Safe and stable electricity production, meeting the system’s mobilization requirements.

Specifically, the cumulative electricity production for the first 9 months of 2025 across the entire Corporation reached 19.83 billion kWh, achieving 78% of the annual plan, a 3.8% increase compared to the same period in 2024.

Phú Mỹ Power Center today, with a capacity of 4,000 MW

|

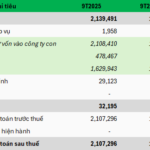

Accordingly, the parent company’s Q3/2025 revenue from sales and service provision exceeded 8.1 trillion VND. Financial activity revenue reached 115 billion VND, a 57% increase year-over-year. The parent company’s Q3 after-tax profit surpassed 159 billion VND.

The cumulative picture shows remarkable growth. After 9 months, EVNGENCO3 achieved nearly 31 trillion VND in net revenue, a 5% growth; after-tax profit exceeded 1.1 trillion VND, a strong recovery from the same period’s loss of 459 billion VND.

Continued reduction in financial lease debt

As of 09/30/2025, EVNGENCO3’s asset scale reached nearly 48.2 trillion VND. Capital structure continued to improve, with total liabilities by the end of Q3 decreasing by nearly 17% compared to the beginning of the year. Specifically, short- and long-term financial lease debt decreased by 12%, to nearly 28 trillion VND. In recent years, EVNGENCO3 has consistently worked to reduce its debt.

Accelerating investment and construction efforts

Buôn Tua Srah Hydropower Plant Reservoir

|

Alongside production, EVNGENCO3 continues to develop new power projects, including the expanded Buôn Kuốp Hydropower (140 MW), expanded Srêpốk 3 Hydropower (110 MW), and two floating solar power projects on the Buôn Kuốp and Srêpốk 3 reservoirs (each 50 MW). These projects have been approved in the adjusted Power Master Plan VIII and the Implementation Plan for the adjusted Power Master Plan VIII. The Corporation is also promoting investment and development of the Ninh Bình Flexible Power Plant (300 MW), which has also been approved in the adjusted Power Master Plan VIII and its implementation plan.

Services

– 3:28 PM, 11/04/2025

Becamex IJC Offers Over 8 Million Unsold Shares to 79 Investors

Following the conclusion of the offering, Becamex IJC has over 8.4 million shares remaining undistributed. As a result, the company will continue to offer these shares to 79 investors at a price of 10,000 VND per share.

PV GAS’ 9-Month Profit Nearly Matches Full-Year 2024 Earnings

In Q3/2025, PV GAS (Vietnam Gas Corporation, HOSE: GAS) saw a modest increase in net profit compared to the same period last year. Despite this slight growth, the company achieved a remarkable feat by nearly matching its entire 2024 profit within just the first nine months of the year.