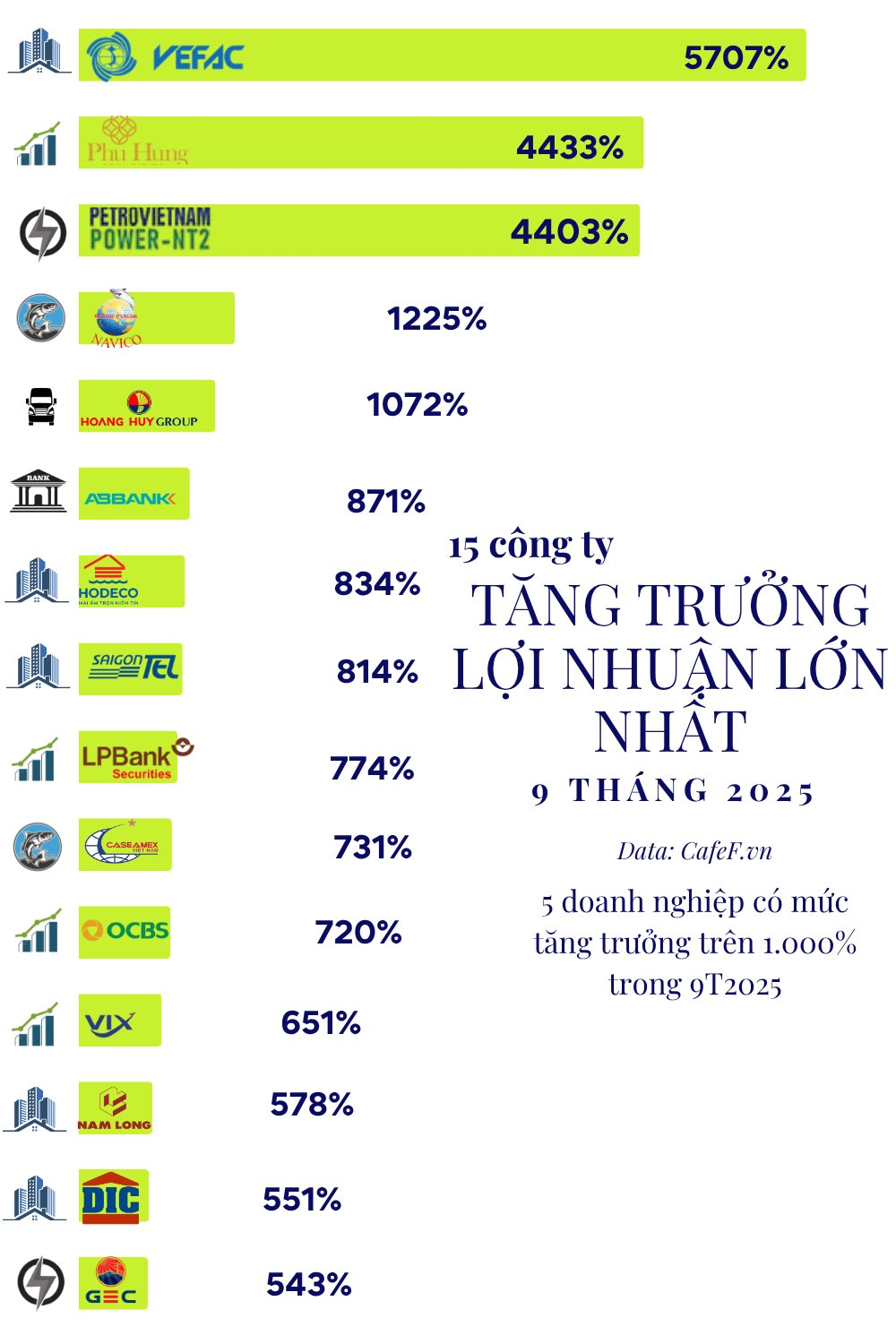

The 2025 financial reporting season has unveiled remarkable profit growth among Vietnamese enterprises, with some soaring by thousands of percent.

Leading the charge is the Vietnam Exhibition and Fair Centre (VEFAC, VEF), boasting a staggering 5,707% profit growth, reaching a pre-tax profit of VND 19,295 billion.

Top 15 Companies by Profit Growth in 2025

Securing the second spot is Phu Hung Securities (PHS) with a 4,433% growth rate.

The real estate sector dominates the list with five entries. Alongside VEF, notable performers include Hodeco (834%), Saigontel (814%), Nam Long (578%), and DIG (551%).

The securities sector also shines, claiming four spots in the top growth list. Joining PHS are LPBank Securities (774%), OCBS Securities (720%), and VIX Securities (651%).

The power sector contributes two entries: Nhon Trach 2 (4,403%) and Dien Gia Lai (543%).

ABBank stands as the sole banking representative in the top 15, achieving an 871% growth rate and a pre-tax profit of VND 2,319 billion.

Beyond impressive growth, several companies have transitioned from losses in 2024 to profitability in 2025.

Top Turnaround Companies in 2025

EVN Genco3 (PGV) exemplifies this turnaround, shifting from a VND 454 billion loss in 2024 to a VND 1,149 billion profit in 2025.

NCB Bank and Masan Meatlife also demonstrate significant improvements, turning losses of VND 58 billion and VND 54 billion, respectively, into profits of VND 654 billion and VND 466 billion.

Market Pulse 04/11: Euphoria Returns, VN-Index Surges Nearly 35 Points

As the session closed on November 4th, the market rewarded investors with a robust gain of nearly 35 points, climbing to approximately 1,652 points. Meanwhile, the HNX-Index surged by almost 7 points, reaching 265.91 points.

Market Pulse October 31: Financial and Real Estate Sectors Struggle, VN-Index Retreats to 1,640 Points

At the close of trading, the VN-Index dropped 29.92 points (-1.79%), settling at 1,639.65 points, while the HNX-Index fell 1.11 points (-0.42%), closing at 265.85 points. Market breadth tilted toward decliners, with 414 stocks falling and 330 advancing. Similarly, the VN30 basket saw red dominate, as 21 constituents declined, 8 rose, and 1 remained unchanged.

Sonadezi Surpasses Annual Plan with Over $1 Billion Profit in 9 Months

Following a record-breaking second quarter, Sonadezi’s net profit continued its upward trajectory in Q3 2025, driven by steady growth in port services, clean water, and improved gross margin. The company has already surpassed its full-year profit target after just three quarters.