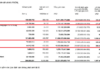

Ricons Construction Investment Corporation (Ricons) has announced its Q3 business results, reporting a net revenue of nearly VND 2.022 trillion, a slight decrease compared to the same period last year. This decline is primarily attributed to a 76% drop in real estate sales, which only generated over VND 15 billion.

However, by reducing financial and operational expenses by 22%, the company achieved a net profit of approximately VND 82 billion, marking a 6% increase.

Source: VietstockFinance

|

For the first nine months, cumulative net revenue reached over VND 5.072 trillion, a 10% decrease, while net profit surged by 61% to more than VND 190 billion.

Ricons has set a 2025 target of VND 8 trillion in revenue, matching the previous year’s figure, and VND 200 billion in net profit, a 26% increase. The company has already achieved 63% of its revenue goal and 95% of its profit target.

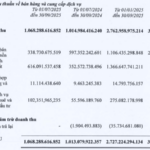

As of Q3, Ricons’ total assets stood at nearly VND 6.462 trillion, a 6% decrease from the beginning of the year. Cash and cash equivalents increased significantly by 59%, reaching over VND 1.1 trillion. Short-term financial investments amounted to more than VND 1.6 trillion, primarily consisting of term deposits with maturities under one year and VND 213 billion in bonds.

Short-term receivables from customers decreased by 41% to over VND 1.9 trillion. Ricons still has approximately VND 159 billion in receivables from Coteccons (CTD), a 51% reduction. Meanwhile, receivables from Vietnam Airlines Corporation (UPCoM: ACV) soared to nearly VND 273 billion, an 80-fold increase from the beginning of the year. The company has also set aside over VND 470 billion for potentially uncollectible short-term receivables.

Source: Ricons

|

Inventory increased by 27% to nearly VND 550 billion, entirely comprising construction in progress at various sites, including the Tay Mo New Urban Area (VND 123 billion), the HH1 – Golden Palace A high-rise (over VND 64 billion), and the HH3 – Imperia Signature Co Loa high-rise (over VND 56 billion).

Total liabilities decreased by 12% to VND 3.727 trillion, with financial debt amounting to VND 230 billion, an 8% reduction, representing 6% of total liabilities.

– 09:00 02/11/2025

Real Estate Businesses Reap Massive Profits

In just nine months this year, TTC Land has surpassed 25% of its pre-tax profit target for 2025. Meanwhile, Thuduc House achieved a net profit of over 103 billion VND, exceeding its annual plan by 56%. Other real estate leaders such as Dat Xanh, Nha Khang Dien, Nam Long, CEO, and Phat Dat are also on the brink of meeting their sales targets.