|

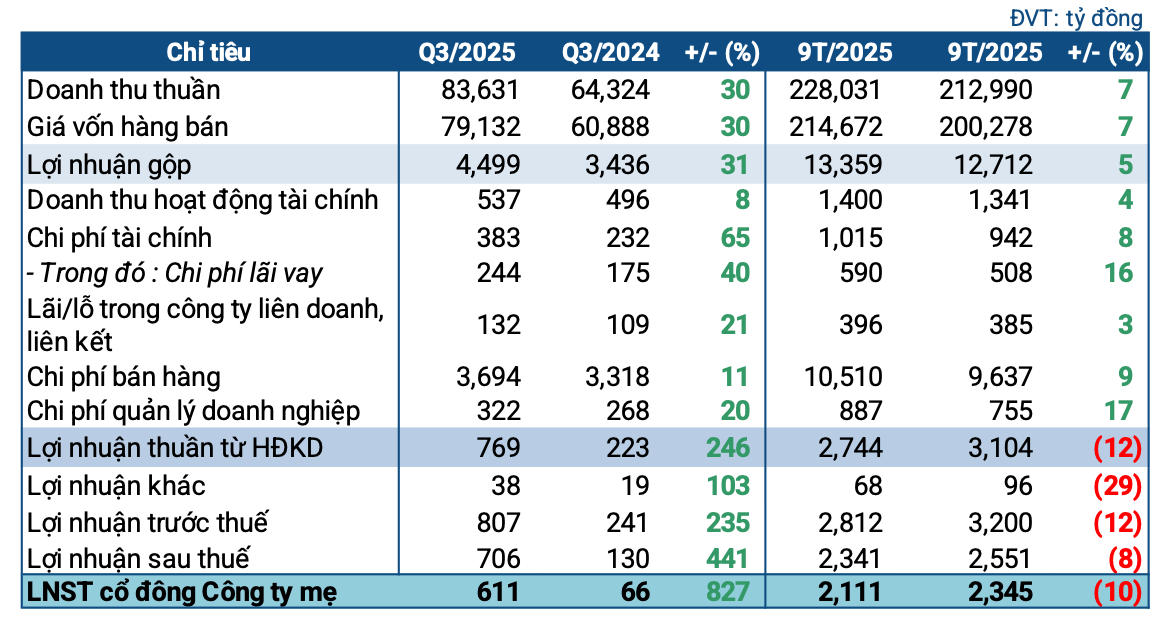

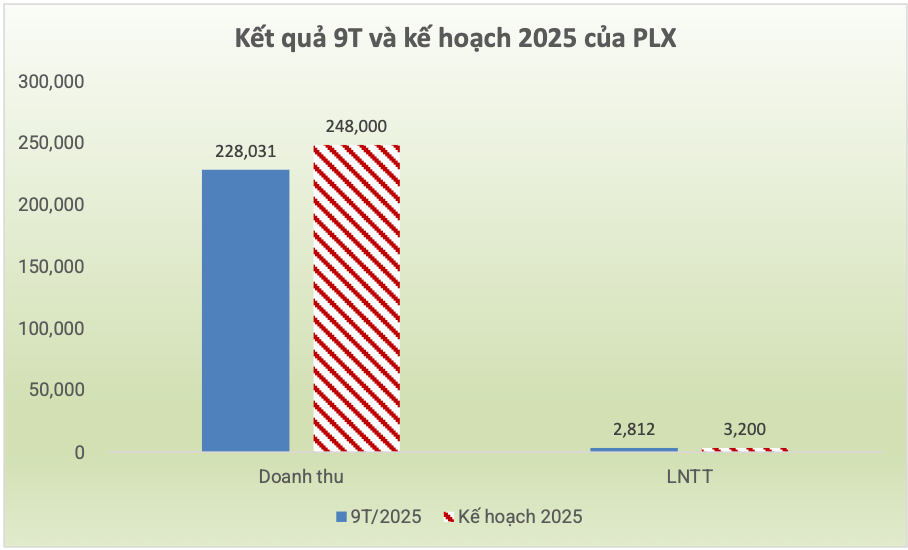

Petrolimex’s Q3/2025 Business Targets

Source: VietstockFinance

|

Specifically, net revenue for the period reached over 83.6 trillion VND, a 30% increase compared to the same period last year. After deducting the cost of goods sold, gross profit reached nearly 4.5 trillion VND, up 31%.

Financial revenue for the period rose by 8% to 537 billion VND, offsetting a 65% surge in financial expenses to 383 billion VND. Selling expenses and administrative expenses increased by 11% and 20%, respectively. Ultimately, the company reported a net profit of 611 billion VND, 9.3 times higher than the same period last year.

In its explanatory statement, Petrolimex attributed the significant increase in Q3 profits to its core petroleum business turning a profit, whereas it had incurred losses in the same period last year. This improvement was due to relatively stable oil prices during the period, which decreased slightly from $68 per barrel to $62-$65 per barrel, compared to a sharp decline from $83 per barrel to $66-$68 per barrel in the same period last year.

Additionally, operations at subsidiary companies remained stable, with several sectors showing strong growth compared to the same period last year, including aviation fuel, lubricants, asphalt, and warehousing services.

However, due to a steep decline in Q1, Petrolimex’s year-to-date results still showed a 10% decrease in net profit to over 2.1 trillion VND, despite a 7% increase in revenue to 228 trillion VND. Nevertheless, the company has nearly achieved its annual targets, completing 92% of its revenue goal and 88% of its post-tax profit plan approved by the 2025 Annual General Meeting.

Source: VietstockFinance

|

As of September 30, 2025, PLX’s total assets reached nearly 91.6 trillion VND, a 13% increase from the beginning of the year, with over 65 trillion VND in current assets, up 9%. The petroleum giant holds a massive amount of cash and deposits totaling nearly 30.2 trillion VND, generating 913 billion VND in deposit interest income in the first nine months (approximately 3.4 billion VND per day).

Short-term receivables increased by 39% to nearly 17.4 trillion VND. Inventory rose by 6% to over 16.6 trillion VND.

Regarding capital sources, total liabilities increased by 21% to nearly 62.7 trillion VND. Notably, short-term loans and finance leases rose by 42% compared to the beginning of the year, reaching approximately 24.7 trillion VND. The petroleum price stabilization fund at the end of the period stood at nearly 3.1 trillion VND.

– 09:13 02/11/2025

Real Estate Businesses Reap Massive Profits

In just nine months this year, TTC Land has surpassed 25% of its pre-tax profit target for 2025. Meanwhile, Thuduc House achieved a net profit of over 103 billion VND, exceeding its annual plan by 56%. Other real estate leaders such as Dat Xanh, Nha Khang Dien, Nam Long, CEO, and Phat Dat are also on the brink of meeting their sales targets.

DCM Profits Surge 2.7x Year-on-Year, Achieving 200% of Annual Plan in 9 Months

PetroVietnam Fertilizer and Chemicals Corporation (PVFCCo or Ca Mau Fertilizer, HOSE: DCM) reported robust earnings in Q3/2025, closely aligning with preliminary estimates. Over the first nine months, the company’s cumulative profit surged by 45%, surpassing its full-year target by an impressive 200%.

“HQC Achieves Only 25% of Annual Profit Plan After 9 Months, Embarks on VND 1.2 Trillion Social Housing Project in Ca Mau”

Despite third-quarter revenue more than doubling year-over-year, HQC’s net profit reached only nearly VND 9 billion, a 17% decline due to the absence of recorded profits from business collaborations. After nine months, the company has achieved just one-quarter of its annual profit target.