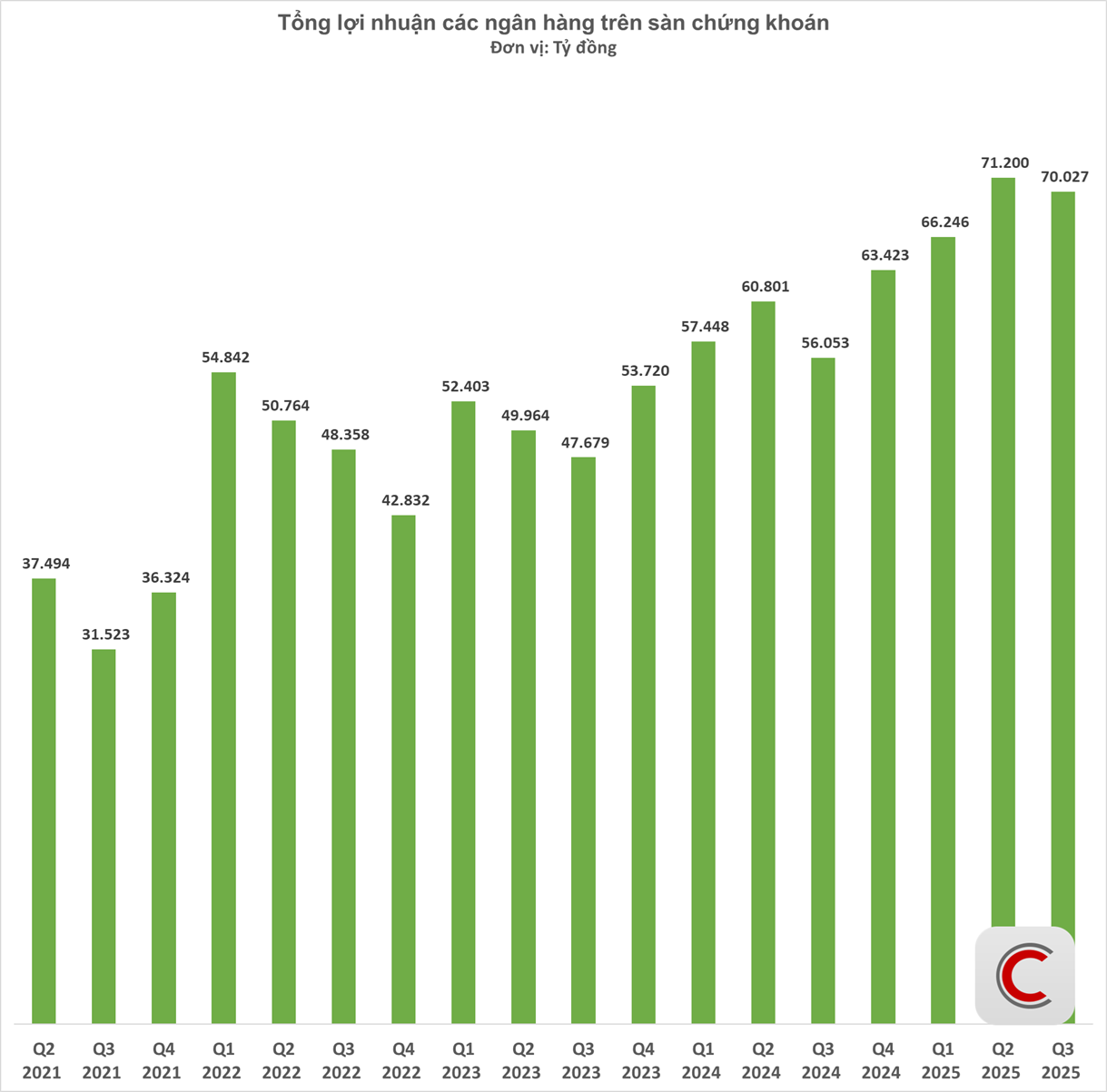

The Q3 2025 post-tax profit rankings of Vietnamese banks reveal significant shifts compared to Q2. Vietcombank surged to the top with VND 9.026 trillion, a 2.1% increase from the previous quarter. VietinBank, Q2’s leader, saw a 12.7% decline to VND 8.512 trillion, settling for second place.

VPBank recorded the most substantial growth among major banks, with profits soaring 49.1% to VND 7.364 trillion, reclaiming the third spot. BIDV dropped to fifth after an 11.8% decrease, while Techcombank maintained fourth place with a modest 4.2% rise. MB slipped 3.4% to sixth, and ACB and HDBank retained their seventh and eighth positions, respectively.

In the mid-sized bank category, Sacombank and LPBank both advanced. Sacombank inched up 0.3% to ninth, and LPBank jumped 15.3% to enter the top 10. Conversely, SHB plummeted 28.5%, falling to 11th and exiting the top 10.

OCB stood out with a 54.9% profit surge, climbing three spots to 15th. SeABank and ABBank faced declines of 31.2% and 37.6%, dropping to 17th and 18th, respectively.

Among smaller banks, Vietbank rose 32.4% to 21st. BVBank achieved the most remarkable growth system-wide, with profits skyrocketing from VND 10 billion in Q2 to VND 274 billion in Q3, a 26-fold increase, propelling it five places to 22nd. NCB and Bac A Bank fell three and four spots, respectively, with declines of 39.1% and 51.4%.

As of Q3 2025, the top 10 banks by post-tax profit are Vietcombank, VietinBank, VPBank, Techcombank, BIDV, MB, ACB, HDBank, Sacombank, and LPBank.

At the Q3 2025 banking performance press conference, the State Bank of Vietnam (SBV) reported that credit growth in 2025 outpaced 2024, with a consistent monthly upward trend. As of September 29, 2025, credit expanded by 13.37% compared to year-end 2024, focusing on production, business, and priority sectors.

In interest rate management, the SBV maintained low policy rates to guide market lending rate reductions, supporting businesses and individuals. It also directed credit institutions to cut operational costs and leverage technology to lower lending rates, continuing the downward trend in borrowing costs.

For the foreign exchange market, the SBV adopted a flexible exchange rate policy, coordinating with other monetary tools. The market operated smoothly, meeting legitimate economic demands with a flexible exchange rate.

Regarding credit management, on December 30, 2024, the SBV issued a document allocating 2025 credit growth targets to all credit institutions, ensuring transparency. On July 31, 2025, the SBV increased these targets transparently, without requiring institutional requests.

Credit institutions were instructed to pursue safe, efficient credit growth, prioritizing production, business, and growth-driving sectors while controlling risky lending. Various support programs were launched, including loans for agriculture, high-quality rice production in the Mekong Delta, social housing, worker housing, and home purchases for individuals under 35.

Interest Rates Show Signs of Rising Despite State Bank’s Net Capital Injection

After a prolonged period of remaining at a low level, deposit interest rates are showing signs of a slight increase in the final months of the year. Despite the system’s ample liquidity, interest rates in both the primary and secondary markets are trending upward, reflecting notable shifts in the balance of capital supply and demand within the system.

Unlocking the Gold Floor Model: Global Insights on Mobilizing Civilian Gold Reserves

The Shanghai Gold Exchange (SGE) is widely regarded as the ideal model for Vietnam’s pilot gold trading platform, focusing primarily on physical spot gold transactions.