Illustrative Image

According to preliminary statistics from the Customs Department, Vietnam’s textile and garment exports in September generated over $3.2 billion, a 15.6% decrease compared to August. Cumulatively, in the first nine months of the year, this sector earned $29.7 billion, an 8.6% increase compared to the same period in 2024.

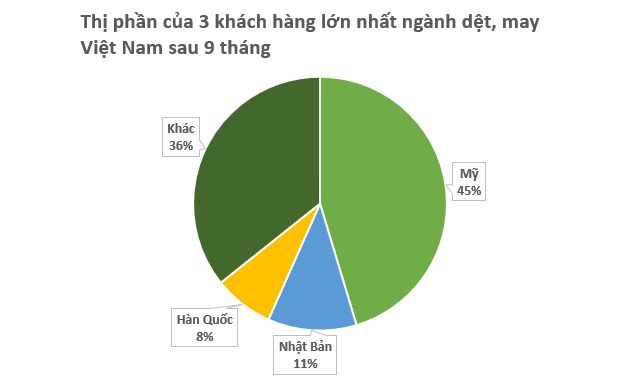

In terms of markets, the United States remains Vietnam’s largest export destination, with over $13.4 billion, a 12% increase year-over-year.

Japan follows with more than $3.3 billion, an 8% increase compared to the same period last year.

South Korea ranks as the third-largest market with over $2.2 billion, though it saw a 5% decline compared to the first nine months of 2025.

In 2024, Vietnam’s textile and garment industry achieved approximately $44 billion in exports, an 11% growth compared to 2023. This result propelled Vietnam to the second position among the world’s top textile and garment exporters. Vietnamese textile products have been exported to 66 countries and territories, encompassing 47-50 different product categories.

One key factor contributing to this success is the shift of orders from Bangladesh to Vietnamese enterprises. However, according to Mr. Vu Duc Giang, Chairman of the Vietnam Textile and Apparel Association, these orders are primarily basic, high-volume, but low-value. Consequently, not all businesses, especially those producing high-end and fashion items, have been able to capitalize on this shift.

Forecasts suggest that Vietnam’s textile and garment exports in 2025 could reach $47-48 billion, a 6-9% increase compared to 2024, in line with industry targets. This growth is supported by free trade agreements (FTAs), supply chain shifts, and global economic recovery. Nonetheless, the sector faces challenges such as high raw material costs, import dependency, and fluctuations in trade policies. To address these issues, the industry must enhance its internal capabilities, including workforce training, AI and robotics adoption in design and production, dual transformation, and circular business models.

Additionally, diversifying markets, customers, product ranges, and raw material sources is essential. Beyond traditional markets like the U.S., EU, Japan, South Korea, and Taiwan, the industry is focusing on emerging markets such as China (high-value products), Canada, Russia, the UK, and ASEAN.

Furthermore, attracting foreign direct investment (FDI) and domestic enterprises, particularly into environmentally compliant industrial zones, is crucial. Developing domestic raw materials will ensure supply chain autonomy and compliance with FTA rules of origin to leverage tariff benefits.

Simultaneously, efforts should be made to develop the domestic market and Vietnamese brands. Accelerating the transition from Cut-Make-Trim (CMT) to Free on Board (FOB), Original Design Manufacturing (ODM), and Original Brand Manufacturing (OBM) production models is also vital.

Vietnam’s Economic Shift: From Labor-Intensive to Capital-Intensive, Experts Say

The global industrial real estate market typically progresses through three distinct phases: labor-intensive, capital-intensive, and research & development. Vietnam is currently transitioning away from the labor-intensive stage and entering the capital-intensive phase.

Samsung Expands Smart Home Robot Production in Ho Chi Minh City

Samsung Electronics Home Appliances Complex (SEHC), a 70-hectare, $1.4 billion investment, broke ground in Ho Chi Minh City in May 2015. Initially focused on premium TVs, including SUHD TV, Smart TV, and LED TV, this state-of-the-art facility marks a significant milestone in Samsung’s global manufacturing footprint.

Accelerating the Attraction of High-Quality FDI in Manufacturing and Processing

Vietnam has witnessed a significant surge in foreign direct investment (FDI), reaching an impressive $28.54 billion in the first nine months. The manufacturing sector remains at the forefront, attracting a substantial number of high-tech investors from Japan. This robust growth underscores Vietnam’s appeal as a prime destination for global investment.

Textile Profits Surge, Many Units Hit 2025 Targets Ahead of Schedule

Revenue and profit for the first nine months across the textile enterprise series have surpassed targets, bolstering the outlook for Vinatex and its member units’ full-year 2025 results. This positive trajectory comes despite mounting order pressures anticipated in the fourth quarter.