On November 3rd, the VN-Index closed at 1,617 points, down 22 points (-1.38%)

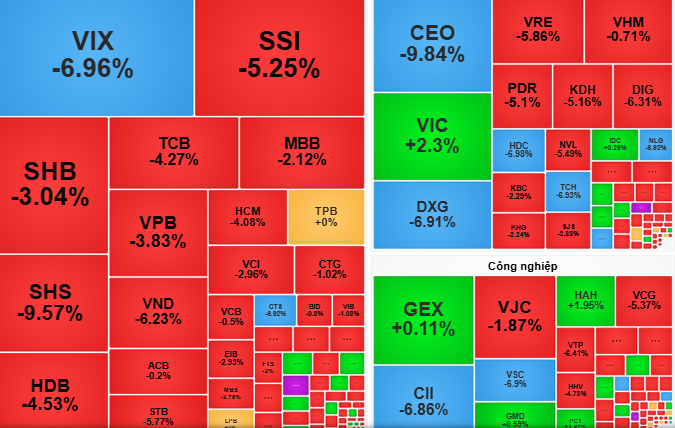

The VN-Index opened the November 3rd session with a near 5-point gain, but selling pressure quickly took over, pushing the index back to the 1,625-point level. Banking, consumer, and select blue-chip stocks like HPG and VJC faced the heaviest sell-offs.

Conversely, defensive sectors such as oil & gas and maritime transport saw impressive gains, with GMD (+2.20%), HAH (+4.07%), and PVD (+4.39%) leading the charge. In the final 30 minutes of the morning session, bottom-fishing demand for HPG and Vingroup stocks (VIC, VHM) helped the VN-Index recover slightly, closing the morning at 1,651 points (+12.11 points).

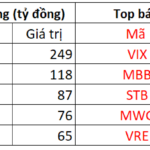

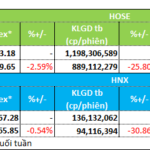

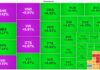

In the afternoon session, selling pressure from banking and securities stocks intensified, driving the VN-Index down by as much as 15 points. The final 15 minutes of trading witnessed a “sell-off storm” in banking (MBB, HDB), real estate (VRE, VIC), and securities (SSI, VND) stocks. The HOSE board was dominated by red, with 240 decliners versus only 85 gainers.

By the close of November 3rd, the VN-Index settled at 1,617 points, down 22 points (-1.38%) – its sharpest decline in over a month.

VCBS Securities noted that the VN-Index lost the 1,620 level after just one corrective session. Investors should closely monitor the market and adjust portfolios when stop-loss thresholds are triggered. “Instead of rushing to bottom-fish, investors can screen for stocks holding support levels to deploy capital once the market stabilizes,” VCBS advised.

Meanwhile, Dragon Capital Securities (VDSC) observed that liquidity surged in the November 3rd session, indicating heating up supply. Investors should monitor supply-demand dynamics, considering profit-taking on rebounds or waiting for more attractive entry points.

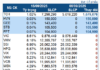

Liquidity Weakens as Capital Flows Out of Multiple Sectors

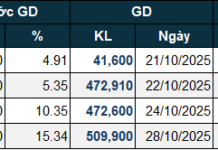

Market activity remained subdued during the trading week of October 27–31, with significant capital outflows observed across multiple sectors.

Will the Stock Market Regain Momentum After Three Weeks of Turbulence?

The VN-Index has endured three consecutive weeks of steep declines, shedding nearly 160 points from its peak of 1,800. Liquidity has also contracted, as a cautious sentiment grips the market. Analysts anticipate a period of divergence, with short-term risks stemming from the market entering an information vacuum following the third-quarter earnings season.

Two Scenarios for Vietnam’s Stock Market in November 2025

According to VFS, the short-term sideways trend remains intact. Investors are advised to maintain stock allocations between 50-80% of their portfolios and refrain from premature actions until clear signals emerge.