Furniture Manufacturing – Illustrative Image

|

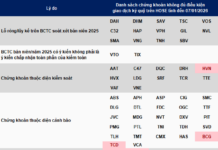

“Big Three” Dominate the Wood Industry’s Profits

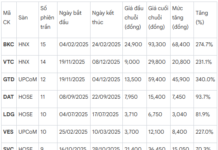

At first glance, the listed wood industry appeared to have a vibrant Q3/2025, with data from VietstockFinance showing 14 companies recording total revenue of over VND 4.6 trillion, up 5% year-on-year, and net profit reaching VND 394.5 billion, up 9%.

However, these figures paint a bittersweet reality, with a profound and deepening polarization within the industry. Nearly 95% of the sector’s total profits are concentrated among the three giants: Phu Tai (PTB), An Cuong (ACG), and Vietnam Forestry Corporation (Vinafor, VIF). This trend is intensifying, with the concentration ratio in the previous quarter at nearly 80%.

|

This disparity becomes even more pronounced when examining the quarterly performance of individual companies. Only 4 out of 14 companies increased profits, 7 decreased, 1 continued to incur losses, and 1 shifted from profit to loss. This reflects a challenging environment where only large-scale enterprises with strong positions can maintain growth.

Phu Tai continues to lead the industry with exceptional growth. Q3 net profit surged 71% to nearly VND 136 billion, the highest in the industry and the company’s highest since Q3/2022. This marks the fourth consecutive quarter of profit growth for PTB. For the first nine months, PTB reported a net profit of VND 374 billion, up 34%, surpassing the entire 2023-2024 results and nearly meeting the profit target (VND 475 billion in pre-tax profit against a goal of VND 477 billion).

The growth driver remains the wood segment, accounting for 56% of total nine-month revenue (nearly VND 2.9 trillion, up 13% year-on-year), with exports making up 94%. However, the gross margin for the wood segment fell to 20.1% from 23.1%, indicating pricing pressure in the international market.

| Phu Tai’s Quarterly Business Results for 2022-2025 |

An Cuong maintained steady performance with a Q3 net profit of over VND 135 billion, up 4%, despite gross margin falling to a two-year low of 28.5%. Efficiency improved through cost control and reduced bad debt provisions. Nine-month results reached a three-year high with revenue exceeding VND 2.9 trillion and profit surpassing VND 358 billion. Compared to PTB, ACG relies heavily on the domestic market, accounting for 81% of total revenue, with the remainder from exports.

| An Cuong’s Nine-Month Business Results by Year |

Meanwhile, Vinafor showed signs of weakening. Q3 net profit fell 3% to just over VND 102 billion, mainly due to a gross margin decline to 13.3% and a sharp drop in financial income and profits from associates. Nine-month net profit fell 39% to under VND 197 billion, despite a 22% revenue increase. As a result, the company achieved only 60% of its annual profit target.

The “Big Three’s” strength stems from distinct strategies: PTB focuses on export revenue growth, accepting thinner margins; ACG emphasizes cost efficiency in the domestic market; while VIF shows risky reliance on non-core business income.

Distinct Marks Among Mid and Small-Cap Enterprises

Amid market polarization, Duc Thanh Wood (GDT) stood out with a contrasting but effective quarter. Revenue fell 13% to under VND 80 billion, but net profit rose 30% to nearly VND 21 billion—a three-year high. GDT achieved a 43.7% gross margin, the industry’s highest, through product portfolio restructuring and cost optimization. For the first nine months, profit increased 36% to nearly VND 53 billion, achieving 86% of the annual target.

| GDT’s Quarterly Business Results for 2022-2025 |

Savimex (SAV) had a brighter Q3 with a 60% net profit increase, thanks to significant reductions in financial, selling, and administrative expenses. However, the nine-month picture remains negative, with profit falling 78% to just over VND 11 billion—a ten-year low for a nine-month period, due to a record loss in Q2 from financial setbacks. The company achieved only 25% of its annual profit target.

| Savimex Hits Decade-Low Nine-Month Profit |

Xuan Hoa (XHC) was the only company to turn a loss into a profit in Q3, with a net profit of over VND 200 million. For the first nine months, profit reached VND 65 billion, largely contributed by dividends from an associate in Q2, nearly matching the 2019 peak and achieving 93% of the annual target.

