BaF Vietnam Agriculture Joint Stock Company (Stock Code: BaF, HoSE) has recently approved adjustments to its public bond issuance plan.

Previously, under Resolution No. 06.10.2025/NQ-HĐQT, BaF Vietnam planned to issue 10,000 BAF12502 bonds with a face value of 100 million VND per bond, totaling 1,000 billion VND. These bonds are non-convertible, unsecured, and not subordinated debt of the issuer.

The bonds have a 36-month term from the issuance date, with a fixed interest rate of 10% per annum, paid semi-annually.

The issuance is expected to take place in Q4/2025 or Q1/2026, following approval from the State Securities Commission (SSC).

BaF Vietnam has adjusted the allocation of funds from the bond issuance as follows:

180 billion VND for purchasing feed, pigs, and other goods from Hai Dang Tay Ninh High-Tech Farming JSC; 30 billion VND for Xanh 1 Farm Investment LLC; 120 billion VND for Xanh 2 Farm Investment LLC; 120 billion VND for Tan Chau Agricultural Investment LLC;

85 billion VND for BaF Vietnam’s Nghe An branch; 85 billion VND for BaF Tay Ninh Animal Feed LLC; 50 billion VND for Bac An Khanh Production and Trading Services LLC.

35 billion VND to partially repay principal to BIDV Bac Ha branch; 200 billion VND to fully repay principal to MSB Ho Chi Minh City branch; 95 billion VND to partially repay principal to E.Sun Bank Dong Nai branch.

BaF Vietnam stated that shifting from repaying subsidiary debts to bank debts aims to alleviate financial pressure, as bank obligations mature earlier than subsidiary loans.

This ensures optimal use of funds from the bond issuance without compromising the overall issuance and capital utilization plan approved by the company.

Regarding debt repayment, BaF Vietnam plans to pay 50 billion VND in bond interest semi-annually. At maturity, the 1,000 billion VND principal will be repaid.

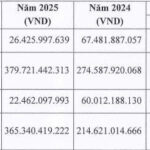

In Q3/2025, the “plant-based pig” company reported net revenue of 1,136 billion VND, down 14% year-on-year. However, a 20% reduction in cost of goods sold led to an 18% increase in gross profit, reaching 264 billion VND.

The company faced rising expenses, including a 23% increase in financial costs to 68 billion VND (nearly 60 billion VND in interest); a 65% surge in selling expenses to over 107 billion VND; and management costs doubling to over 70 billion VND. Consequently, net profit fell 66% year-on-year to 22 billion VND.

In the first nine months, revenue reached 3,647 billion VND, down 7%, but pig sales (100% of revenue) rose 13% compared to 2024.

Net profit totaled 365 billion VND, up 70%, achieving 65% of revenue and 57% of annual profit targets.

Hà Ly

HBC Reports Hundred-Billion Profit but Fails to Repay VND 12.4 Billion in Bond Principal

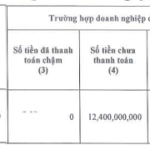

Hòa Bình Construction Group Joint Stock Company (UPCoM: HBC) has announced its inability to repay the principal amount of VND 12.4 billion for the bond issuance HBCH2225002, citing challenges in securing the necessary funds.

Pig Prices Cool Down, Baf Vietnam’s Q3 2025 Profits Plunge by 63%

Amidst a decline in pork prices and escalating costs, Baf Vietnam’s after-tax profit for Q3/2025 plummeted by 63% year-on-year. Despite this, the company has surpassed the halfway mark of its annual profit target after the first nine months.