Updated as of 4:00 PM on November 4th, domestic gold prices continued to decline compared to this morning, pushing the total decrease since opening to nearly 1 million VND per tael.

Specifically, Bao Tin Minh Chau is currently listing

Updated as of 4:00 PM on November 4th, domestic gold prices continued to decline compared to this morning, pushing the total decrease since opening to nearly 1 million VND per tael.

Specifically, Bao Tin Minh Chau is currently listing the price

Updated as of 4:00 PM on November 4th, domestic gold prices continued to decline compared to this

Updated as of 4:00 PM on November 4th, domestic gold prices continued to decline compared to this morning, pushing the total decrease since opening to nearly 1 million VND per tael.

Specifically, Bao Tin Minh Chau is currently listing

Updated as of 4:00 PM on November 4th, domestic gold prices continued to decline compared to this morning, pushing the total decrease since opening to nearly 1 million VND per tael.

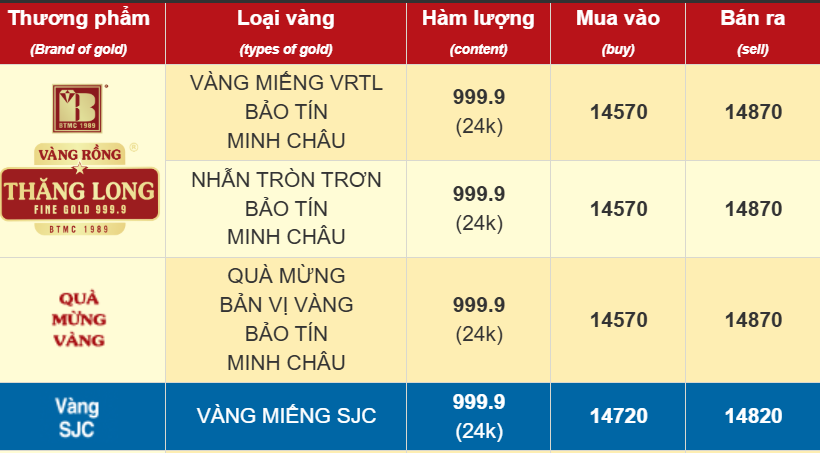

Specifically, Bao Tin Minh Chau is currently listing the price of gold rings at 145.7-148.7 million VND per tael, a further drop of 500 thousand VND per tael since 9:00 AM, totaling an 800 thousand VND decrease since opening.

SJC Company sets the price of gold rings at 143.4-145.9 million VND per tael. Both DOJI and PNJ list their prices at 145.0-148.0 million VND per tael.

The price of SJC gold bars currently stands at 146.2-148.2 million VND per tael.

The buying-selling price gap remains high, at around 2-3 million VND per tael.

——————–

Updated as of 9:00 AM, domestic gold prices collectively dropped, mirroring the global gold price decline to around 3,975-3,985 USD/ounce.

At SJC Company, the price of SJC gold bars is 146.2-148.2 million VND per tael, an 800 thousand VND decrease in both buying and selling prices. The price of plain gold rings fell by 500 thousand VND to 143.4-145.9 million VND per tael.

Bao Tin Minh Chau adjusted the price of SJC gold bars down to 147.2-148.2 million VND per tael. Their 24k plain gold rings also decreased by 300 thousand VND to 146.2-149.2 million VND per tael.

Both DOJI and PNJ list the price of plain gold rings at 145.0-148.0 million VND per tael.

——————————-

Opening on November 4th, some gold shops reduced prices by 200-300 thousand VND per tael, while most major enterprises maintained yesterday’s closing prices.

At Bao Tin Minh Chau, SJC gold bars are listed at 147.5 – 149.0 million VND per tael, with 9999 plain gold rings priced at 146.5-149.5 million VND per tael.

At DOJI, SJC gold bars and gold rings are listed at 147.0-149.0 million VND per tael and 145.5-148.5 million VND per tael, respectively.

At PNJ, SJC gold bars and gold rings are listed at 147.0-149.0 million VND per tael and 145.0-148.0 million VND per tael, respectively.

SJC Company is buying SJC gold bars at 147.0 million VND per tael and selling at 149.0 million VND per tael. Meanwhile, their 9999 plain gold rings are significantly lower than other major brands, listed at 143.9-146.4 million VND per tael.

Previously, on November 3rd, domestic gold prices fell in the morning but rebounded in the afternoon. Both SJC gold and gold rings increased by 600-800 thousand VND per tael during the November 3rd session.

Internationally, gold prices, after a correction, are still hovering around the 4,000 USD/ounce mark.

According to Kitco News, UBS experts believe the current gold market correction is temporary, and prices are still on track to reach 4,200 USD/ounce. Under an optimistic scenario—if geopolitical or market risks escalate—prices could surge to 4,700 USD/ounce. “Beyond technical factors, we see no fundamental reasons for this sell-off,” UBS reported.

The Swiss banking group notes that the price slowdown has further reduced open interest in futures markets, though underlying demand remains robust.

UBS cites a World Gold Council report, highlighting that gold purchases by central banks and individual investors are “very strong and accelerating.”

Earlier, on October 20th, Sagar Khandelwal, a strategist at UBS Global Wealth Management, predicted that low real interest rates, a weak USD, rising public debt, and geopolitical instability could push gold prices to 4,700 USD/ounce by Q1 2026. He warned that U.S. real interest rates could turn negative as the Fed cuts rates amid persistent inflation.

Gold Prices Rebound: SJC and Ring Gold Surge, Yet Investors Face Weekly Losses of Up to $270 per Tael

On the afternoon of November 3rd, the prices of SJC gold and gold rings at several gold retailers reversed their trend, experiencing a slight increase.