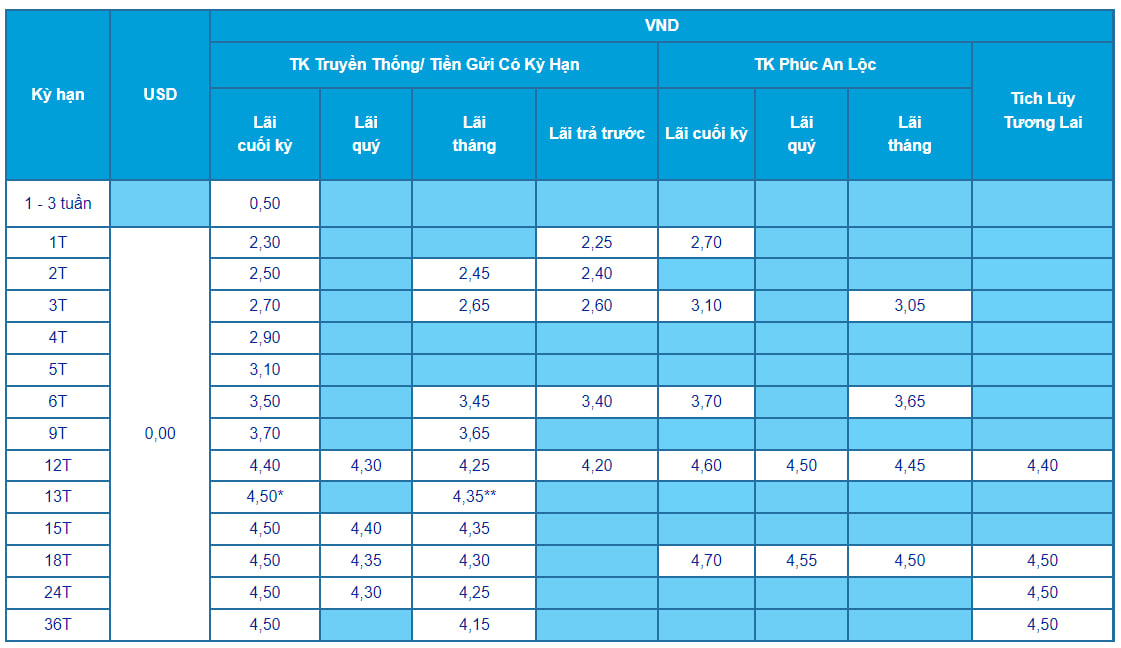

ACB Counter Deposit Rates for November 2025

According to the latest survey, Asia Commercial Bank (ACB) continues to offer counter deposit interest rates for customers, with end-of-term interest ranging from 0.5% to 4.5% per annum.

Specifically, ACB lists a 0.5% per annum interest rate for deposits of 1-3 weeks; 1-month term deposits earn 2.3% per annum; 2-month term deposits earn 2.5% per annum; 3-month term deposits earn 2.7% per annum; 4-month term deposits earn 2.9% per annum; 5-month term deposits earn 3.1% per annum; 6-month term deposits earn 3.5% per annum; 9-month term deposits earn 3.7% per annum; and 12-month term deposits earn 4.4% per annum.

ACB applies a 4.5% per annum deposit interest rate for longer terms from 13 to 36 months. Notably, for 13-month term deposits of 200 billion VND or more, customers receive a preferential interest rate of 6.0% per annum.

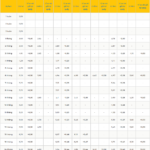

ACB Counter Deposit Interest Rate Table for November 2025

Source: ACB

In addition to end-of-term interest, ACB offers flexible interest payment options: Quarterly Interest: Rates range from 4.30% to 4.4% per annum; Monthly Interest: Rates range from 2.45% to 4.35% per annum (13-month term deposits of 200 billion VND or more receive a preferential rate of 5.9% per annum); Advance Interest: Rates range from 2.25% to 4.2% per annum.

Furthermore, ACB offers the Phuc An Loc and Tich Luy Tuong Lai savings packages, with interest rates up to 4.7% per annum.

