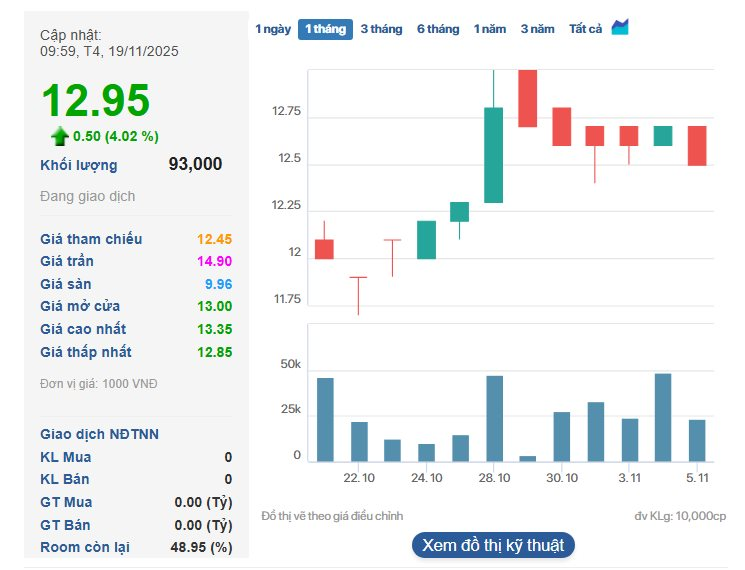

During its first trading session, PDV’s stock price surged above its reference point. Opening at 13,000 VND per share, by 10:00 AM, the stock was trading at 12,950 VND per share, marking a 4% increase. With an initial listing price of 12,450 VND per share, PDV’s market capitalization reached 823 billion VND.

At the ceremony, representatives from the Ho Chi Minh City Stock Exchange (HOSE) officially presented the listing decision and congratulated PDV on its debut trading session. Speaking at the event, the Chairman of PVT Logistics emphasized that the official listing on HOSE marks a significant milestone, underscoring the company’s maturity following its comprehensive restructuring phase from 2020 to 2024.

Company leadership expressed optimism that joining this prestigious platform will enhance governance capabilities, bolster transparency, and strengthen brand credibility among major oil industry players in demanding markets such as the U.S. and Europe. Ultimately, this move aims to maximize shareholder value.

Representatives from the Ho Chi Minh City Stock Exchange (HOSE) presented the listing decision to PDV.

Founded in 2007 as the Eastern Oil Products Transportation Joint Stock Company, PVT Logistics specializes in maritime, road, inland waterway transport, and maritime services.

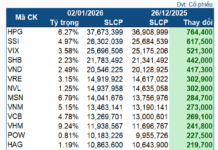

Currently, the company boasts a concentrated ownership structure, backed primarily by its parent company, PVTrans (PVT), which holds 51.87% of the charter capital, and Tan Long LLC, a major shareholder with 16.85%. The transition from UPCoM to HOSE is a strategic move to expand access to domestic and international investment capital.

Upon its HOSE debut, PVT Logistics demonstrated robust financial health, with cumulative revenue for the first nine months of 2025 reaching 1,465 billion VND, a 37% year-on-year increase. In Q3 2025 alone, revenue grew by 27.1% quarter-on-quarter to 616.6 billion VND. As of the period’s end, total assets stood at 2,270 billion VND, with equity surpassing 1,000 billion VND.

According to PDV, the company’s fleet expanded to 10 vessels in August following the acquisition of the bulk carrier PVT Emerald (33,802 DWT). These vessels are currently operating efficiently on international routes and participating in Pool alliances.

Looking ahead to 2026–2030, leveraging its strategic role within the Petroleum Group’s logistics chain, PVT Logistics aims to expand its fleet to 18 vessels, focusing on chemical tankers (19,000–26,000 DWT) and Supramax/Ultramax bulk carriers.

Alongside asset expansion, the company plans to increase its charter capital to 1,800 billion VND and equity to 2,400 billion VND by 2030. In the near term, PVT Logistics will issue 13.2 million shares to pay a 20% dividend for 2024 in Q4 2025.

Becamex Group Successfully Raises VND 660 Billion Through Bond Issuance

Becamex Group has successfully issued a VND 660 billion bond series, BCM12503, with a 3-year maturity.

PVT Logistics to Officially List on HoSE on November 19, 2025

Over 66 million PDV shares of PVT Logistics will debut on the HoSE trading floor with a reference price of VND 12,450 per share.