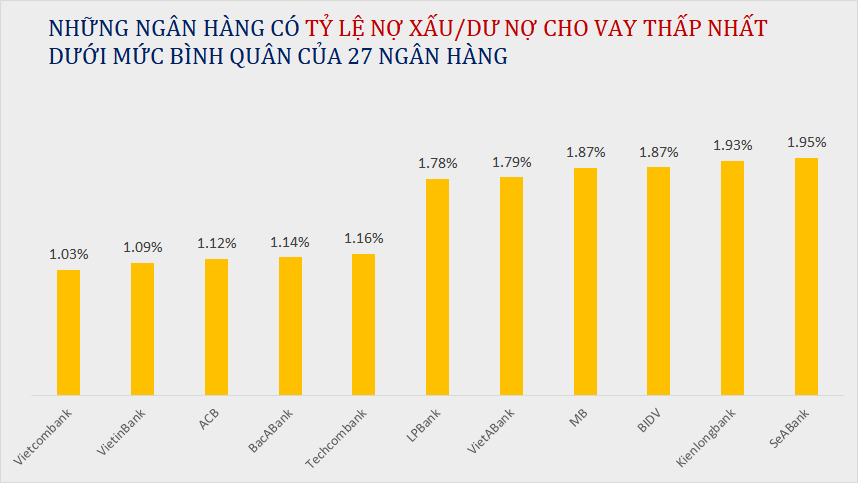

The non-performing loan (NPL) ratio has risen from 1.82% earlier this year but shows a positive improvement compared to the 1.98% recorded at the end of Q2 2025.

Eleven banks reported an NPL ratio below the industry average of 1.95%, including Vietcombank, VietinBank, ACB, BacABank, Techcombank, LPBank, VietABank, MB, BIDV, Kienlongbank, and SeABank.

Among these, the top 5 banks with the lowest NPL ratios are Vietcombank, VietinBank, ACB, BacABank, and Techcombank.

Vietcombank (VCB) leads with the highest pre-tax profit in the first nine months of the year and boasts the lowest NPL ratio in the system at 1.03%. By the end of Q3 2025, its customer loan portfolio exceeded 1.6 million billion VND, with NPLs totaling over 16.8 trillion VND. This translates to just 10.3 million VND in bad debt per billion VND lent, of which 7.5 million VND is potentially irrecoverable.

VietinBank (CTG) demonstrated one of the most significant improvements in credit quality, reducing its NPL ratio from 1.24% at the end of 2024 to 1.09% by the end of Q3 2025. Its customer loan portfolio reached nearly 2 million billion VND, with NPLs at approximately 21.7 trillion VND. On average, for every billion VND lent, 10.9 million VND is classified as bad debt, with 5.9 million VND potentially irrecoverable.

ACB remains among the private banks with the most stable and high-quality assets, maintaining an NPL ratio of 1.12% as of Q3 2025. Its customer loan portfolio stands at 653 trillion VND, with NPLs at around 7.3 trillion VND. This equates to approximately 11.2 million VND in bad debt per billion VND lent, with 8.4 million VND potentially irrecoverable.

Bac A Bank (BAB) is the only small-scale bank in the top 5 with the lowest NPL ratio, at 1.14%. By the end of Q3 2025, its loan portfolio reached 125 trillion VND, with NPLs at approximately 1.4 trillion VND. Thus, for every billion VND lent, 11.4 million VND is classified as bad debt, with 9.1 million VND potentially irrecoverable.

Techcombank (TCB) maintains its position as a leading private bank in terms of credit scale and asset quality, with an NPL ratio of 1.16% as of Q3 2025. Its customer loan portfolio stands at 767 trillion VND, with NPLs at 8.9 trillion VND. This means that for every billion VND lent, approximately 11.6 million VND is bad debt, with only 6.6 million VND potentially irrecoverable.

Notably, the NPL situation across banks shows a positive trend, with nearly half of the surveyed banks reporting a decrease in their NPL ratios in Q3 2025. BVBank saw the most significant improvement, with a 0.69 percentage point reduction in its NPL ratio. VPBank and VietinBank also recorded notable decreases of 0.46 and 0.22 percentage points, respectively.

Will Bank Bad Debt Return to Safe Levels by Year-End?

Despite lingering risks, particularly in real estate and consumer sectors, the overall outlook remains positive as the year draws to a close. With credit growth sustaining its steady pace and legal frameworks for debt resolution improving, bad debt levels are likely to ease slightly by year-end, staying within manageable limits.

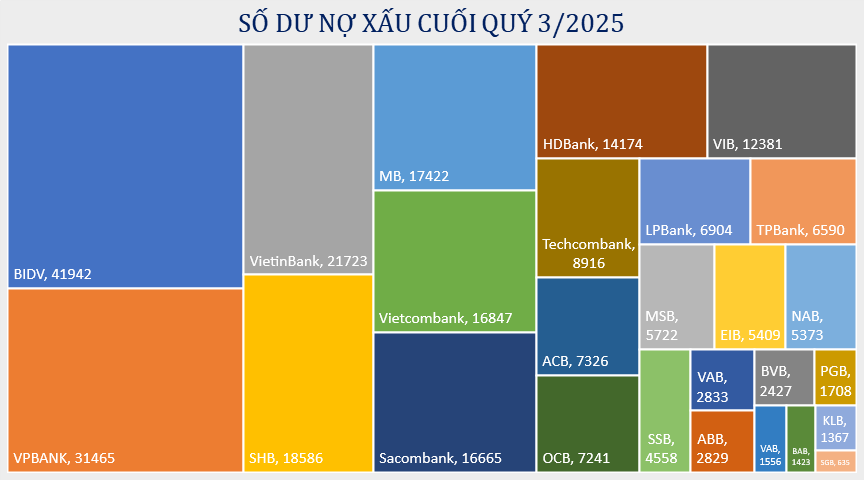

Bank Bad Debt Polarization

By the end of Q3 this year, the landscape of non-performing loans (NPLs) within the banking system revealed a clear polarization. While many large and mid-sized banks demonstrated improved asset quality, smaller banks recorded a trend of rising NPLs.

November 2025 Savings Interest Rates: Slight Uptick, Yet Remain at Low Levels

Interest rates for regular VND savings deposits at bank counters as of early November 2025 remain relatively stable, with slight increases observed in some short-term tenures. Analysts predict a modest upward trend in deposit rates for the final months of the year, though overall rates are expected to stay at a low level.