In the first quarter of 2024, FRT reported net revenue of nearly VND9.042 billion, an increase of 17% compared to the same period last year, of which online revenue reached VND1.555 billion, an increase of 10%. This revenue has enabled FRT to achieve 24% of its annual target.

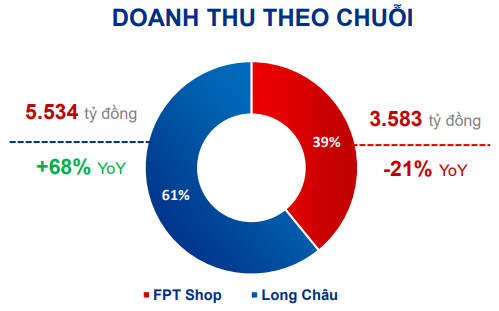

In terms of business segments, FPT Long Chau accounted for VND5.534 billion in revenue (61% contribution), increasing by 68%, equivalent to VND1.2 billion/month, per pharmacy. Revenue for FPT Shop in the first quarter recorded VND3.583 billion, representing a 21% decrease.

Source: FRT

|

In terms of its network of stores, by the end of the first quarter of 2024, FRT was operating 1,587 Long Chau pharmacies, 90 more than at the beginning of 2024, indicating progress toward the target of 1,900 pharmacies by the end of 2024. In addition, the vaccination system had opened 41 new centers. FRT announced that it is developing a network of vaccine centers with three models: shop-in-shop, side-by-side, and standalone stores.

Not as robust in its growth, the FPT Shop chain closed 12 stores due to inefficient operations, with the aim of gradually optimizing operating costs. Following these closures, FPT Shop now has 743 remaining stores.

Source: FRT

|

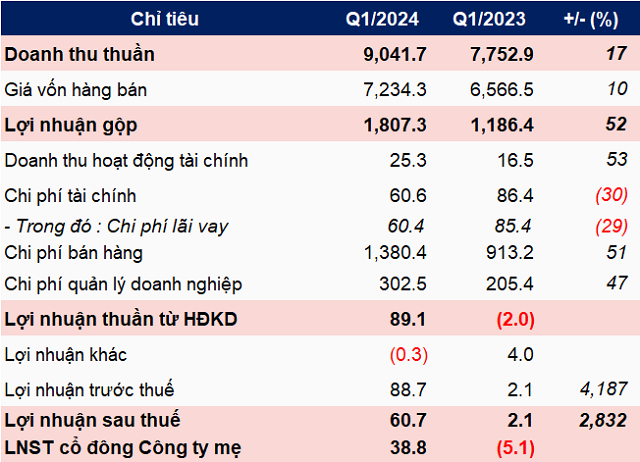

FRT reported a pre-tax profit of nearly VND89 billion in the first quarter of 2024, 43 times higher than the previous year, and reaching 71% of its annual target. After deducting taxes and non-controlling interests, FRT made a net profit of nearly VND39 billion, compared to a loss of over VND5 billion in the same period last year.

According to FRT, the positive results in the first quarter of 2024 were due to a significant reduction in losses by the parent company after restructuring its product portfolio. This move contributed to an increase of approximately 3 percentage points in the gross profit margin of the FPT Shop chain compared to the first quarter of 2023. Additionally, the company was able to access low-interest loans due to a decrease in market interest rates compared to the same period last year, resulting in a 50% reduction in financial costs. Furthermore, Long Chau Pharmaceutical, a subsidiary of FRT, continued to expand its pharmacy network, maintaining its revenue growth.

|

Q1 2024 Business Results of FRT

Unit: Billion VND

Source: VietstockFinance

|

At the end of the first quarter of 2024, FRT‘s total assets had decreased by 4% compared to the beginning of the year, reaching VND12.637 billion, with a significant portion (60%) of this being inventory, valued at VND7.537 billion.

On the other side of the balance sheet, FRT‘s liabilities account for 86% of its total liabilities and equity, despite a 5% decrease from the beginning of the year. FRT mainly has bank loans of over VND7.217 billion, which are unsecured loans denominated in VND and have a maturity of less than one year, with interest rates ranging from 2.15-4% per year. These loans aim to supplement working capital needs.

The high debt was mentioned by FRT‘s CFO, Mr. Phạm Duy Hoàng Nam, in his response at the 2024 annual shareholders’ meeting. According to him, FRT‘s debt-to-asset ratio of about 13% in 2023 is not optimal, and there is a need to raise capital to improve the financial structure, reduce debt pressure, and provide more long-term investment capital.

He added that Long Chau’s rapid growth and participation in the healthcare market increase its working capital requirements, which makes fundraising necessary.

At the meeting, the plan for a private offering of 10% was mentioned by FRT Chairman Nguyễn Bạch Điệp as a solution to implement the strategy of expanding the comprehensive healthcare ecosystem.