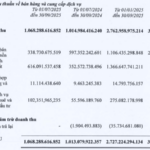

Vietnam Construction and Import-Export Joint Stock Corporation (Vinaconex – VCG) has released its Q3 2025 financial report, revealing a net revenue of VND 4,429 billion, a 65% increase compared to Q3 2024. Gross profit for the quarter also rose by 56%, reaching VND 611 billion.

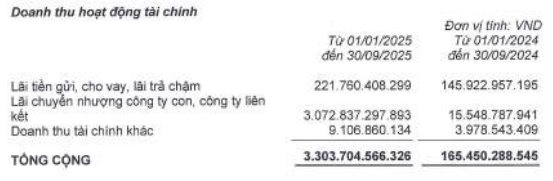

Financial revenue saw a dramatic surge, skyrocketing 78 times higher than the same period last year, totaling VND 3,186 billion. Of this, nearly VND 3,073 billion came from the transfer of profits from subsidiaries and associates.

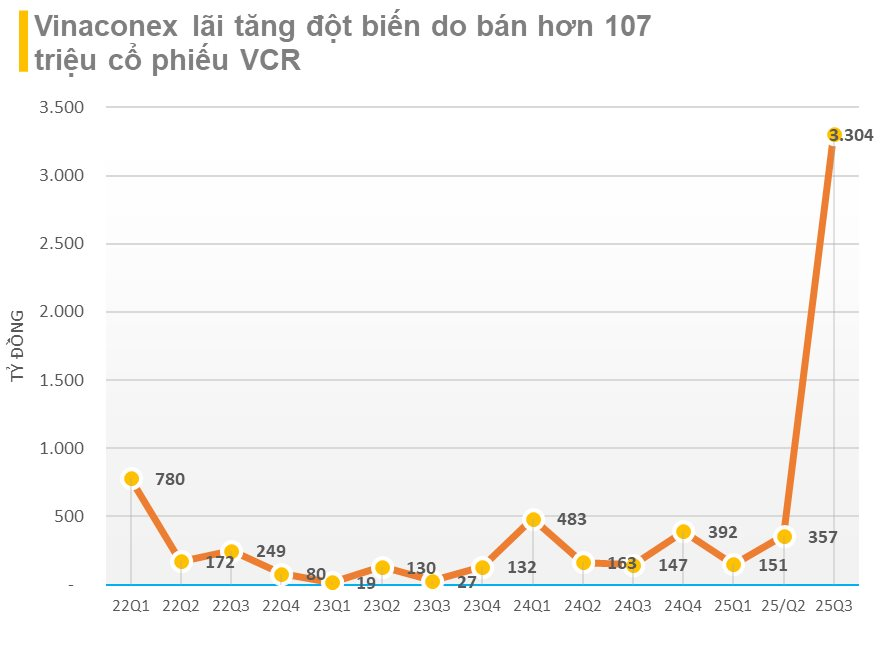

As a result, after-tax profit for Q3 2025 reached VND 3,304 billion, a staggering 2,000% increase year-over-year. The parent company’s after-tax profit stood at VND 3,282 billion, 41 times higher than the same period last year. This remarkable growth is attributed to the successful transfer of investments in subsidiaries during the quarter. Specifically, Vinaconex sold 107.1 million shares, representing a 51% stake in Vinaconex Tourism Investment and Development JSC (VCR).

Accumulated net revenue for the first nine months of 2025 reached VND 11,413 billion, a 40% increase compared to the same period in 2024. Thanks to a 20-fold surge in financial revenue, after-tax profit for the nine months hit VND 3,783 billion, five times higher than the same period in 2024. The parent company’s after-tax profit was VND 3,689 billion, six times higher year-over-year.

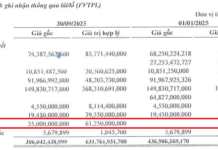

As of September, VCG’s total assets slightly decreased by 1% from the beginning of the year to VND 29,021 billion. Total liabilities stood at VND 16,753 billion, down 9% from the start of the year. Short-term debt increased slightly by 7% to VND 13,878 billion, while long-term debt decreased by 47% to VND 2,785 billion.

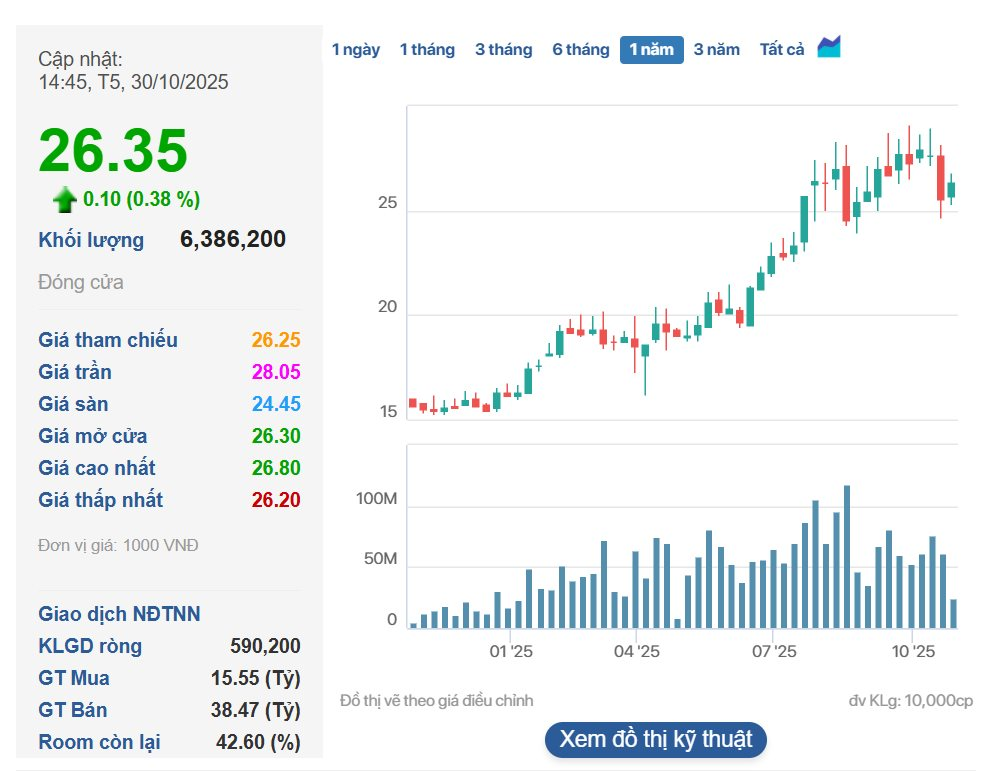

At the close of trading on October 30th, VCG’s stock price reached VND 26,350 per share, up 0.38%. Since the beginning of the year, VCG’s stock has increased in value by nearly 63%.

Landmark Group Expands Workforce by 1,000 in 9 Months, Secures Over 2.9 Trillion VND in Personal Prepayments for Apartment Purchases

As of Q3/2025, Dat Xanh Group Corporation (HOSE: DXG) holds over VND 2.9 trillion in customer deposits for apartment pre-sales, nearly tripling the figure from the beginning of the year and marking a 70% increase from the previous quarter.