On November 12th, Viglacera Tien Son Joint Stock Company (VIT) held an Extraordinary General Meeting of Shareholders to approve the merger of Viglacera Thang Long Joint Stock Company (TLT) and Viglacera Ha Noi Joint Stock Company (VIH) into Viglacera Tien Son.

The merger aims to innovate and streamline the organizational structure of the Tile Group under the parent company, Viglacera Corporation – JSC.

Post-merger, the company will retain the name Viglacera Tien Son Joint Stock Company.

Currently, Viglacera Tien Son does not own any shares in TLT and VIH. Therefore, VIT plans to issue up to 18.8 million additional shares at a specific exchange ratio to swap all outstanding shares held by TLT and VIH shareholders, equivalent to approximately 37.6% of VIT’s charter capital.

Based on the valuation reports of VIT, TLT, and VIH shares, the Board of Directors has determined the following exchange ratios:

Exchange ratio of VIT shares to TLT shares: 1:1.4 (meaning 1 TLT share will be exchanged for 1.4 VIT shares).

Exchange ratio of VIT shares to VIH shares: 1:1.61 (meaning 1 VIH share will be exchanged for 1.61 VIT shares).

All TLT and VIH shares will be fully and automatically converted into VIT shares. Following the successful share swap, TLT and VIH shares will be delisted from the UpCom trading platform and deregistered at the Vietnam Securities Depository.

Upon completion of the merger procedures, VIT will assume all assets, legal rights, and interests, as well as liabilities, labor contracts, and other obligations of TLT and VIH (including but not limited to business rights, property rights, receivables, payables, and obligations under any contracts signed with third parties) based on the book values of TLT and VIH.

The merger is expected to be implemented in Q4/2025 – Q1/2026.

From January 1, 2026, Viglacera Tien Son will take over the product distribution of Viglacera Ha Noi, Viglacera Thang Long, and Viglacera Aerated Concrete, by transferring all Tile Sales personnel from Viglacera to Viglacera Tien Son.

Viglacera Tien Son will inherit all brands and product lines of Viglacera Ha Noi, Viglacera Thang Long, and Viglacera Aerated Concrete.

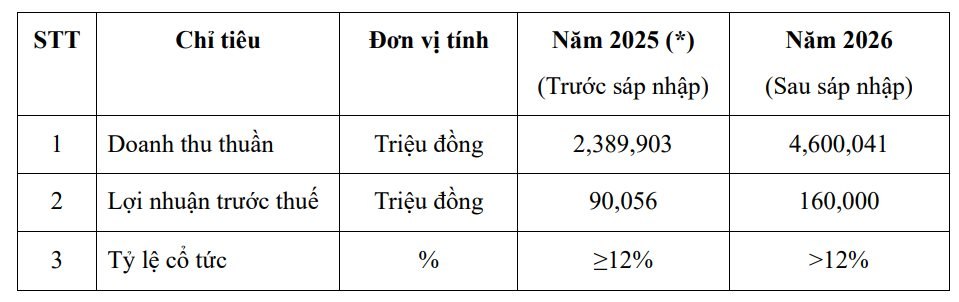

Post-merger, the company projects a revenue of over VND 4,600 billion and pre-tax profit of over VND 160 billion in 2026.

This move is part of Viglacera’s strategy to restructure its business segments.

On November 10th, Viglacera’s Board of Directors approved the restructuring plan for the tile and brick segment. Accordingly, Viglacera Ha Long JSC will develop a strategy focused on optimizing operational efficiency and sustainable growth. Viglacera will divest from Yen Hung Construction Ceramics JSC and Cau Duong Firebrick JSC.

Viglacera Sets Date to Distribute Nearly VND 1 Trillion in 2024 Dividends

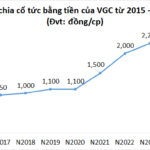

On December 5, 2025, Viglacera will distribute a substantial dividend of 986.37 billion VND to its shareholders, reflecting the company’s strong performance in 2024.