|

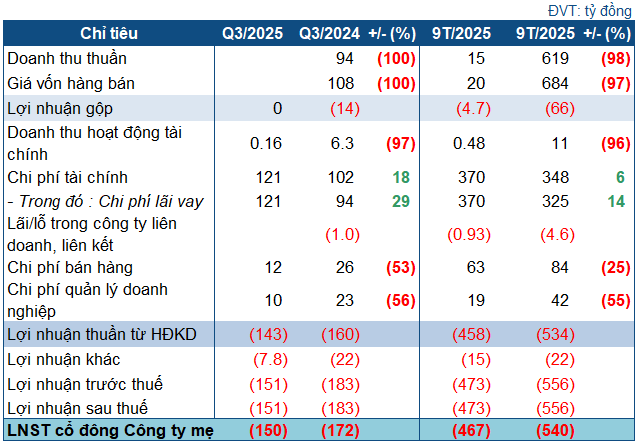

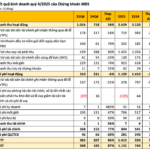

PSH’s Q3/2025 Business Targets

Source: VietstockFinance

|

In Q3, PSH reported zero revenue and cost of goods sold, resulting in no gross profit (compared to a loss of VND 14 billion in the same period last year). Meanwhile, financial expenses continued to rise by 18% to over VND 121 billion. The company also recorded selling and administrative expenses, although both decreased significantly year-over-year.

Other losses were substantially reduced to VND 7.8 billion (from VND 22 billion in the same period last year). Ultimately, PSH posted a net loss of VND 150 billion, a slight improvement from the VND 172 billion loss in the same quarter last year.

For the first nine months of the year, PSH achieved a mere VND 15 billion in revenue, a 98% drop year-over-year, with a net loss of VND 467 billion (compared to VND 540 billion in the same period last year). Given these results, meeting the targets set by the Annual General Meeting (VND 14.6 trillion in revenue and VND 328 billion in after-tax profit) seems nearly impossible.

Financially, PSH’s total assets as of Q3 stood at VND 10.5 trillion, slightly down from the beginning of the year, with nearly VND 5.9 trillion in current assets. Cash surged to nearly VND 60.8 billion (from just over VND 5.2 billion at the start of the year).

Inventory remains the largest asset, accounting for 44% at VND 4.7 trillion, unchanged from the beginning of the year. Work-in-progress construction costs also remained flat at over VND 1.9 trillion.

On the liabilities side, PSH’s total debt reached over VND 10.2 trillion, up 3% from the start of the year, with the majority being short-term debt. Total loans amounted to over VND 6.9 trillion, representing 66% of total capital.

What’s the Way Out?

Despite reducing losses in the first nine months, PSH’s situation appears increasingly dire. The company has been in trouble since late 2023, when it was fined and had its invoices forcibly suspended by the Tax Departments of Hau Giang and Can Tho provinces, totaling over VND 1.2 trillion. Without invoices, the company cannot operate, leading to a freefall in revenue. Accumulated losses as of Q3/2025 reached nearly VND 981 billion.

Over the years, shareholders and even the company’s leadership have pinned their hopes on Acuity Funding, a financial organization. In early 2024, PSH announced Acuity Funding’s involvement, with a commitment to provide a USD 720 million credit facility in two tranches to settle outstanding debts and invest in unfinished projects. Mr. Ranjit Prithviraj Thambyrajah, introduced as Acuity Funding’s Chairman and CEO, was elected to the Board of Directors for the 2022-2027 term at the 2024 AGM and later appointed as CEO.

At the time, Acuity Funding was known as an “Australian giant,” having signed a USD 1 billion investment agreement with Tin Thanh Group, a biomass energy company, in October 2023.

Returning to PSH, Acuity Funding pledged to disburse funds in Q2/2024 but failed to do so. At the 2024 AGM, PSH Chairman Mai Van Huy explained that the State Bank of Vietnam (SBV) prohibited using foreign loans to repay domestic debts under Circular 08. He also mentioned plans to bring cash into the country as bank deposits to create a three-party asset transfer agreement for collateral with foreign partners.

However, months passed with no sign of the funds, and PSH remained entangled in tax debts and revenue shortages. The relationship between PSH and Acuity Funding showed signs of strain after Mr. Ranjit filed a complaint with authorities regarding his delayed departure from the country.

Eventually, PSH’s lifeline officially sank when Mr. Ranjit was arrested by the Police Investigation Agency (PIA) of the Ministry of Public Security on charges of “fraud to appropriate property” for providing false information about the capital sponsorship agreement with PSH. The complaint was filed by Chairman Mai Van Huy. Among the complainants was also Tin Thanh Group. By October 31, Nguyen Viet Anh, Director of Acuity Funding and Deputy CEO of PSH, was also arrested for his role in introducing hundreds of millions to billions of USD in loans to domestic companies.

Ranjit Prithviraj Thambyrajah (left) and Nguyen Viet Anh have both been arrested

|

PSH Announces Dismissal of Arrested CEO

PSH CEO Arrested for Fraud and Embezzlement

Acuity Funding Vietnam Director Arrested

With the CEO arrested, PSH temporarily entrusted Chairman Mai Van Huy to lead the company. Given its inventory of nearly VND 4.7 trillion, mostly consisting of goods and finished products, and the specific demand in the petroleum industry, PSH’s recovery is feasible—provided it resolves its tax debts and lifts the invoice suspension. However, finding a solution to these debts remains a challenging question.

– 13:28 06/11/2025

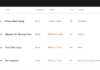

Cen Land (CRE) Reports Q3/2025 Profit Doubling Year-on-Year, Completes VND 450 Billion Bond Payment

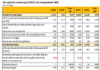

Century Real Estate Joint Stock Company (Cen Land, stock code: CRE) has released its consolidated financial report for Q3/2025, showcasing robust business performance. In Q3/2025, the company achieved a post-tax profit of VND 20 billion, marking a 25% increase compared to the same period last year. This strong performance has propelled the nine-month cumulative profit to VND 63 billion, reflecting an impressive 103% growth year-on-year.

Q3 Profits Surge on Financial Revenue, Yet Hoa Binh Trails Behind After 9 Months

Despite a significant surge in profits during the third quarter, the nine-month business results of Hoa Binh Construction Group JSC (UPCoM: HBC) still reflect a decline in both revenue and profitability year-on-year.

Q3 Oil Prices Stabilize, PVOIL Secures Major Gains

According to the Q3/2025 Consolidated Financial Report, PV OIL (Vietnam Oil Corporation – JSC, UPCoM: OIL) recorded a net profit of VND 125 billion, a 4.5-fold increase compared to the same period last year, driven by stable oil and gas prices.