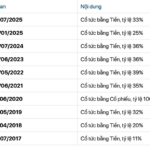

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), in October 2025, Vietnam’s pangasius exports reached USD 217 million, an 8% increase compared to the same period in 2024. Over the first ten months, the export turnover surpassed USD 1.8 billion, marking a 9% growth year-on-year. This positive trend highlights the industry’s resilience, despite declining demand in certain markets.

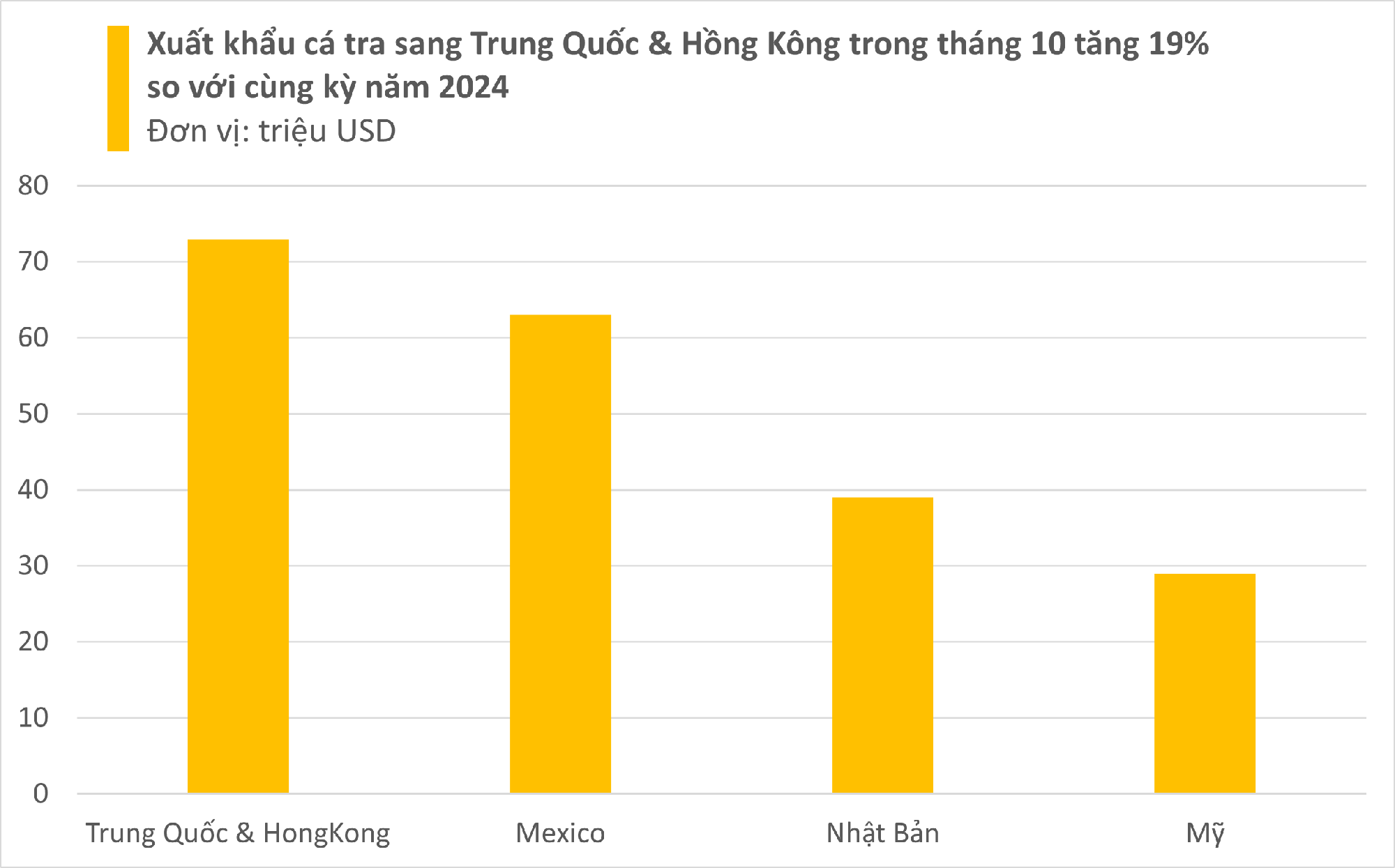

Exports to China and Hong Kong in October totaled USD 73 million, a 19% rise from 2024. After a slowdown in September, this market rebounded strongly, indicating a clear recovery in import demand, particularly as the year-end approaches.

In the U.S., October exports reached USD 29 million, down 17% year-on-year. Brazil recorded USD 15 million, a 1% increase, reversing its September decline. Meanwhile, the UK market saw a sharp 33% drop to USD 4 million compared to 2024.

Within the CPTPP bloc, the first ten months of 2025 saw pangasius exports reach USD 305 million, a 36% increase, accounting for 17% of total exports. Key markets included Mexico (USD 63 million, +1%), Japan (USD 39 million, +14%), and Malaysia (a robust 37% growth), reflecting expanding demand within the region.

In the EU, the ten-month total reached USD 149 million, up 3% year-on-year. While traditional markets like the Netherlands and Germany continued to decline, Spain saw a notable 22% growth. These disparities highlight varying consumption trends among EU member states.

Frozen pangasius fillets (HS code 0304) dominated exports, reaching nearly USD 1.5 billion, an 11% increase. Whole frozen pangasius (excluding HS 0304) remained stable at USD 315 million (+0.1%). Processed pangasius products grew by 19% to USD 44 million, representing 2.4% of total exports, underscoring the potential for value-added products.

Following a slowdown in Q3, Vietnam’s pangasius exports in October showed positive signs as major markets began to recover, though some remained stagnant due to inventory levels and seasonal import cycles.

In Q4 2025, key markets may continue to face challenges due to incomplete demand recovery. A critical driver for late 2025 and 2026 will be the results of the POR20 review in the U.S., where a 0% CBPG duty could significantly boost importer confidence.

However, the 20% countervailing duty remains a margin constraint, prompting companies to diversify markets.

The focus for Q4 2025 and 2026 will be expanding exports to CPTPP countries (Canada, Mexico, Malaysia, UK) and the Middle East, leveraging tariff advantages and favorable market access. The EU is also expected to maintain growth, supported by relaxed technical regulations for aquaculture products, fostering opportunities for processed pangasius.

Elevating Bilateral Ties: General Secretary’s UK Visit Set to Usher in a New Era of UK-Vietnam Relations

The upcoming visit of General Secretary To Lam marks a significant milestone in the relationship between the United Kingdom and Vietnam, paving the way for an elevated bilateral partnership, according to UK Ambassador to Vietnam Iain Frew.

Vietnam’s Affordable, Nutritious Delicacy Captivates China, EU, and the World, Generating Over $200 Million in Revenue Since Early 2023

Vietnam’s exports of this product to the EU have skyrocketed, boasting a remarkable 60% growth rate.