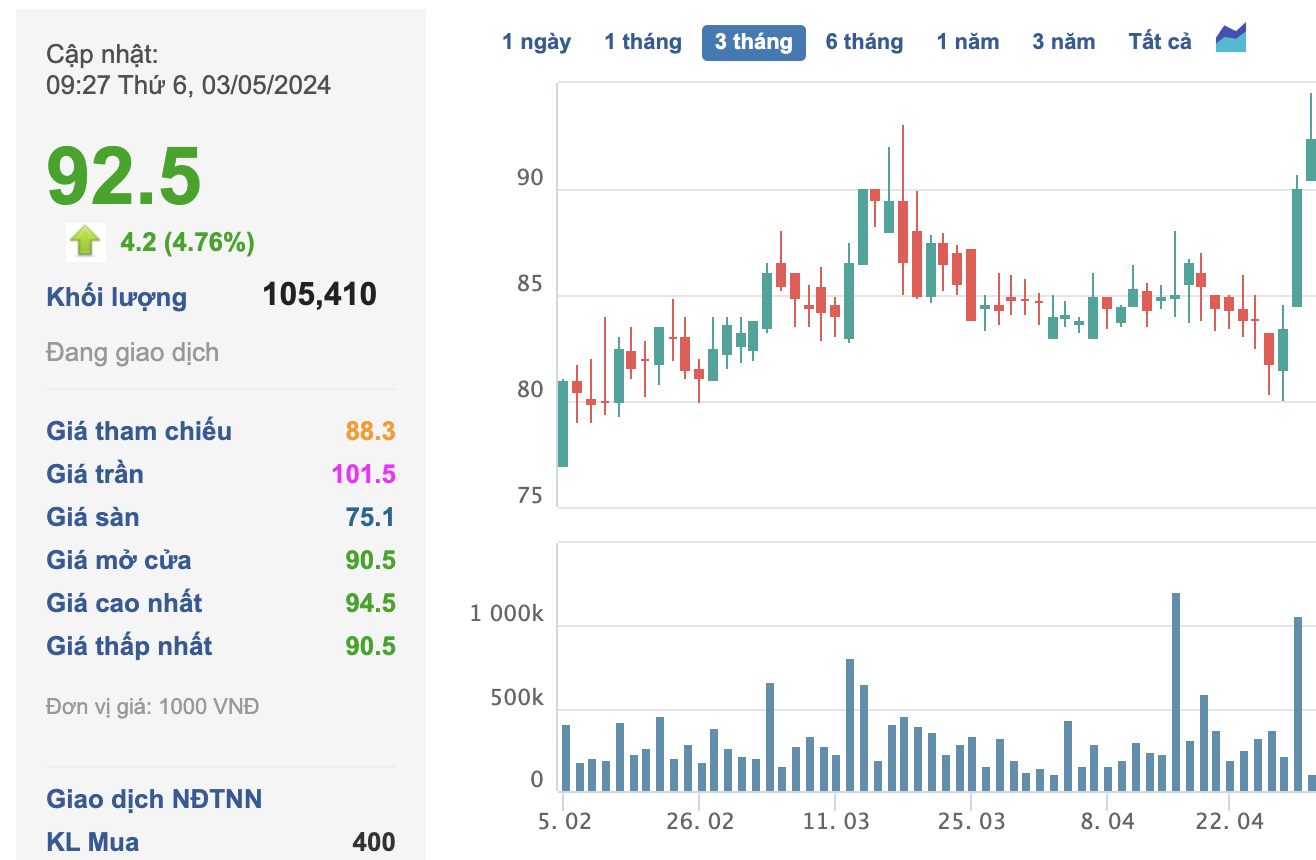

In the market, the stock ACV of the Vietnam Airport Corporation has continuously increased and set a price level of over 90,000 VND/share in the morning of May 3, 2024, at times rising to 94,500 VND. Correspondingly, the capitalization of the Company is currently at approximately 202,000 billion VND – ranking 4th on the stock market, only behind Vietcombank (HOSE, 517,000 billion), BIDV (HOSE, 283,000 billion), Viettel Global (Upcom, over 207,000 billion) and surpassing other “big names” like Hoa Phat, Vingroup, Vinamilk, VPBank, Techcombank…

From the beginning of the year (January 2) until now, this stock has increased by nearly 45%, resulting in a capitalization increase of over 62,260 billion VND (~2.4 billion USD). The growth momentum is supported by positive signals from the industry and the business results of the enterprise.

