According to the consolidated financial report for Q3 2025, Bac A Commercial Joint Stock Bank (Bac A Bank) recorded a pre-tax profit of over 145 billion VND, a 50% decline compared to Q2 2025 and the same period in 2024.

In Q3 2025, Bac A Bank’s net interest income reached 701 billion VND, a decrease of more than 21% from Q2 2025 (892 billion VND) and 6% from Q3 2024 (748 billion VND). This marks the sharpest decline since the beginning of the year, reflecting a rapid increase in funding costs.

Specifically, the bank’s interest income and similar revenues in the quarter totaled 3,471 billion VND, up from 2,925 billion VND in Q3 2024. However, interest expenses and similar costs rose even faster, reaching 2,770 billion VND (compared to 2,178 billion VND in Q3 2024), significantly narrowing the net interest margin (NIM).

Bac A Bank’s service and non-credit activities in Q3 also failed to deliver standout results. Service income reached only 56 billion VND, while service expenses were around 17 billion VND, leaving net service profit at just over 39 billion VND—a modest increase from the same period last year.

Both foreign exchange trading and investment securities recorded underwhelming results.

| Metric | Q3-2025 | Q3-2024 | Change |

| I. Net Interest Income | 701.40 | 747.60 | -6% |

| II. Net Service Profit | 39.50 | 30.60 | 29% |

| III. Net Forex Trading Profit/(Loss) | -16.30 | -29.20 | |

| IV. Net Trading Securities Profit/(Loss) | 0.00 | 0.00 | |

| V. Net Investment Securities Profit/(Loss) | 38.10 | 144.80 | -74% |

| VI. Net Other Operating Profit/(Loss) | 3.30 | 4.50 | -27% |

| VII. Equity Investment Income | 11.60 | 0.00 | |

| VIII. Total Operating Income | 777.50 | 898.30 | -13% |

| IX. Operating Expenses | 549.50 | 586.00 | -6% |

| X. Net Operating Profit Before Provisions | 228.00 | 312.30 | -27% |

| XI. Loan Loss Provisions | 82.80 | 41.00 | 102% |

| XII. Pre-Tax Profit | 145.20 | 271.30 | -46% |

Across all business segments, Bac A Bank’s total operating income in Q3 2025 was over 777 billion VND, a 13% decline from the same period in 2024. Meanwhile, operating expenses decreased by only 6% to nearly 550 billion VND. After deductions, the bank’s net profit reached 228 billion VND, down 27%.

In Q3, Bac A Bank’s loan loss provisions doubled year-over-year, reflecting proactive measures to address potential risky loans amid rising non-performing loans (NPLs). This further eroded the quarter’s net profit.

For the first nine months of 2025, Bac A Bank reported a pre-tax profit of 816 billion VND, nearly flat compared to the same period in 2024, thanks to strong performance in the first two quarters.

As of September 30, 2025, Bac A Bank’s total assets reached 191,965 billion VND, an increase of nearly 26,500 billion VND (16%) from the end of 2024 (165,487 billion VND), and up by over 35,800 billion VND (23%) year-over-year.

By the end of Q3 2025, customer loans stood at nearly 125,400 billion VND, a 14.4% increase from the beginning of the year.

As of Q3 2025, customer deposits exceeded 130,418 billion VND, a 6.4% increase from the end of 2024.

Regarding asset quality, as of September 2025, Bac A Bank’s total NPLs were 1,423 billion VND, a 5% increase from the start of the year. Within this, potentially irrecoverable debt rose by 28%, while substandard and doubtful debts decreased by 41% and 38%, respectively. Despite this, the NPL ratio dropped slightly from 1.24% at the end of 2024 to 1.13%, driven by rapid loan growth.

Vietnam’s Largest Gold Mining Company Amid Record-Breaking Gold Price Surge

In 2025, the company aims to produce 60,716 tons of copper ore, 30,000 tons of copper cathode, 173,681 tons of iron ore, 806 kg of gold, and 2,751 kg of silver.

Bùi Cao Nhật Quân’s Debt to Novaland Reaches Nearly Hundred Billion VND

Novaland is currently owed VND 76 billion by Mr. Bui Cao Nhat Quan, the son of Mr. Bui Thanh Nhon, Chairman of Novaland’s Board of Directors. This receivable has been reflected in Novaland’s financial reports since 2020. In the recently released Q3 financial report, the debt was reclassified from long-term to short-term.

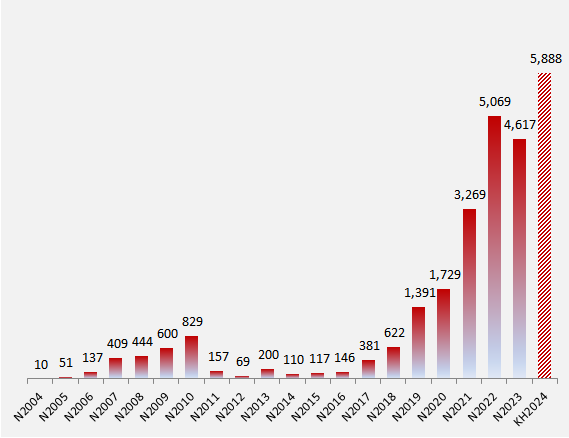

SMC Chairman Aims to Acquire 1 Million SMC Shares

Mr. Pham Hoang Anh, Chairman of the Board of Directors at SMC, has recently registered to purchase 1 million SMC shares with the intention of increasing his ownership stake as a long-term investment.