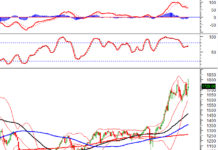

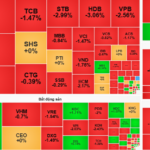

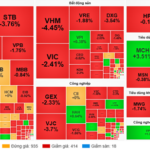

The stock market opened the final session of the week on November 7th under continued selling pressure. As the session progressed, selling intensified, particularly focusing on the Vingroup and banking sectors. By the close, the VN-Index plunged by 43.54 points, or 2.65%, to 1,599.10 points, breaching the 1,600-point threshold. Foreign trading activity was a notable negative, with net selling reaching 1.35 trillion VND across the market.

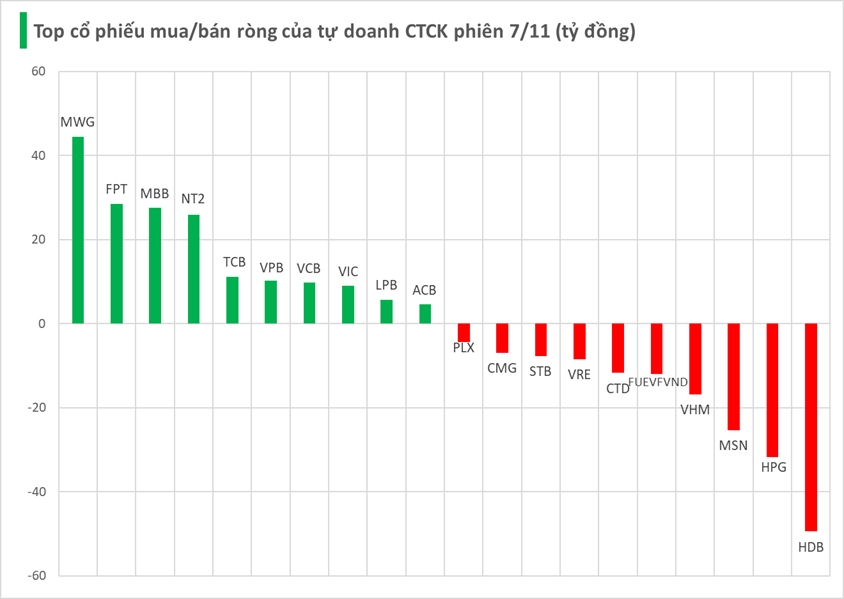

Securities firms’ proprietary trading desks net bought 35 billion VND on HOSE.

Specifically, MWG saw the strongest net buying at 45 billion VND, followed by FPT (29 billion), MBB (28 billion), NT2 (26 billion), TCB (11 billion), VPB (10 billion), VCB (10 billion), VIC (9 billion), LPB (6 billion), and ACB (5 billion VND) – all actively net bought by securities firms’ trading desks.

Conversely, the strongest net selling by securities firms was observed in HDB, with a value of -49 billion VND, followed by HPG (-32 billion), MSN (-25 billion), VHM (-17 billion), and FUEVFVND (-12 billion VND). Other stocks also recorded significant net selling, including CTD (-12 billion), VRE (-8 billion), STB (-8 billion), CMG (-7 billion), and PLX (-4 billion VND).

Stock Market Update November 7: Awaiting Signals to Invest in Oil & Gas Stocks

Despite the lackluster market conditions, savvy investors can strategically allocate funds into stocks within the oil and gas sector, as well as public investment domains, particularly those trading near their support levels.

Vingroup Doubles Charter Capital to 77 Trillion VND, Stock Price ‘Splits’ to 100,000 VND Level: What’s Next?

The remarkable fivefold surge in VIC shares since the beginning of 2025, reaching an all-time high, makes the provisional price of 100,000 VND more accessible to individual investors. Additionally, the increased number of outstanding shares will enhance the stock’s liquidity, benefiting traders and investors alike.

Market Pulse 07/11: Foreign Investors Offload Financial & Real Estate Stocks, VN-Index Dips Below 1,600 Points

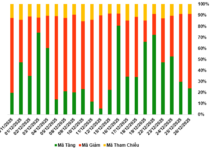

At the close of trading, the VN-Index dropped 43.54 points (-2.65%), settling at 1,599.1 points, while the HNX-Index fell 6.04 points (-2.27%), closing at 260.11 points. Market breadth was overwhelmingly negative, with 540 decliners outpacing 204 advancers. Similarly, the VN30 basket saw red dominate, as 28 stocks declined and only 2 advanced.