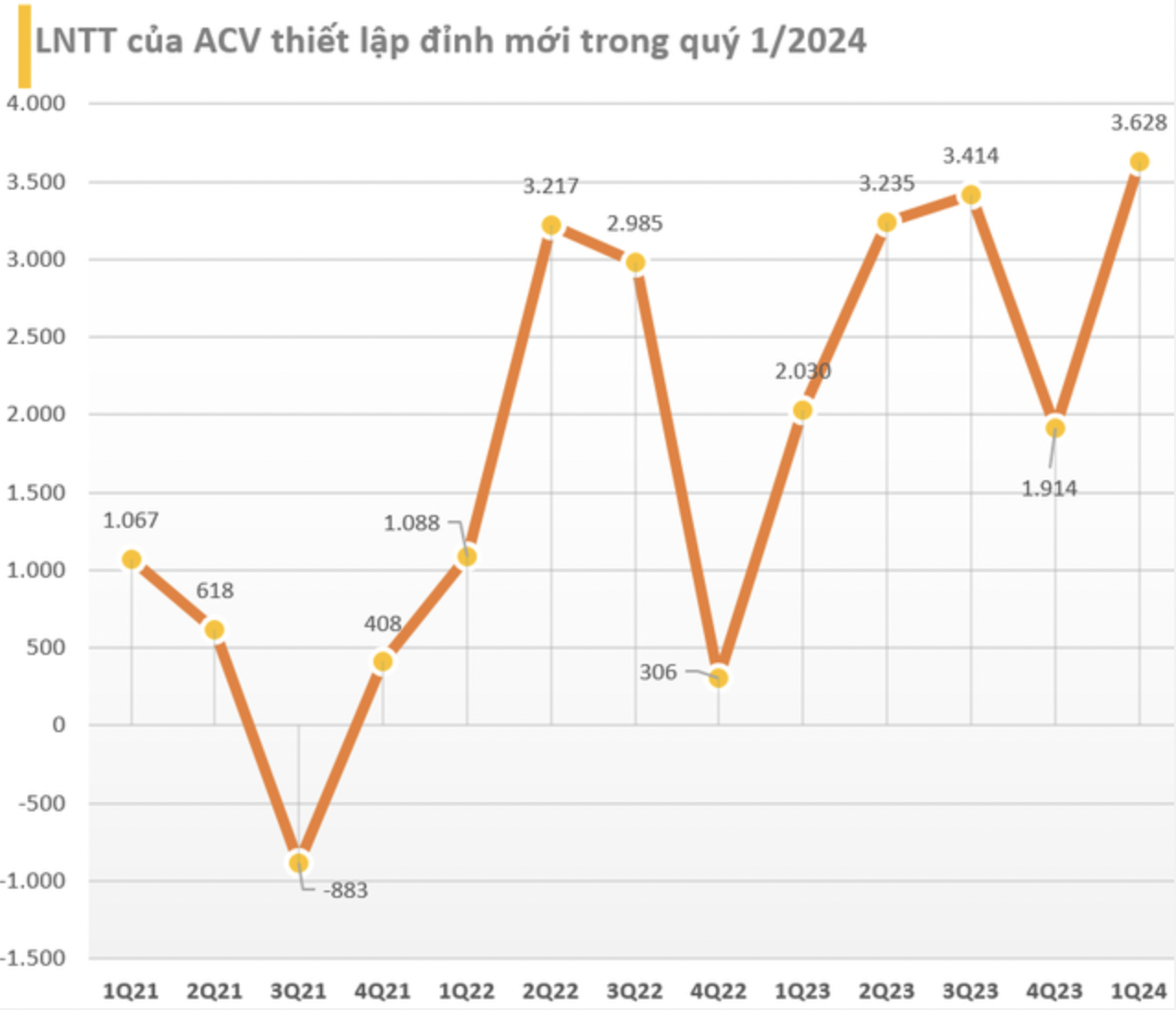

ACV has just announced its consolidated financial statements for the first quarter of 2024, with revenue of 5,643 billion VND, an increase of 19% compared to the same period last year. After deducting the cost of goods sold, ACV’s gross profit was 3,599 billion VND, an increase of 22.5% compared to last year. The gross profit margin was nearly 64%.

In the financial sector, revenue during the period was 479 billion – mostly from interest on bank deposits. Notably, during the period, the Company no longer recorded any losses due to exchange rate differences, resulting in a sharp 79% increase in net profit to 2,917 billion VND.

This is ACV’s highest profit to date.

Later this year, ACV will host the Trinity Forum 2024 in Ho Chi Minh City.

About ACV, the Corporation was established in 2012 based on the merger of the Airport Corporations in the three regions of the North, Central and South. In 2015, the Corporation was equitized and officially operated as a Joint Stock Company from April 1, 2016 with a charter capital of 21,771 billion VND, of which the State shareholder held 95.4% of the charter capital.

Nearly 2.18 billion ACV shares were officially listed on UPCoM on November 21, 2016 with a reference price of 25,000 VND/share, corresponding to an initial valuation of approximately 54,400 billion VND (~2.3 billion USD).

ACV currently has a monopoly on providing aviation services to domestic and foreign airlines, such as security services, ground services, passenger services, take-off and landing services, etc.; at the same time, it is assigned to manage, coordinate operations and invest in exploiting the entire system of 22 airports throughout Vietnam, including 9 international airports and 13 domestic airports.

In addition, ACV also owns two subsidiaries: Noibai Airport Fuel Services Company (NAFSC) and Southern Airports Aircraft Maintenance Services Company (SAAM). Together with 10 associated companies, mainly operating in the aviation services sector, many of which are listed on the stock exchange such as Tan Son Nhat Airport Services Company (SASCO – SAS), Saigon Ground Services Company (SAGS – SGN), Saigon Cargo Services Company (SCS),…

After being listed on the stock exchange, ACV’s revenue and profit continuously increased year after year before Covid-19 appeared. After a difficult period in 2020-2021, ACV quickly recovered after the pandemic was pushed back and the economy entered a recovery phase.

In 2023, ACV served 113.5 million passengers, an increase of 15% compared to 2022, of which international passengers reached 32.6 million passengers, an increase of 173%; total cargo and mail throughput reached 1.2 million tons; Total take-offs and landings reached 710,000 flights.

Thanks to this, the Company’s revenue reached a record of over 20,000 billion VND, an increase of 45% compared to the previous year. Profit after tax also increased by nearly 21% compared to 2022, reaching nearly 8,600 billion VND.