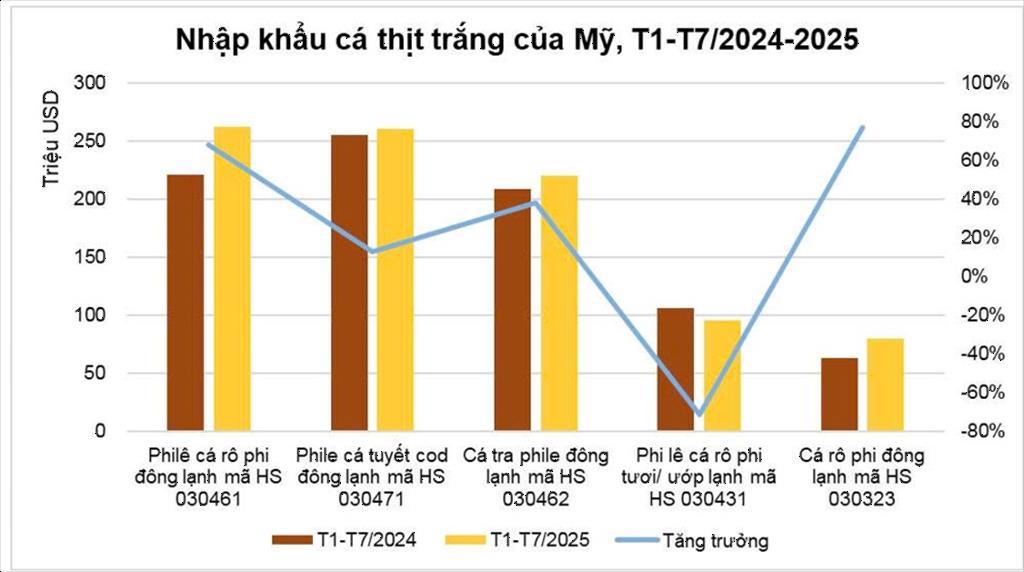

Amid these challenges, tilapia is emerging as a strategic alternative. Frozen tilapia fillets (HS 030461) became the most consumed white fish product in the US by July 2025, as reported by VASEP.

A significant opportunity arises as China, the world’s largest tilapia supplier, faces US tariffs of up to 150% (including Trump’s initial 25% and the new 125%). This has virtually halted China’s tilapia exports to the US, creating a massive market gap for other suppliers.

Seizing this opportunity, Vietnam has ramped up tilapia exports. Customs data compiled by VASEP shows that in the first eight months of 2025, tilapia exports (excluding Nile tilapia) surged by 359% to $52 million, with 70% destined for the US. Total tilapia exports for these eight months (including Nile tilapia, reaching $63 million) surpassed the combined results of the previous five years.

According to VASEP.

Notably, the International Trade Centre (ITC) reports that for frozen tilapia fillets (HS 030461), Vietnam has become the second-largest supplier to the US market, trailing only China. In the first seven months of 2025, the US imported $262 million worth of frozen tilapia fillets globally, a 19% increase year-over-year, indicating strong market demand.

ANV: From 0% to 21.4% Revenue in One Year

Nam Viet Corporation (ANV) exemplifies a successful strategic shift. Its subsidiary, Indo-Pacific LLC, became Vietnam’s largest tilapia exporter in the first eight months of 2025, according to VASEP.

Phu Hung Securities reports that tilapia contributed 21.4% to ANV’s total revenue in the first nine months of 2025 (over $100 million), compared to almost zero in the same period last year.

“Export orders are abundant, and our production can’t keep up with demand,” said Doan Toi, CEO and Vice Chairman of ANV, in early April 2025.

ANV’s fish farming area in Binh Phu

To meet demand, ANV is converting its 600-hectare Binh Phu farming area—its largest—to tilapia, with 70% already transitioned. The company also plans to increase processing capacity to 1,000 tons/day.

ANV’s competitive edge lies in its raw material self-sufficiency. Its tilapia farming costs are just $1.03-$1.07/kg, significantly lower than the market price of $1.26-$1.30/kg. Meanwhile, US selling prices reach $4.02/kg (approximately $4.50), boosting profit margins.

