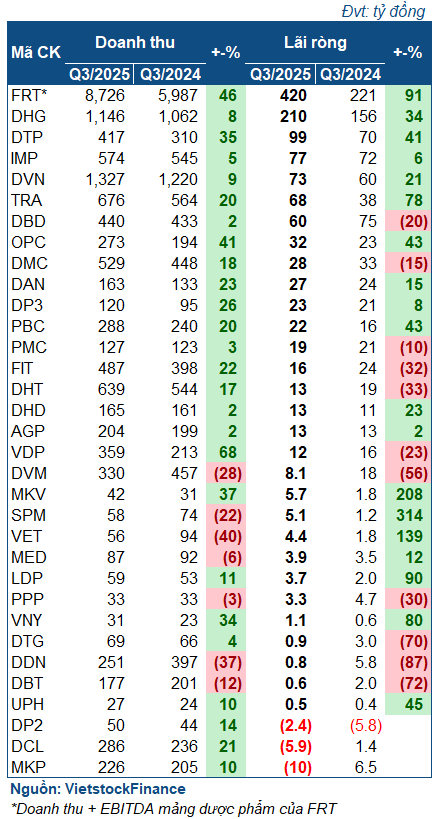

According to VietstockFinance, out of 33 pharmaceutical companies that released their Q3 financial reports, 19 saw profit increases, 11 experienced declines, and 3 reported losses. Notably, several industry leaders maintained strong growth by optimizing product structures and operational efficiency.

|

Q3 2025 Performance of Pharmaceutical Companies

|

Dược Hậu Giang (HOSE: DHG) continued its impressive performance, with revenue and net profit reaching over 1.1 trillion VND and 210 billion VND, respectively, marking an 8% and 34% increase year-over-year. This is the fourth consecutive quarter the company has achieved profits exceeding 200 billion VND.

DHG attributed its growth to the recovery of pharmacy channels, cost optimization, and enhanced operational efficiency. Notably, the company’s cost of goods sold (COGS) in Q3 even decreased compared to the same period last year, indicating significant improvements in business performance.

| Business Performance of DHG |

DTP (Dược phẩm CPC1 Hà Nội) achieved a record quarterly profit of 99 billion VND, a 41% increase, with revenue rising 35% to 410 billion VND. While the company cited enhanced sales efforts, improved cash flow management, and lower market interest rates, the significant increase in gross profit margin from 50% to over 59% highlights its improved operational efficiency.

Imexpharm (HOSE: IMP), following a record-breaking Q2, posted its highest-ever Q3 profit of 77 billion VND, a 6% increase. Revenue grew by 5% year-over-year, while COGS increased slightly by 3%. The company credited stable growth in both OTC and ETC channels, as well as efficient production planning, optimized factory capacity, and cost-saving measures across its four manufacturing clusters.

| IMP Achieves Record Q3 Profit |

Traphaco (HOSE: TRA) saw a 78% profit increase to 68 billion VND in Q3, primarily due to improved gross margins as revenue outpaced COGS. The company attributed this growth to increased sales of flagship products, expanded pharmacy channels, and a focus on higher-margin product lines.

Dược Việt Nam (HOSE: DVN), after three quarters of decline, rebounded in Q3 with a 21% profit increase to 73 billion VND. This recovery was mainly due to lower financial provisioning costs and increased income from subsidiaries.

| DVN Rebounds in Q3 2025 |

Other notable performers include OPC and PBC, both with 43% profit increases, and SPM, which saw profits quadruple year-over-year.

However, several industry leaders faced setbacks. Dược Bình Định (HOSE: DBD) ended its six-quarter profit growth streak with a 20% decline in Q3 net profit to 60 billion VND. The company cited increased R&D investments and higher sales and marketing expenses as the main reasons. Additionally, gross profit decreased by 15% due to rising COGS.

| DBD Ends Six-Quarter Growth Streak Due to Operational Costs and R&D |

Dược Hà Tây (HNX: DHT) reported its second consecutive quarter of profit decline, with Q3 profits falling 33% to 13 billion VND, primarily due to higher COGS. DDM saw profits more than halve to 8 billion VND, attributing the decline to broader market challenges. Other significant profit declines were recorded by DDN (-87%), DBT (-72%), and DTG (-70%).

Three companies reported losses in Q3: DP2, DCL, and MKP. While DP2 reduced its losses, the other two turned from profit to loss. MKP reported a net loss of 10 billion VND (compared to a 6.5 billion VND profit last year) due to increased production costs, and DCL lost nearly 6 billion VND (compared to a 1.4 billion VND profit) due to higher interest expenses.

Overall, the pharmaceutical sector’s strong Q3 performance was supported by favorable government policies. The amended Pharmaceutical Law, the 2023 Public Procurement Law, and the Health Insurance Law, effective since late 2024 and early 2025, are creating significant opportunities for domestic pharmaceutical production, reducing reliance on imports, and boosting R&D investment.

Long-term prospects for the industry remain promising, driven by Vietnam’s rapidly aging population. By 2036, Vietnam is expected to transition from an “aging” to an “aged” society, with older adults typically requiring more pharmaceuticals and healthcare services due to age-related health issues.

– 09:00 09/11/2025

Real Estate Credit Surges to New Heights

Over the past 10 months, real estate credit has seen robust growth, emerging as a key driver of economic expansion. However, experts argue that while real estate credit has surged, it has not generated liquidity, as investors primarily engage in short-term speculative trading.

Vietnam’s Record-Breaking $2.06 Billion, 800-Hectare Megacity Unveiled Adjacent to International Airport and Seaport

Nestled along one of the world’s most breathtaking coastal bays, this premier metropolitan city in Vietnam redefines urban elegance and natural splendor. Its strategic location offers unparalleled views, blending modern sophistication with the serene beauty of the sea, making it a global destination like no other.