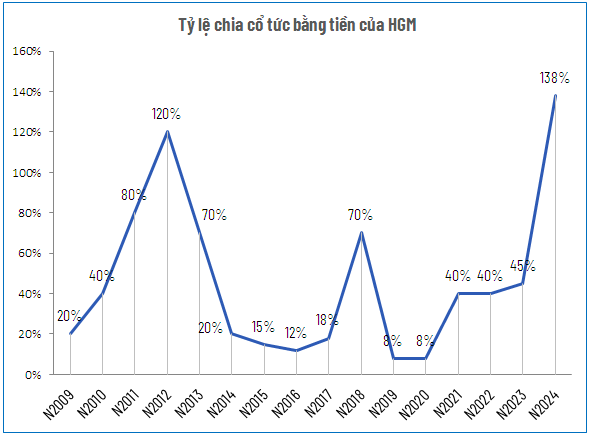

With 12.6 million outstanding shares, HGM plans to allocate approximately VND 107 billion for this dividend payout. Earlier, the company completed the first dividend payment of 2025 at a rate of 45% (VND 4,500 per share), totaling nearly VND 57 billion. Consequently, the total cash dividend for 2025 reaches an impressive 130%, significantly surpassing the minimum 50% plan approved by the Annual General Meeting.

Source: VietstockFinance

|

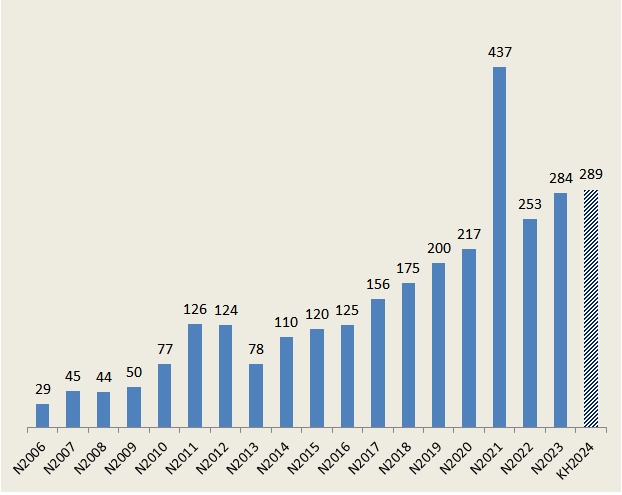

In 2024, HGM also recorded a record dividend payout of 138% (VND 13,800 per share) due to remarkable growth in both revenue and profit.

| HGM’s Financial Performance Over the Years |

Moving into 2025, despite anticipated declines in antimony mining and consumption volumes, HGM has set ambitious targets of VND 400 billion in revenue and VND 248 billion in pre-tax profit, representing increases of 8% and 2% respectively compared to the previous year.

| HGM’s Quarterly Financial Performance |

However, actual results have far exceeded expectations. In Q2/2025, the company reported record-high revenue of VND 279 billion, 3.3 times higher than the same period last year; gross profit reached VND 240 billion, more than quadrupling. As a result, net profit for the quarter hit nearly VND 205 billion. For the first six months, HGM achieved VND 433 billion in revenue and VND 382 billion in pre-tax profit, surpassing the annual plan by 8% and 54% respectively.

Following the interim dividend payment after the record-breaking Q2 results, HGM continued with the second payout after announcing strong Q3 results, with VND 173 billion in net revenue and nearly VND 116 billion in net profit, up 53% and 97% year-on-year. For the first nine months, the company recorded over VND 606 billion in net revenue and VND 422 billion in net profit, 2.4 times and 3.3 times higher than the same period last year, exceeding the annual profit plan by 112% in just three quarters.

Source: VietstockFinance

|

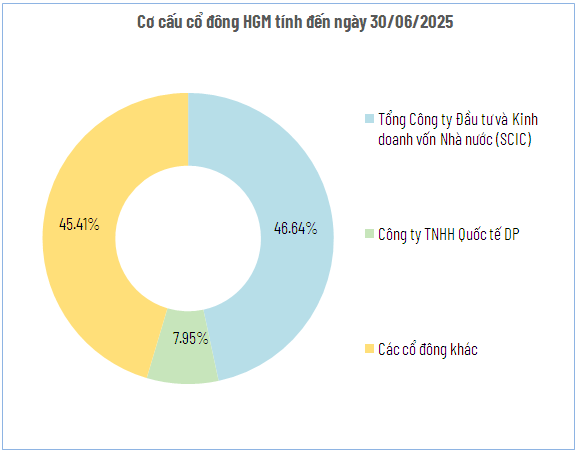

Currently, the State Capital Investment Corporation (SCIC) remains the largest shareholder of HGM, holding 46.64% of the capital and expected to receive nearly VND 50 billion from this payout. DP International LLC, with a 7.95% stake, will receive approximately VND 8.5 billion.

– 11:04 12/11/2025

Saigonres Holds Undisbursed Capital of VND 200 Billion from Fundraising Efforts

As of November 7, 2025, Saigonres has disbursed VND 194.85 billion out of the total VND 394.85 billion raised from its private placement offering concluded in May 2025, leaving VND 200 billion yet to be allocated.

“TBD Sustains 3 Consecutive Years of 20% Cash Dividend Payouts”

Dong Anh Electrical Equipment Corporation – JSC (UPCoM: TBD) announces the finalization of its shareholder list for the 2024 cash dividend distribution. Shareholders will receive a 20% dividend, equivalent to VND 2,000 per share. The ex-dividend date is set for November 21st, with payments expected to commence on December 24th.

Thai Billionaire Set to Pocket Over $45 Million from Vietnam’s “Golden Goose” Venture

With nearly 1.3 billion outstanding shares, Sabeco is set to allocate approximately VND 2,570 billion for this dividend payout.