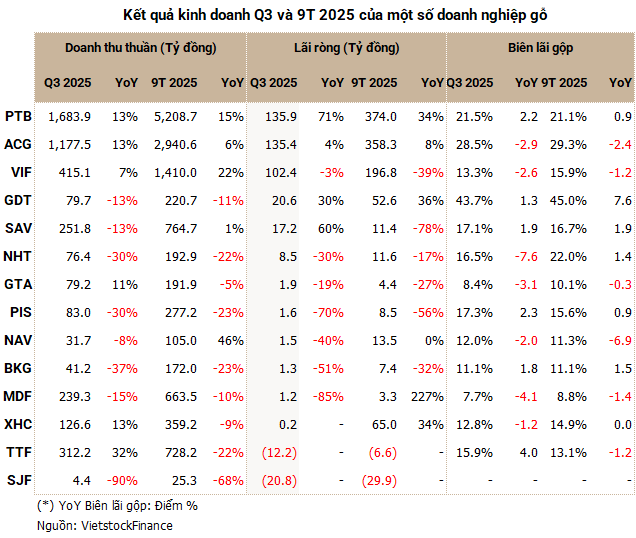

Struggling Bottom-Tier Companies Face Prolonged Losses

Among the struggling companies, many continued to see significant declines. Thuan An Wood (GTA), BKG, NAV, PIS, MDF, and NHT all saw profit reductions of 19-85%. Although they escaped losses, the profits achieved were marginal and did not significantly improve performance.

Truong Thanh Wood (TTF) continued to incur a loss of over VND 12 billion in Q3. Financial costs, primarily interest expenses, remain a challenge, consuming over VND 52 billion in nine months from a debt balance exceeding VND 574 billion. Despite a fivefold increase in financial income to over VND 82 billion from investment liquidations, TTF‘s 2025 profit target of VND 50 billion seems unattainable. Accumulated losses reached nearly VND 3.263 trillion, with equity capital falling below VND 376.5 billion, a consequence of continuous losses from 2016-2023.

| TTF’s Business Results for 2015-9M2025 |

Sao Thai Duong (SJF) shifted from profit to a loss of nearly VND 21 billion, marking the heaviest quarterly loss since 2024. SJF‘s nine-month results were deemed the “worst in history,” with revenue hitting a record low of just over VND 25 billion and a net loss of VND 30 billion. This was due to unsold produced inventory and rising costs for maintaining operations and bad debt provisions.

| SJF Records Lowest Nine-Month Performance Since Inception |

Rising Inventory Poses Widespread Risk

Inventory issues are not unique to SJF but have become an industry-wide risk indicator. At SJF, inventory value increased 55% since the beginning of the year to over VND 48 billion, with provisions of over VND 27 billion. All raw material inventory, valued at over VND 16 billion, was fully provisioned.

Notably, this trend is also evident among industry leaders. PTB saw inventory rise 15% to nearly VND 1.675 trillion, with work-in-progress costs for the Phu Tai Central Life project increasing 2.5 times to over VND 614 billion, indicating risks not only from the core wood segment but also from real estate diversification.

ACG experienced a 33% inventory increase to VND 1.33 trillion, primarily raw materials (46%) and finished goods (27%), with VND 107 billion used as collateral for loans. In contrast, VIF saw inventory slightly decrease by 8% to over VND 932 billion, though work-in-progress costs still accounted for over 82% of total inventory.

Exports Maintain Growth but Face New Challenges

The growth of leading companies is closely tied to export markets. According to the General Department of Customs, total wood and wood product exports in the first nine months reached USD 12.5 billion, up nearly 7% year-on-year. The U.S. remained the largest market, accounting for 55-56% of exports and growing by 7%. Japan and Canada maintained stability, offsetting declines in the Chinese market.

This growth is expected to continue through year-end, but the industry faces significant risks from increasingly stringent origin tracing requirements and “green” product standards in international markets. Additionally, U.S. tax policy fluctuations could directly impact costs and competitiveness.

Overall, Q3/2025 highlights the polarization in the listed wood industry. The leading group—PTB, ACG, and VIF—continues to capture nearly all industry profits, while most other companies struggle with thin margins, high financial costs, and rising inventory risks.

In a context of promising but challenging exports, long-term advantages will favor companies that strengthen supply chains, ensure material origin transparency, and invest in sustainable production. The rest of the industry must find more effective strategies to avoid being left behind in an increasingly competitive market.

– 09:00 17/11/2025