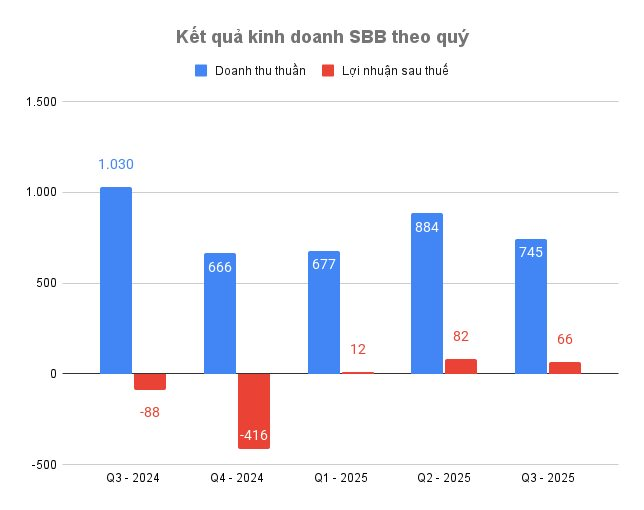

The Q3/2025 financial report of Saigon Binh Tay Beer Corporation (Sabibeco, stock code SBB) reveals robust growth in both revenue and profit, following Sabeco’s (SAB) acquisition of controlling interest in late 2024.

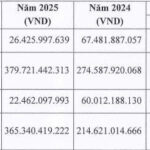

In the first nine months of 2025, SBB recorded net revenue of VND 2,306 billion, a 52% increase compared to VND 1,515 billion in the same period of 2024.

Most notably, profitability has significantly improved. By the end of the nine months, SBB reported an after-tax profit of over VND 108 billion, a stark contrast to the VND 76.5 billion loss in the same period of 2024.

In Q3/2025 alone, SBB’s net revenue reached VND 745 billion, up 54% from VND 484 billion in Q3/2024. After-tax profit for Q3/2025 stood at VND 66 billion, compared to a loss of nearly VND 10 billion in the same quarter of the previous year.

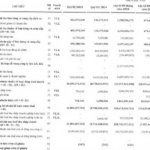

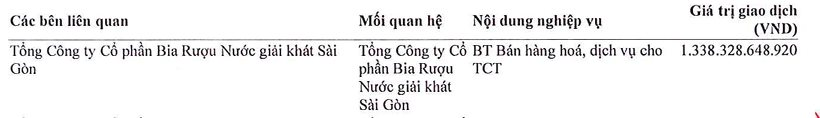

Much of the revenue growth stems from internal collaboration. According to the financial statement notes (Section VII.2), revenue from goods and services sold to parent company Sabeco in the first nine months of 2025 totaled VND 1,338 billion, accounting for approximately 58% of SBB’s total net revenue.

Positive results are attributed not only to revenue growth but also to cost optimization. Gross profit in Q3/2025 reached nearly VND 86 billion, 6.2 times higher than in Q3/2024.

Additionally, financial expenses in Q3 decreased by 48% year-on-year to VND 2.5 billion, primarily due to reduced interest expenses. As of September 30, 2025, SBB’s short-term debt stood at just under VND 149 billion.

Other operating costs were also reduced. Selling expenses in Q3/2025 dropped sharply to VND 2.4 billion from VND 7 billion in the same period last year. Administrative expenses also decreased slightly from VND 13.6 billion to nearly VND 12 billion.

Established in 2005, Saigon Binh Tay Beer Corporation operates six breweries in Ho Chi Minh City, Binh Duong, Dong Thap, Ninh Thuan, Ha Nam, and Dong Nai. Despite past financial challenges, the company became a market focal point when Sabeco completed the acquisition of 37.8 million shares in 2024, increasing its ownership stake to 65% and gaining control of Sabibeco.

Dragon Capital Acquires 2.7 Million Shares of DXG

Dragon Capital, a leading foreign investment fund, has recently acquired 2.7 million shares of DXG, elevating its ownership stake in Dat Xanh Group to 10.0001%.

State-Owned Giant Joins Vingroup to Develop Electric Vehicle Charging Network, Projecting Q3/2025 Profits to Surpass 1 Trillion VND, a 4-Year High

Over the first nine months, cumulative revenue reached VND 25,404 billion, a 17% increase year-on-year, with pre-tax profit hitting VND 2,332 billion, up 84% compared to the same period. Net profit for the nine months surged 74% to VND 1,857 billion.