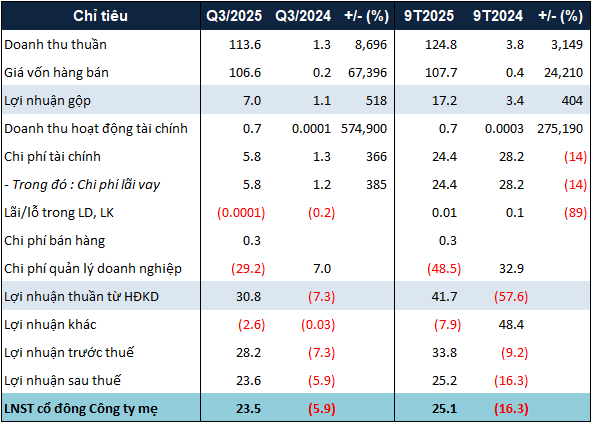

Specifically, NRC’s Q3 net revenue reached nearly VND 114 billion, a significant increase from just over VND 1 billion in the same period last year. This remarkable growth is attributed to the company generating over VND 35 billion in goods revenue and more than VND 78 billion in service revenue.

Amidst the revenue surge, NRC’s financial expenses quadrupled to nearly VND 6 billion compared to the same quarter last year. Additionally, the company incurred an extra VND 290 million in selling expenses.

However, the most notable aspect is the management expenses, where the company reversed over VND 33 billion in provisions (compared to VND 423 million in Q3/2024). Simultaneously, administrative staff costs were less than half of the previous year’s figure. As a result, total management expenses for the period were reduced by more than VND 29 billion due to the provision reversal.

Thanks to this substantial provision reversal, NRC recorded a net profit of nearly VND 24 billion in Q3/2025, the highest in the last seven quarters (since Q1/2024).

|

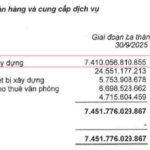

NRC’s 9-month business results in 2025. Unit: Billion VND

Source: VietstockFinance

|

For the first nine months, the company’s consolidated pre-tax profit reached nearly VND 34 billion, compared to a loss of over VND 9 billion in the same period last year. This result exceeds the annual target of VND 25 billion for 2025 by more than 35%.

NRC’s AGM: 2025 Profit Target Within Reach

On the balance sheet, NRC’s total assets stood at nearly VND 2.1 trillion, a 7% increase from the beginning of the year. Short-term receivables rose by 61% to nearly VND 623 billion, while receivables from related parties decreased by 45% to VND 127 billion. Notably, provisions for this category shrunk from VND 83 billion to VND 24 billion.

NRC clarified that the VND 127 billion receivable includes business cooperation and investment funds between the company and Danh Khôi Holdings in the Nhơn Hội eco-tourism urban area projects (sub-zones 2, 4, and 9) and the Bình Dương I commercial and luxury apartment project. It also includes receivables from the termination agreement related to the rental and management of the Sales Gallery and Đà Nẵng operation center with DKPM Asset Management and Services JSC (with a balance of nearly VND 6.4 billion as of September 2025).

Furthermore, NRC’s deposit with VHR Investment JSC for The Welltone Luxury Residence project increased from VND 13 billion to VND 32.5 billion.

Regarding liabilities, NRC’s total payables rose by 14% to over VND 880 billion. This increase is primarily due to a surge in short-term payables to sellers from VND 4 billion to over VND 167 billion, including VND 80 billion in consulting fees for investor search services owed to Danh Khôi Holdings by Netland Real Estate JSC and over VND 83 billion payable to food industry suppliers.

NRC Plans to Invest Nearly VND 20 Billion to Integrate a Real Estate Company into Its Ecosystem

Meanwhile, the company’s debt decreased by 20% to nearly VND 285 billion, mainly due to a reduction in bond debt from VND 223 billion to VND 160 billion, accounting for 56% of total debt.

– 12:02 01/11/2025

Bao Viet Securities to Distribute 8% Cash Dividend by Late November

On October 31st, the Board of Directors of Bao Viet Securities Corporation (HNX: BVS) passed a resolution to pay a cash dividend for 2024 at a rate of 8% (800 VND per share). The ex-dividend date is November 13th, with payment expected on November 26th.

Bảo Việt Group Reports Over 2 Trillion VND in Profits After 9 Months

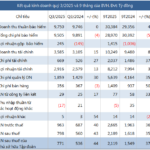

Bao Viet Group (HOSE: BVH) has achieved remarkable business results in the first nine months of 2025, marking three consecutive quarters of profit growth compared to the same period last year. In Q3 alone, the company recorded a net profit of VND 771 billion, a 44% increase, setting a new record for the highest quarterly profit in its history.

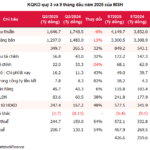

Coteccons Posts Q1 Net Profit of Nearly VND 300 Billion, Highest in 27 Quarters

Fueled by a surge in construction contract revenue and proceeds from the liquidation of a business cooperation contract, Coteccons kicked off its 2026 fiscal year with a net profit of nearly VND 300 billion in Q1, more than tripling its performance from the same period last year and achieving over 40% of its annual plan.