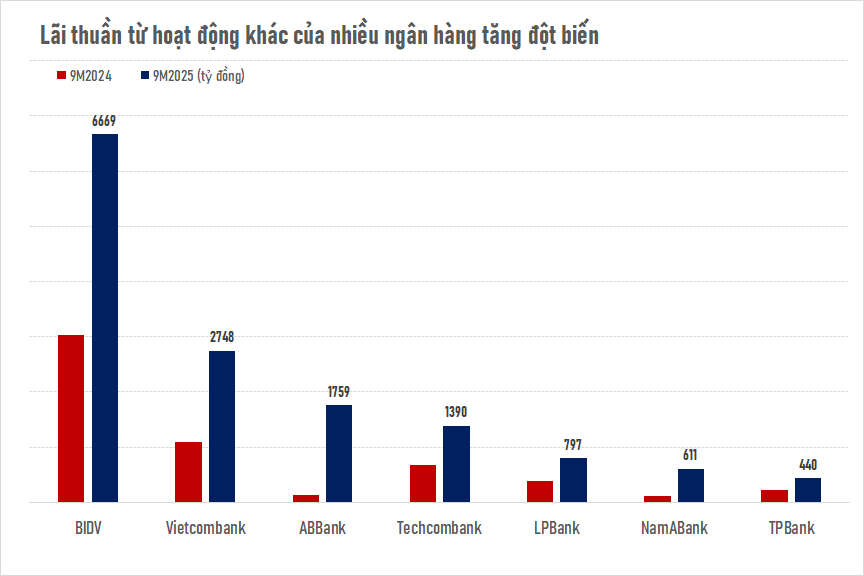

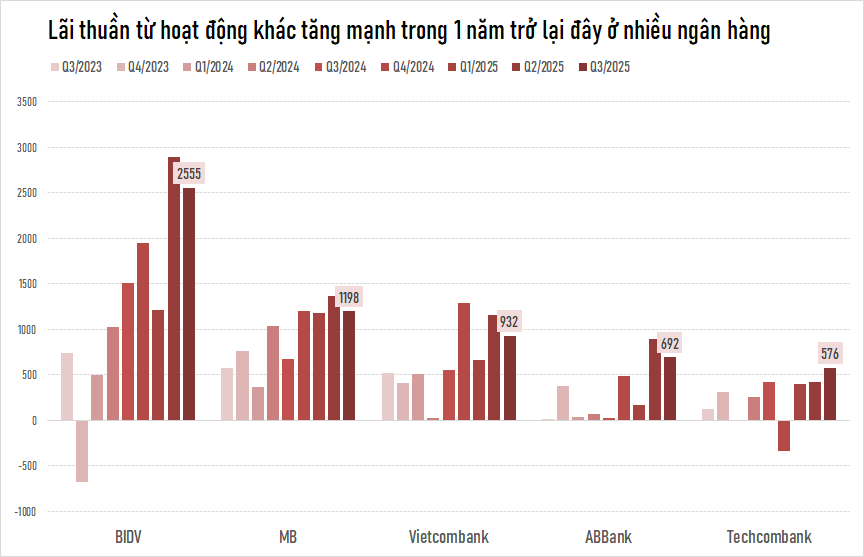

Among 27 banks, 23 reported an increase in net non-interest income during the first nine months of 2025 compared to the same period last year. Only 5 banks experienced a decline. The overwhelming majority of banks showing growth highlights a widespread recovery in non-interest income activities this year.

In terms of growth rates, several banks saw exponential leaps, including BIDV, BVBank, NamABank, NCB, Techcombank, TPBank, and Vietcombank. For instance, Techcombank’s net non-interest income in the first nine months of 2025 reached 1.39 trillion VND, doubling from the previous year. TPBank also saw more than a twofold increase, reaching 440 billion VND. BIDV’s income surged twofold to 6.669 trillion VND, while ABBank recorded a 13-fold increase to 1.291 trillion VND.

Across the entire system, the contribution of “net non-interest income” to total operating income showed a significant improvement. In the first nine months of 2024, this metric accounted for only 4.45% of total income, but by the same period in 2025, it had risen to 6.33%. This reflects two key factors: non-interest income grew faster than total operating income, and many banks recorded substantial revenues from debt sales, debt resolution, asset liquidation, and recovery of previously written-off amounts.

In some banks, the contribution of non-interest activities soared to remarkably high levels. ABBank stands out as the most notable case, with its contribution ratio jumping from 4.34% to 33.40%, nearly eight times higher than the previous year. Saigonbank also recorded a significant increase, rising from 12.15% to 19.56%, while even major players like VietinBank and BIDV saw contributions exceeding 10%.

Consequently, non-interest income has become the largest non-credit revenue source for many banks, surpassing income from securities trading, foreign exchange, and service activities.

For example, at BIDV, non-interest income in the first nine months of 2025 reached 6.669 trillion VND, compared to 5.16 trillion VND from service activities and over 3 trillion VND from foreign exchange trading.

Similarly, at VietinBank, non-interest income in the same period exceeded 7 trillion VND, while service activity income was just over 4.6 trillion VND.

A key driver of this strong growth in 2025 is the recovery of the collateral asset market, particularly real estate. After a prolonged slump, improved liquidity and rising sales prices have made it easier for banks to sell assets and recover higher values. Additionally, 2025 marks a period of intensified non-performing loan resolution, with many previously provisioned debts being fully addressed. Every recovered amount is recorded entirely as non-interest income.

Dr. Can Van Luc: Comprehensive Solutions for Financial Market Development

Despite numerous challenges, Vietnam is poised for unprecedented growth opportunities. Now is the time for all stakeholders to unite and contribute to the nation’s “new era.”

“HPX Swaps HQC Shares – A Move to Recover Outstanding Debt”

The real estate market is witnessing a gradual recovery from its slump, and the debt swap agreement between Hai Phat Investment Joint Stock Company (HPX) and Hoang Quan Trading Services Real Estate Consultancy Joint Stock Company (HQC) is a testament to their proactive financial restructuring efforts. This bold move showcases their commitment to sharing growth opportunities and navigating through challenging economic times.