The banking sector is continuously enhancing its financial capacity, solidifying a robust foundation for growth strategies, and meeting the capital demands of the economy.

System-wide Credit Growth Hits 15-Year High

In the first ten months of this year, the banking system has injected an additional VND 2.1 trillion into the economy. With this credit growth rate and the goal of supporting economic growth, credit growth for the entire year is expected to reach 19-20%, the highest level in approximately 15 years.

As of October 31, according to Rong Viet Securities, all 27 listed banks have released their Q3/2025 financial reports, revealing a total customer loan balance of VND 13.6 trillion, a 15% increase compared to the end of 2024 (credit scale reached VND 13.8 trillion, up 14.5%). This reflects a strong credit demand across the system in a stable interest rate environment.

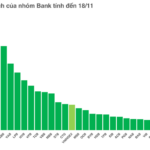

However, deposit growth among listed banks stands at 11.4%. Consequently, the gap between deposit growth and credit growth has widened to -3.1 percentage points, after narrowing to just 10 percentage points in the previous quarter. These figures partly explain the recent trend of capital increases among many banks.

At an event earlier this November, Dr. Nguyen Tu Anh, Director of Policy Research at VinUni University, estimated that if Vietnam aims for a 10% GDP growth rate by 2030, the economy’s credit scale will need to double. This would require a corresponding increase in the banking system’s assets, equity, and related factors. The role of the banking system in the economy is undeniably crucial.

Among private banks, many have already implemented or are planning capital increases, primarily through annual stock dividend issuances, including SHB, MBB, OCB, KLB, MSB, and VietABank.

Recently, SHB announced a plan to increase its charter capital by VND 7.5 trillion, bringing it to VND 53.442 trillion, through: (1) issuing over 90 million ESOP shares, (2) offering more than 459 million shares to existing shareholders, and (3) privately placing 200 million shares with professional investors.

Advantage Shifts to Banks with Strong Capital and High CAR Ratios

Experts agree that high credit growth is expected to continue in the coming years, supporting the economy’s goal of achieving double-digit growth.

Private banks, in particular, are anticipated to sustain credit growth, with an average annual increase of over 20% in the next three years. As credit growth limits are adjusted to allow banks to grow based on market mechanisms, banks with strong capital and high Capital Adequacy Ratios (CAR) will have a significant advantage.

SHB, for instance, will see its charter capital exceed VND 53.4 trillion after the successful capital increase, propelling it to the TOP 4 private banks with the largest charter capital in the system. SHB is also known for consistently maintaining a CAR of over 12%, well above the minimum requirement of 8%.

The raised capital will enable SHB to expand its lending scale, meet banking safety standards, and comply with international regulations, while also accelerating its transformation into the most efficient and leading retail bank in the region.

In Q3/2025, SHB recorded a 15% credit growth, with funds directed towards key economic sectors, significantly contributing to GDP growth. SHB also achieved impressive business results in the first nine months, with pre-tax profits exceeding VND 12.3 trillion, a 36% increase year-on-year, and fulfilling 85% of its 2025 plan.

The bank’s Net Interest Margin (NIM) is trending upward, from 3.23% in Q1/2025 to 3.9% in Q3/2025. Return on Equity (ROE) has also improved, rising from 16.71% to 19.23%.

SHB’s NIM and ROE for the quarters of 2025

These figures demonstrate the bank’s sustainable growth, with expectations that the final quarter could push SHB’s results beyond its 2025 targets.

Coupled with the bank’s internal growth potential, SHB’s stock is attracting investors on the stock market, as it is predicted to be one of 28 strong candidates for the FTSE Global All Cap index. This presents an opportunity to attract foreign investment to SHB’s stock, given the bank’s remaining foreign ownership room.

Year-End Interest Rates Surge: What It Means for You

Interest rates on deposits are heating up as multiple banks have collectively raised their rates since the beginning of November.

How Record-Breaking Stock Markets Have Fueled Bank Performance

The third quarter of 2025 marks a historic milestone as the VN-Index surpasses its peak, with the banking sector playing an irreplaceable leading role. Interestingly, the vibrant stock market has also delivered a powerful boost to the business operations of banks, particularly those owning securities companies.