According to the Q3/2025 financial report, HAH‘s service revenue reached nearly VND 1.35 trillion, a 20% increase year-over-year and the highest level ever recorded. The flagship shipping operations contributed VND 1.42 trillion (before inter-company eliminations), up 25%. Net profit for the quarter hit VND 304 billion, a 53% surge and just shy of the record set in Q2.

As of September, HAH reported a net profit of VND 899 billion, 2.4 times higher than the same period last year and exceeding the annual plan by 20%. Shipping operations generated over VND 1.16 trillion in gross profit, nearly triple the previous year, while port operations remained stable.

CEO Nguyễn Ngọc Tuấn attributed the positive results to the addition of two vessels, Gama and Zeta, as well as increased transport volume, freight rates, and chartering activities compared to last year.

| Hai An Container Shipping Company’s 9-Month Profit Hits Record High |

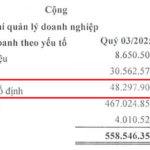

The financial snapshot reveals HAH is in a robust investment phase. As of Q3, tangible fixed assets reached nearly VND 6.8 trillion, up approximately VND 515 billion from the beginning of the year and almost four times the 2020 year-end figure.

In the first nine months, cash flow for asset purchases and construction totaled nearly VND 1.3 trillion, bringing the total investment over the past four years to over VND 5.8 trillion. Total assets exceeded VND 8.2 trillion, including nearly VND 900 billion in cash and bank deposits. Accounts receivable reached a record high, primarily due to a VND 700 billion advance payment to Jiangsu NewYangzi Shipbuilding Co., Ltd., reflecting plans to expand the fleet.

Alongside fleet expansion, HAH is broadening partnerships domestically and internationally. In August, the company joined forces with Vietnam Container Corporation (Viconship, HOSE: VSC) to establish Hai An Green Shipping, with a charter capital of VND 1 trillion (HAH holds 40%, Viconship 60%). This joint venture aims to build two 7,000 TEU vessels with a total investment of approximately USD 180 million (nearly VND 4.7 trillion) to operate longer international routes, reduce per-container costs, and expand market share in Asia.

| HAH‘s Fixed Assets Double Over the Past Five Years |

On October 17th, the company took delivery of the Haian Iris, a 1,100 TEU vessel, increasing the fleet to 18 ships with a total capacity of 29,300 TEU, primarily operating on domestic and intra-Asia routes. Additionally, the company has signed contracts for four 3,000 TEU vessels, expected to be delivered between late 2027 and early 2028.

The company is also strengthening international collaborations, such as a joint venture with a South Korean partner to establish the Pan Hai An Warehouse Center, acting as the general agent for SML (South Korea), and partnering with several other top 10 global shipping companies.

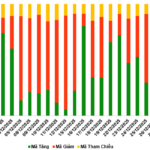

This strong growth has propelled HAH‘s stock to near its historical peak of VND 63,000 per share, up over 70% since the beginning of the year.

| HAH Stock Soars to New Heights Since the Start of the Year |

HAH took delivery of the Haian Iris in October – Photo: HAH

|

– 16:25 31/10/2025

Cassava Starch Industry Rebounds: Apfco and Yfatuf Report Extraordinary Profit Surges

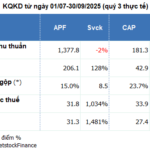

Two of the rare listed companies in the cassava starch industry, Quang Ngai Agricultural and Food Joint Stock Company (Apfco, UPCoM: APF) and Yen Bai Forest Agricultural Products and Food Joint Stock Company (Yfatuf, HNX: CAP), have both reported exceptional profit growth in Q3, despite revenues not yet showing a strong recovery.

Intense Selling Pressure in Investment Fund Transactions

Last week (October 20–24, 2025), investment funds recorded no new transactions, instead solely disclosing the results of the previous week’s trades, which were overwhelmingly dominated by sell-side activity.