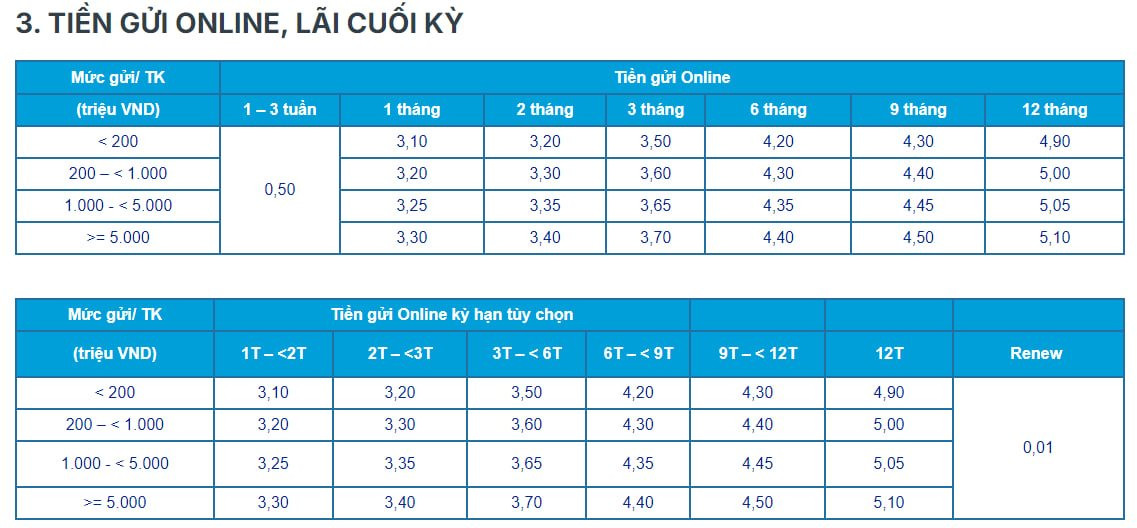

ACB Online Deposit Rates for November 2025

For online deposits via the bank’s app, ACB’s deposit interest rates range from 0.5% to 5.1% per annum for end-of-term interest.

Specifically, ACB applies a 0.5% per annum interest rate for 1-3 week deposits. Other terms have tiered interest rates based on deposit amounts:

Deposits under 200 million VND: 1-month term deposits earn 3.1% per annum; 2-month term deposits earn 3.2% per annum; 3-month term deposits earn 3.5% per annum; 6-month term deposits earn 4.2% per annum; 9-month term deposits earn 4.3% per annum; 12-month term deposits earn 4.9% per annum.

Deposits from 200 million VND to under 1 billion VND: 1-month term deposits earn 3.2% per annum; 2-month term deposits earn 3.3% per annum; 3-month term deposits earn 3.6% per annum; 6-month term deposits earn 4.3% per annum; 9-month term deposits earn 4.4% per annum; 12-month term deposits earn 5.0% per annum.

Deposits from 1 billion VND to under 5 billion VND: 1-month term deposits earn 3.25% per annum; 2-month term deposits earn 3.35% per annum; 3-month term deposits earn 3.65% per annum; 6-month term deposits earn 4.35% per annum; 9-month term deposits earn 4.45% per annum; 12-month term deposits earn 5.05% per annum.

Deposits of 5 billion VND or more: 1-month term deposits earn 3.3% per annum; 2-month term deposits earn 3.4% per annum; 3-month term deposits earn 3.7% per annum; 6-month term deposits earn 4.4% per annum; 9-month term deposits earn 4.5% per annum; 12-month term deposits earn 5.1% per annum.

Thus, 12-month online deposits currently offer the highest interest rates at ACB, ranging from 4.9% to 5.1% per annum, depending on the deposit amount.

ACB Online Deposit Interest Rate Table for November 2025

Source: ACB

Tin Vũ

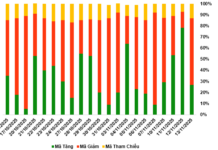

What Does the Surge in Bank Deposit Interest Rates Reveal?

After a prolonged period of low interest rates, the race to attract deposits has suddenly heated up as multiple banks announce increases in their deposit interest rates. However, many experts argue that these hikes, while notable, remain below historical averages and do not yet signal a complete reversal in the interest rate trend.

Interest Rates on Deposits Edge Up Amid Year-End Capital Demand

Interest rates are expected to fluctuate minimally within a narrow range during the final two months of the year. More significantly, lending rates will remain stable at low levels, providing optimal conditions for businesses to sustain their production and operational recovery.