Vingroup (VIC) has announced a proposal to issue 3.85 billion shares (1:1 ratio), doubling its charter capital to over 77 trillion VND, as per the written shareholder consultation document.

If VIC shares maintain their value above 200,000 VND until the record date, the share price will be technically adjusted to 100,000 VND, while the number of shares will double.

Given that VIC shares have surged fivefold since the beginning of 2025, reaching historical highs, this projected price of 100,000 VND becomes more accessible to individual investors. Theoretically, the increased number of circulating shares should enhance liquidity.

With a charter capital of 77 trillion VND, Vingroup will surpass Hoa Phat to become the largest non-financial enterprise on the stock market, second only to Vietcombank, MB, and VPBank.

This substantial charter capital not only underscores the conglomerate’s stature but also bolsters its financial capabilities, enabling continued investment in long-term projects.

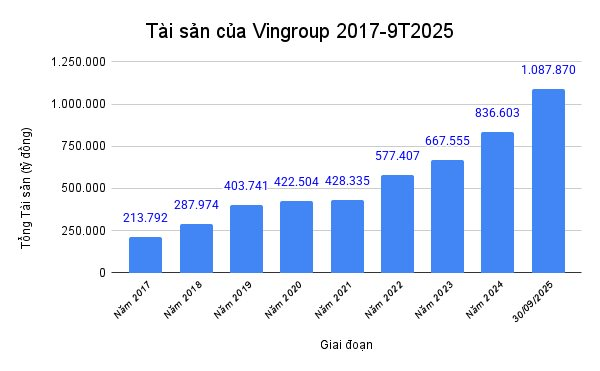

According to the Q3/2025 consolidated financial report, Vingroup’s total assets exceeded 1 million trillion VND, making it the first private enterprise (excluding banks) to achieve this milestone.

Consolidated equity reached 161.9 trillion VND, including a charter capital of 38.8 trillion VND and retained earnings of 52.5 trillion VND. These retained earnings will fund the issuance of over 3.85 billion bonus shares.

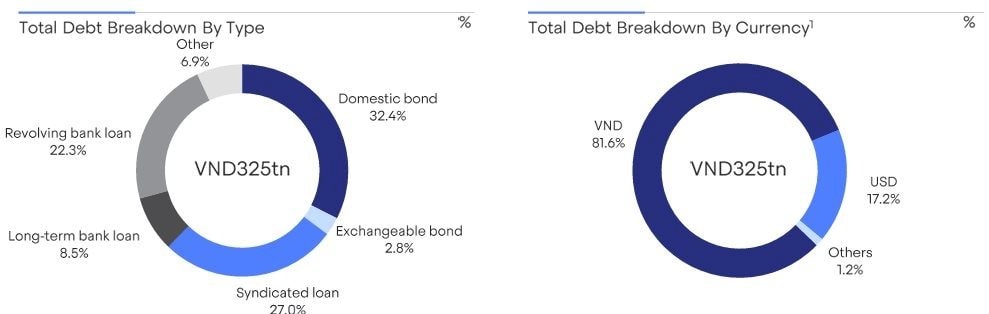

To support its massive asset base, Vingroup holds a debt portfolio of approximately 325 trillion VND, diversified across 32% domestic bonds and 27% syndicated loans.

Source: Vingroup’s Q3 report

The capital increase is crucial considering Vingroup’s investment pace in the first nine months of 2025. The conglomerate invested 144.5 trillion VND, including 104.4 trillion VND in capital contributions and 68.8 trillion VND in fixed asset acquisitions.

During this period, Vingroup’s total assets grew by 251 trillion VND.

Among ongoing projects, VinFast remains a key driver with 17.7 trillion VND in construction costs. The electric vehicle manufacturer aims to sell 200,000 vehicles across 50 countries in 2025 (double 2024 figures), while activating the Ha Tinh factory and establishing international plants.

The real estate division, a traditional cash flow generator, is developing large-scale projects such as Vinhomes Can Gio (10-11 billion USD), Vinhomes Royal Island (Hai Phong), Vinhomes Phuoc Vinh Tay (Long An), and seven Happy Home social housing projects nationwide.

Construction site of the Vinhomes Green Paradise Can Gio mega-project

Additionally, the conglomerate is venturing into new sectors. VinMetal was established with an initial investment of 10 trillion VND to build a 5 million ton/year steel complex.

Vingroup also holds stakes in VinSpeed (10%), VinEnergo (19%), and Vin New Horizon (65% in senior care services), among others.

Billionaire Pham Nhat Vuong and His Two Sons Establish Vinspace, a New Aerospace and Space Company

Recently, Vingroup has been expanding its operations into various new sectors, such as establishing V-Film in the film industry and V-Culture Talents in the arts sector.