Dr. Le Duy Binh – CEO of Economica Vietnam – Photo: BTC

|

At the Vietnam Investment Forum 2026, held on November 4th, Dr. Le Duy Binh, CEO of Economica Vietnam, stated that Vietnam is undergoing a transition in its growth model, necessitating significant infrastructure development and economic expansion. He added that increased public investment remains fiscally feasible, given stable budget revenues and a public debt ceiling within permissible limits.

However, Dr. Binh cautioned that Vietnam must be mindful of the long-term risks associated with overly aggressive public investment.

Excessive public investment can crowd out private sector investment, diminishing its motivation. During periods of heightened public investment, the government may need to increase taxes or borrow more, placing additional financial burdens on the private sector. “Businesses and taxpayers alike will feel this pressure,” Dr. Binh noted.

He expressed hope that while public investment will remain crucial, private investment will gradually take on a larger role, particularly in infrastructure projects where participation is encouraged.

Public investment should then focus on projects lacking private sector appeal or serve as seed capital for large-scale infrastructure initiatives. It should act as both a catalyst and a key driver, prioritizing high-impact projects that open new growth avenues previously untapped.

Aiming for High Growth

At the Forum, Dr. Binh expressed optimism about the economy’s potential for higher growth in 2026.

He highlighted that international buyers’ confidence in Vietnam’s goods and production capabilities remains strong, despite global economic challenges and sluggish recoveries in many markets. This is evidenced by the projected total import-export turnover for 2025, estimated at $800-850 billion, despite trade tariff issues.

A key factor supporting 2026 growth is the global trend toward monetary policy expansion, fostering a worldwide economic recovery. This is particularly beneficial for export-dependent nations like Vietnam. Additionally, global trade tensions show signs of easing.

Dr. Binh also anticipates faster public investment disbursement in 2026, directly contributing to growth and creating new development opportunities. Private investment and consumption are also expected to perform well, with Resolution 68 enabling private enterprises to participate in key projects and legal obstacles being removed. Consumer spending will strengthen as disposable incomes rise with economic growth.

However, Dr. Binh emphasized that future economic growth will depend on how effectively Vietnam navigates challenges, including monetary policy risks, inflation, public debt, and a growth model still reliant on capital and credit.

Inflation Concerns Subside, Focus Shifts to Exchange Rates

At the Forum, Dr. Le Anh Tuan, CEO of Dragon Capital, opined that inflation risks are currently low due to subdued domestic consumption. He identified exchange rate dynamics and monetary policy as the primary concerns.

Dr. Le Anh Tuan (right) – CEO of Dragon Capital – Photo: BTC

|

Dr. Tuan noted Vietnam’s high dollarization, with substantial foreign exchange and gold reserves. Exchange rate fluctuations significantly impact monetary policy, explaining why domestic interest rates are rising despite global declines.

Looking ahead to 2026, Dr. Tuan believes that as long as exchange rates remain stable, monetary policy should maintain an accommodative stance.

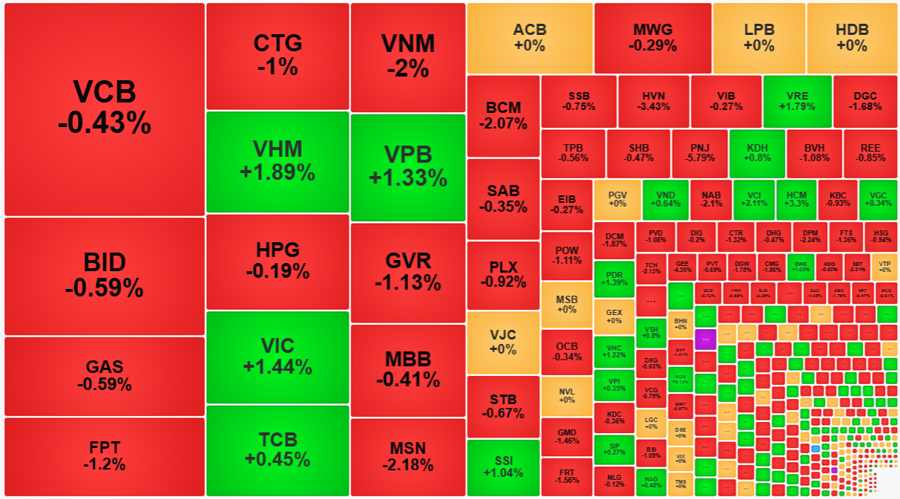

Currently, Vietnam’s foreign exchange reserves stand at approximately $80 billion, covering three months of imports. The decline is partly due to foreign investors’ net selling on the stock market, totaling $12 billion over the past five years.

Foreign ownership of Vietnamese stocks has fallen to 14.5%, significantly lower than the 20-40% levels seen in other regional markets, despite those economies facing greater instability than Vietnam.

Dr. Tuan attributed this to recent global geopolitical shifts influencing foreign funds’ top-down investment strategies. Vietnam was initially perceived as high-risk in early 2025, but Dr. Tuan predicts that market dynamics will reset in 2026. Consequently, Vietnamese equities may receive more attention and accurate valuation.

– 08:04 05/11/2025

Gold and Dollar’s 50-Year Cycle Nearing Reversal, 2026 to Mark the New Race, Says TTC Chairman Dang Van Thanh

Mr. Thanh asserts that the gold market lacks the tangible contributions of the capital market. The challenge lies in mobilizing the gold held by the public at a reasonable cost, to integrate it into national reserves.

SCIC’s 10-Month Profit Surges to Nearly VND 11,400 Billion: On Track to Become the Government’s Premier Investment Fund

SCIC is proactively advocating for the Ministry of Finance and the Government to issue a separate Decree, establishing a favorable legal framework for state capital investment and management in the upcoming period. This initiative also seeks to enable a transition to a Government Investment Fund (Sovereign Wealth Fund) operational model.

How Much Capital Must Banks Inject into the Economy to Achieve 10% Annual GDP Growth by 2030?

Dr. Nguyen Tu Anh, Director of Policy Research at VinUni University, asserts that Vietnam’s credit scale must double within the next five years to achieve the ambitious GDP growth target of approximately 10% annually.

Retail Sales and Consumer Service Revenue Surge 9.3% Year-on-Year by May 10, 2025

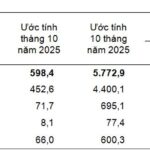

The Statistics Bureau reports that trade and service activities in October were impacted by natural disasters and flooding in several regions. Retail sales and consumer service revenue for the month are estimated to have risen slightly by 0.2% compared to September, and increased by 7.2% year-on-year. Over the first ten months of 2025, total retail sales and consumer service revenue grew by 9.3% compared to the same period last year.