The Rise of Hybrid Assembly in Vietnam

Vietnam’s automotive market is witnessing a new wave of investment as major manufacturers shift towards domestic hybrid vehicle assembly. This move is seen as a bridge between traditional gasoline vehicles and fully electric cars. After years of relying on fully imported vehicles (CBU), manufacturers are investing hundreds of millions of USD in localized production lines to capitalize on policy incentives and enhance price competitiveness.

According to the latest plans, Honda Vietnam will launch the assembly of the CR-V e:HEV model at its Phu Tho plant starting in 2026. This marks Honda’s first domestically produced hybrid model, signaling a shift from import-focused strategies to local manufacturing. The company stated that this move is part of its plan to introduce a series of electrified vehicles, aligning with upcoming emission and fuel efficiency regulations expected to take effect in 2027.

Meanwhile, Toyota Vietnam has confirmed a $360 million investment to upgrade its plant for hybrid model assembly. The new-generation Corolla Cross Hybrid or Camry Hybrid is expected to be the first “Made in Vietnam” models starting in 2027. Holding over 70% of Vietnam’s hybrid market share, the Japanese automaker views this as a critical step to expand production and maintain its leadership amidst the electric vehicle surge.

Beyond traditional giants, emerging brands are also entering the fray. Omoda & Jaecoo, subsidiaries of China’s Chery, announced a $319 million investment to build an assembly line in Hung Yen starting in 2025.

Analysts see this trend as inevitable. With Vietnam’s government set to reduce special consumption tax on hybrids to 70% of that for equivalent gasoline vehicles (effective from January 1, 2026), local assembly offers a dual advantage: leveraging tax benefits and meeting localization requirements for additional policy support.

Hybrid assembly plants also provide production flexibility—allowing adjustments to battery configurations, electric motors, or energy management systems to suit Vietnam’s road conditions and climate. More importantly, as component supply becomes localized, costs could significantly drop compared to imported vehicles, expanding the potential customer base.

Strong Sales and Continuous New Model Launches

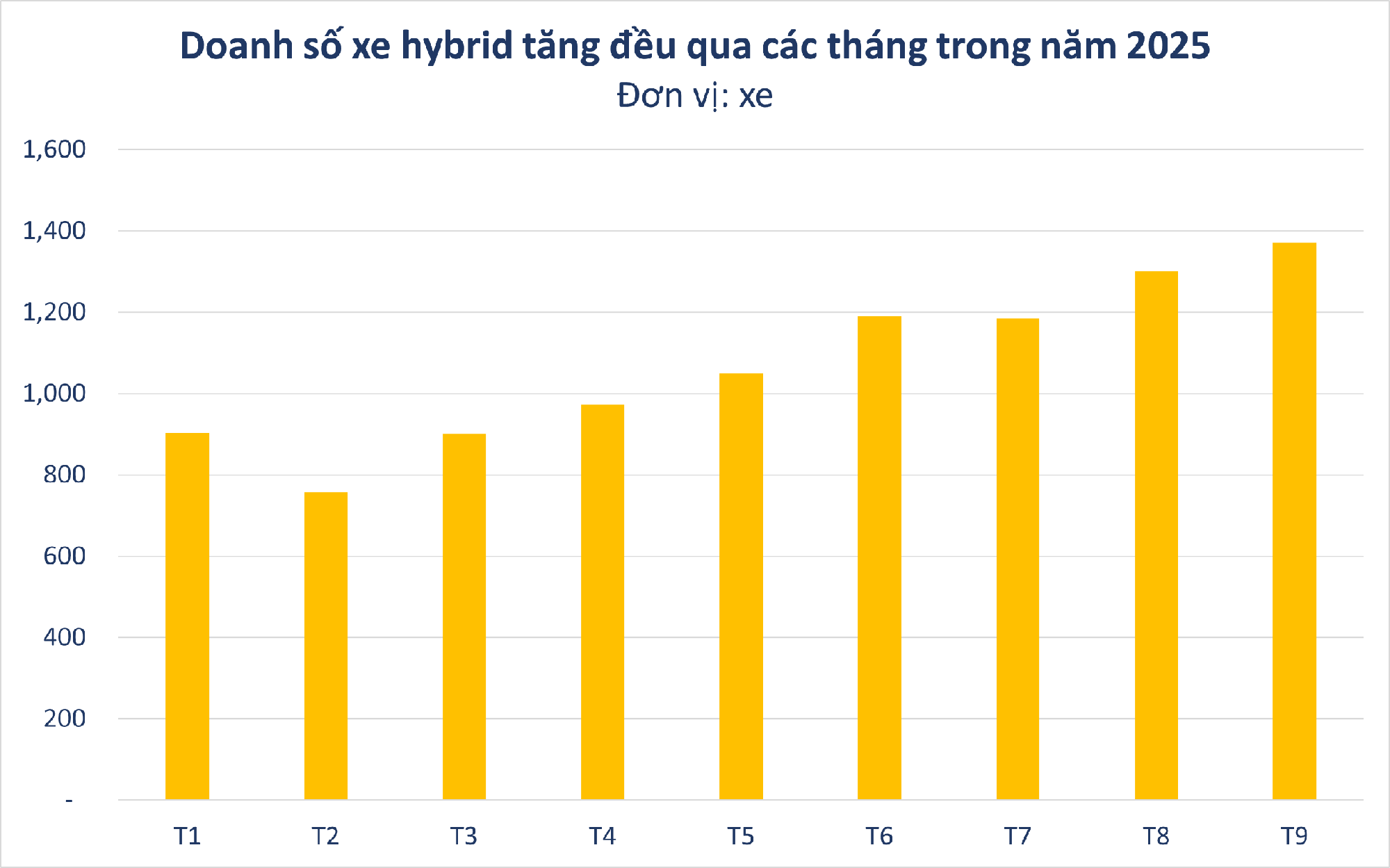

Just a few years ago, hybrids were a novelty in Vietnam, but now they’re showing robust growth. According to the Vietnam Automobile Manufacturers’ Association (VAMA), 1,371 hybrids were sold in September, a 5% increase from the previous month.

In the first nine months of the year, hybrid sales reached 9,785 units, up 73% year-on-year (from 5,652 units). This segment now accounts for approximately 2.5% of the total market share.

Among top-selling hybrids, Toyota dominates with six models leading the pack. The Innova Cross HEV remains Vietnam’s best-selling hybrid for the first nine months. The Corolla Cross HV and Camry 2.5 HEV also feature prominently, alongside the CR-V RS e:HEV and Suzuki XL7 Hybrid.

Vietnam’s hybrid market also includes luxury and Chinese brands, though these companies do not disclose specific sales figures.

The growth is primarily driven by shifting consumer behavior. Hybrids offer a balanced solution: fuel efficiency without the need for charging stations. As local assembly expands, service centers will have readily available parts, reducing repair times and maintenance costs—a significant factor in Vietnamese purchasing decisions.

Notably, there are reports that VinFast, Vietnam’s electric vehicle maker, will develop a hybrid line, potentially including EREV models. VinFast’s entry into this market is surprising, given its July 2022 announcement to halt gasoline vehicle production to focus solely on pure electric vehicles.

Why Do Honda and Other Japanese Automakers Need 2-3 More Years for the “Green Transition” Despite Long-Standing Policies?

Reflecting on the journey, the policy to restrict gasoline-powered motorbikes is far from unexpected: it was first outlined in 2017, updated with specific implementation milestones for 2025, and is now entering its “final progress phase” between 2026 and 2028.