13 Major Corporations Approach ANV Post-Tariff Announcement

Following US tariffs on Chinese seafood, 13 major corporations contacted ANV to explore supply possibilities, highlighting the rapid shift in global supply chains from China to Vietnam.

ANV is also expanding its market reach. Alongside deals with US retailers like Walmart, Costco, Kroger, and Meiji, on July 5, 2025, ANV partnered with AV09 Comercio Exporter Ltda, Brazil’s leading food importer, becoming the first Vietnamese company to officially export tilapia to Brazil.

This strategic shift is reflected in ANV’s financial performance. Its Q3 2025 report shows nine-month revenue exceeding $480 million (+35% YoY) and pre-tax profit surpassing $85 million (+1,220%), achieving 170% of its annual profit target.

Phu Hung Securities notes that tilapia offers higher profit potential than pangasius due to lower farming costs and FOB prices to the US reaching $5/kg (vs. $2.5-$3.4/kg for pangasius).

ANV aims to maintain a 7:3 or 6:4 revenue ratio between pangasius and tilapia, with pangasius remaining the core but tilapia driving growth. The company targets $760 million in revenue and $130 million in pre-tax profit by 2026.

Intense Global Competition

The global tilapia market is highly competitive, with the US attracting major producers like Indonesia (1.2 million tons), Egypt (>1 million tons), and Brazil (>662,000 tons), per VASEP data.

Despite Vietnam’s lower output (around 300,000 tons in 2024), its focus on high-value frozen fillets for the US market is seen as a suitable strategy.

Vietnam’s tilapia industry faces challenges, according to VASEP, including limited seed quality, disease risks (especially TiLV virus), reliance on imported feed, tariff barriers, technical standards in markets like the US, competition from Brazil and China, and a weak domestic supply chain.

For sustainable growth, VASEP recommends integrated solutions: improving breeding and farming technology, feed self-sufficiency, investing in value-added processing, obtaining ASC and BAP certifications, supply chain transparency, trade promotion, tariff negotiations, and government policy and infrastructure support.

Nguyen Hoai Nam, VASEP Secretary-General, predicts the global tilapia market could reach $14.5 billion by 2033. This presents an opportunity for Vietnam to make tilapia its next flagship product after shrimp and pangasius.

Aquaculture Experts Predict 2025 Seafood Exports Unlikely to Hit $11 Billion Target

Despite Vietnam’s seafood exports surpassing $8 billion in the first nine months of the year, marking a nearly 16% increase compared to the same period last year and fueling optimism for a promising year, VASEP experts assert that achieving the $11 billion target by 2025 remains a significant challenge.

Unlocking Vietnam’s Billion-Dollar Economic Potential: The Golden Land Opportunity

Vietnam boasts a myriad of advantages that set it apart as a dynamic and vibrant destination. From its rich cultural heritage and breathtaking landscapes to its rapidly growing economy and strategic geographic location, Vietnam offers unparalleled opportunities for both personal and professional growth. Its diverse ecosystems, bustling cities, and warm, welcoming people make it a unique and compelling place to explore, invest, and thrive.

U.S. Urged to Objectively Review Seafood Trade by Vietnam’s Minister of Industry and Trade

On September 15th, Vietnam’s Minister of Industry and Trade, Nguyen Hong Dien, sent a letter to U.S. Secretary of Commerce Howard Lutnick. In the letter, Minister Dien urged the U.S. to reconsider its decision to deny equivalency status to 12 Vietnamese seafood harvesting methods. He emphasized that this decision could significantly disrupt bilateral trade and jeopardize the livelihoods of hundreds of thousands of Vietnamese fishermen and workers.

Captivating Global Audiences with Billion-Dollar Fish Exports: Are We Neglecting the Domestic Market?

The seafood export industry, including the tra fish sector, boasts an annual revenue of billions of USD. While maintaining its strong export focus, the industry is now also strategically targeting the domestic market, aiming to win over Vietnamese consumers and build a solid foundation for sustainable global expansion.