To ensure safety bonds, choose a reputable “Companion”

In the context of declining bank interest rates, which have already dropped to a low of less than 5.5% per year for a 12-month term, the bond market is gradually gaining attention. Along with that, after the market consolidation phase, investors have a clearer view of bond products, as well as the need for a reputable and dedicated advisory unit.

This is also the reason why even though bond interest rates distributed by Ky Thuong Securities Joint Stock Company (TCBS) in the past were 0.5%-1% lower than other organizations, investors were still willing to choose to stick with this unit.

“Instead of choosing bonds with interest rates of 14-15% per year that always make me anxious whether I can receive the principal and interest on time or not, I chose bonds with lower interest rates, which may be just a few percentage points higher than the savings interest rate, but in return, I can receive interest payments and maturity on time. More importantly, once I buy bonds at TCBS, I always feel that my investment is shared transparently and I am confident in it,” Mr. Nguyen Quoc Minh, a TCBS customer, shared.

In fact, choosing a bond issuer with a higher credit rating will be safer for bondholders. For example, at TCBS, for a bond to be offered to the public, these codes must undergo strict investment procedures, including appraisal, screening, monitoring, and risk management in line with Techcombank’s bond investment process.

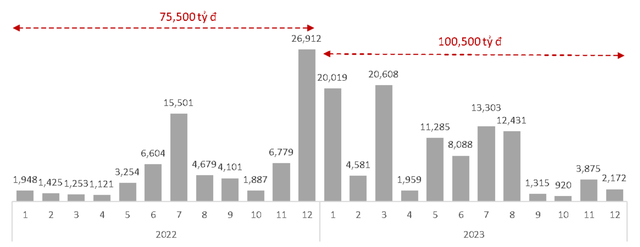

Even in the difficult period of 2022, TCBS did not have any bonds that it advised slow in meeting maturity and interest payment. More than 500 bond codes advised by TCBS have been fully paid and matured on time in 2022 with an amount of over VND 75,000 billion, and will continue to pay more than VND 100,500 billion of principal and interest on bonds to investors from this year 2023.

In 2023, TCBS has paid more than VND 100,500 billion of principal and interest on bonds to investors.

Transparent information for wise investment decisions

Along with that, the prerequisite is the transparency of the market information. Investors need to have access to complete information about individual corporate bonds and the financial situation of the issuing organizations. This helps investors have enough data before making investment decisions, thereby protecting their legitimate rights and interests.

By following the investment experience at TCBS, it can be seen that customers will receive full transparent information in 3 stages when buying bonds on the TCInvest system. Specifically, before buying, investors are always provided with all the bidding documents with information about new bonds, reports analyzing issuing organizations, reports on expected cash flows, general information about bond selling industries, reports on the corporate bond market, comparisons of listed issuing organizations, and the history of liquidity transactions in the market.

During the purchase process, investors receive detailed offers of interest rates, bond cash flows, simulated interest rates for premature resale, risk warnings when investing on the TCInvest online trading interface. The contract and risk recognition document are both sent to the customer’s email for convenient and transparent monitoring and storage.

After the purchase, TCBS has a department responsible for monitoring the information of issuing organizations to provide timely important information to bond buyers, always ensuring the rights and interests of investors.

It is worth noting that during the process of placing bond orders, investors are always informed by TCBS about the risks they may encounter when investing in bonds. Customers can try to place an order to preview the contract content on the TCInvest system. In the contract, risk identification is expressed in a separate, independent document, independent of the terms and conditions of trade and other information of the contract. TCBS also enhances risk awareness for investors by showing warnings about risks in the content of all trading-related emails.

iConnect: Liquidity solution for investors at TCBS

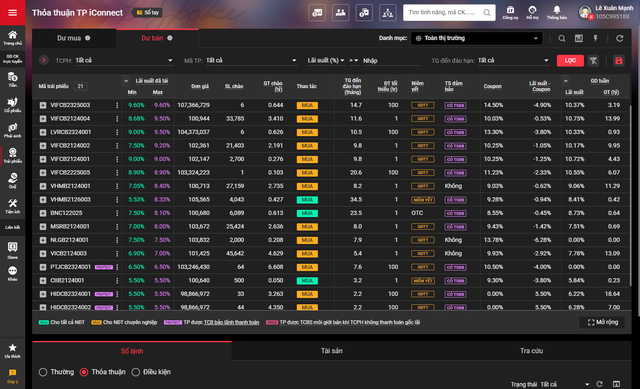

Representatives of TCBS share that the iConnect Bond Agreement system helps customers solve 2 problems: First, manage and limit liquidity risks; Second, increase profitability compared to the regular interest rate of bonds when there is a need to sell before maturity.

Introduced in Vietnam in 2018, iConnect at TCBS is a pioneering technology project in the market that digitizes trading corporate bonds, supports customers in monitoring and finding advertising orders (buying and selling) individual and organizational bonds. Until now, iConnect has had nearly 79,000 investors using it, with an average of nearly 13,000 customer accesses to the system per day.

In 2023 alone, investors traded VND 24,527 billion of bonds on iConnect and there were 29,000 customers who successfully sold their bonds with higher interest rates than when they bought them on this system.

Trading screen on the iConnect Bond Agreement System

It can be seen that on the journey of investment with many difficulties, individual investors always need reliable and responsible “companions”. Therefore, reputable advisory and bond issuance organizations like TCBS will continue to be chosen when they always prioritize the rights of customers