Illustrative image

According to preliminary statistics from the General Department of Customs, Vietnam’s rubber imports in October reached over 184,000 tons, valued at more than $280 million, marking a significant increase of 25.3% in volume and 20.1% in value compared to the previous month. Cumulatively, in the first 10 months of the year, the country imported over 1.5 million tons of rubber, worth more than $1.4 billion, reflecting a 2.3% rise in volume and a 7.4% increase in value year-on-year.

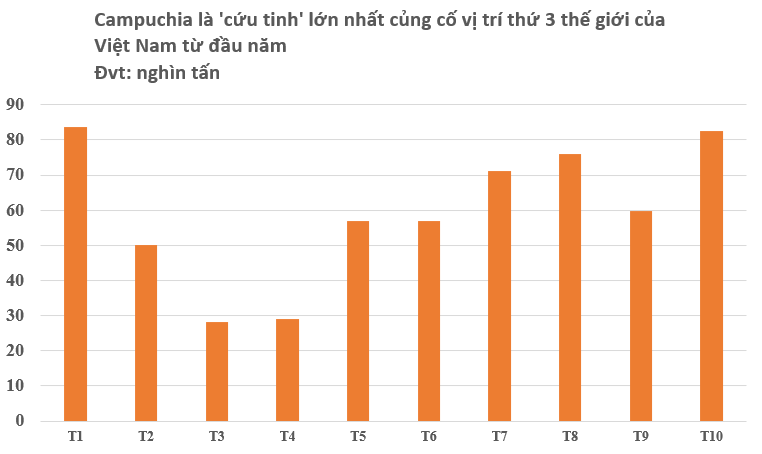

In terms of market sources, Cambodia remains Vietnam’s largest supplier, with over 591,000 tons valued at more than $784 million, though this represents an 8.8% decline in volume and a 2% drop in value compared to the same period last year. The average price increased by 8%, reaching $1,325 per ton.

China ranks as the second-largest supplier, with over 226,000 tons valued at more than $388 million, showing a 40.5% increase in volume and a 23% rise in value compared to the same period in 2024. The average price stands at $1,713 per ton, a 13% decrease year-on-year.

South Korea follows in third place, supplying over 160,000 tons valued at more than $263 million, with a 6% increase in volume and a 1% rise in value. The average price decreased by 5%, to $1,645 per ton.

Currently, the import tax on natural rubber ranges from 5% to 10%, depending on the product type and origin. For imports from ASEAN countries, free trade agreements like AFTA may offer preferential rates, including 0% tax with a valid Certificate of Origin (C/O).

According to the Import-Export Department (Ministry of Industry and Trade), rubber prices at the end of October 2025 showed an upward trend due to disrupted harvesting activities in Southeast Asia, the world’s largest rubber-producing region. Prolonged heavy rains in Thailand, Indonesia, and Vietnam have not only reduced latex yields during the peak harvesting season but also complicated transportation and logistics.

Analysts suggest that supply could recover in Q4 if weather conditions improve, while demand remains robust due to stable tire production. Positive signals from China’s industrial sector, the world’s largest rubber consumer, coupled with expectations of easing U.S.-China trade tensions, have bolstered market sentiment and strengthened short-term consumption prospects.

Chaos Tiancheng Research (China) predicts that rubber supply may increase in Q4, while demand remains well-supported by stable factory operations and strong tire export growth. This positions the rubber market for a dual upswing in both supply and demand.

In Indonesia, one of the world’s largest rubber producers, output has continued to decline in recent years. The Association of Natural Rubber Producing Countries (ANRPC) forecasts that Indonesia’s rubber production in 2025 will drop by 9.8% compared to the previous year.

Most of the country’s rubber plantations are managed by smallholder farmers, characterized by aging trees, low yields, and vulnerability to price fluctuations and diseases. Additionally, the allure of alternative crops like oil palm, which offer higher profits, is prompting many farmers to switch or abandon rubber cultivation.

Hundreds of Thousands of Tons of Cambodia’s ‘White Gold on Trees’ Flood into Vietnam: As the World’s Third-Largest Player, Vietnam Emerges as Thailand’s Long-Standing Rival

Since the beginning of the year, Vietnam has spent nearly $2 billion on importing this particular commodity.