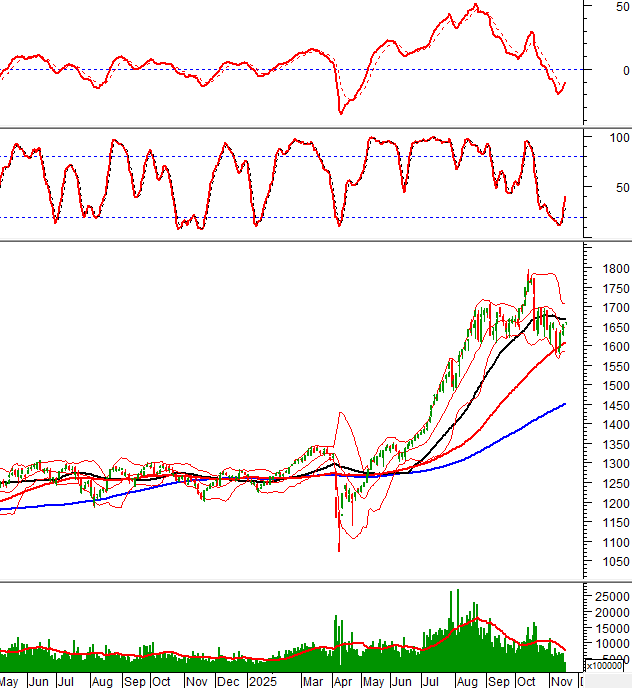

Technical Signals of VN-Index

During the morning trading session on November 18, 2025, the VN-Index continued its upward trend for the third consecutive session, decisively breaking through the Middle line of the Bollinger Bands. This threshold is expected to act as a support level in the near future.

Both the Stochastic Oscillator and MACD indicators are signaling a buy opportunity. As these indicators trend upward, the short-term outlook appears positive.

The author anticipates the index to surpass the 50-day SMA in the near term.

Technical Signals of HNX-Index

In the morning session on November 18, 2025, the HNX-Index paused its upward momentum, forming an Inverted Hammer pattern.

Trading volume has remained below the 20-day average since November 5, 2025, and needs to surpass this level in upcoming sessions to confirm the upward trend.

ANV – Nam Viet Corporation

In the morning session on November 18, 2025, ANV shares rose, accompanied by a White Marubozu candlestick pattern. The stock remains above the 50-day SMA, with a significant surge in volume exceeding the 20-session average, indicating renewed investor activity.

Currently, ANV’s price has crossed above the Middle line of the Bollinger Bands, while the MACD indicator has issued a buy signal and is approaching the zero line. If these signals strengthen in upcoming sessions, the recovery momentum will be further solidified.

VND – VNDIRECT Securities Corporation

In the morning session on November 18, 2025, VND shares extended their rally for the third consecutive session, forming a Three White Soldiers pattern. Volume continued to rise and is projected to exceed the 20-day average by session close, reflecting investor optimism.

Currently, VND’s price has crossed above the Middle line of the Bollinger Bands, as the Stochastic Oscillator climbs out of the Oversold region following a buy signal. If these positive technical signals persist, the short-term recovery will gain further stability.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning session. Therefore, signals and conclusions are for reference only and may change by the close of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:03 November 18, 2025

VN-Index Rebounds with Caution: Prioritize Portfolio Management Over Bottom-Fishing

The VN-Index rebounded above 1,600 points, yet its trend remains unconfirmed. Experts advise investors to hold off on portfolio adjustments until the index surpasses 1,650 and liquidity shows significant improvement.