On November 19, 2025, Mobile World Investment Corporation (HOSE: MWG) approved a restructuring plan for its subsidiaries, focusing on specialized business operations. The plan organizes products and services related to mobile phones and electronics in Vietnam and abroad under a dedicated subsidiary, while pharmaceutical products and services will be managed by another specialized subsidiary.

As part of this restructuring, the MWG Board of Directors approved the transfer of 100% of the shares in Green Electrician Joint Stock Company (formerly Known as Dedicated Installation – Repair – Warranty Joint Stock Company) to Green Electronics Investment Joint Stock Company (formerly Mobile World Joint Stock Company).

The transfer involves 9,999,890 shares, valued at nearly 100 billion VND based on par value.

Additionally, MWG approved the transfer of 100% of the shares in An Khang Pharma Pharmaceutical Joint Stock Company from Green Electronics Investment to Thien Tam Trading Single Member LLC (a wholly-owned subsidiary of MWG). This transfer includes 201,294,010 shares, valued at approximately 2,013 billion VND.

Both transactions are expected to be completed before December 31, 2025.

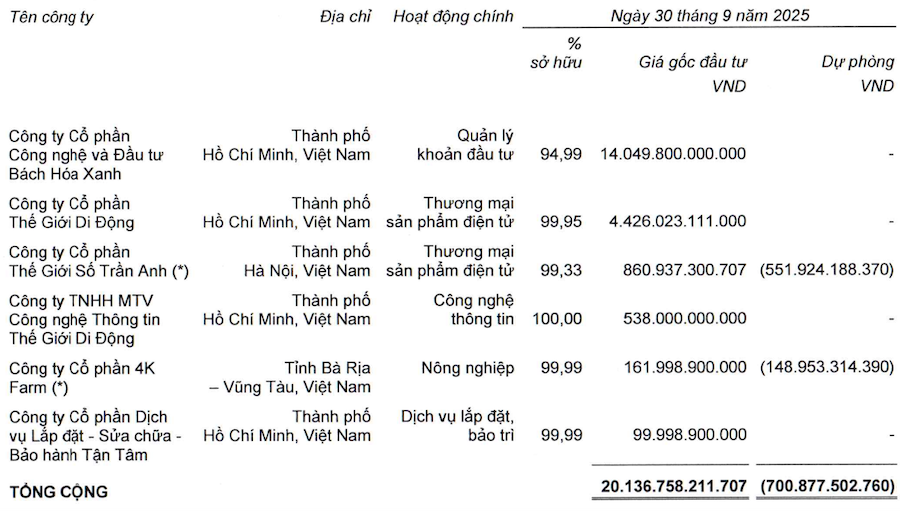

As of September 30, 2025, MWG has six subsidiaries with a total investment value of 20,137 billion VND. Provisions of over 700 billion VND have been set aside, primarily for Tran Anh Digital World Joint Stock Company (552 billion VND) and 4k Farm Joint Stock Company (149 billion VND).

Source: MWG

|

– 07:00 20/11/2025

Should You Invest in SZC, BSR, and MWG?

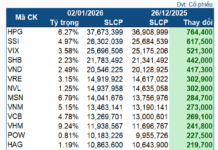

Securities firms are recommending the purchase of SZC, citing expectations of improving business conditions following Vietnam’s new agreement framework with the U.S. They also advise increasing exposure to BSR, driven by the anticipated surge in petrochemical product demand during the latter part of the year. Additionally, MWG is favored due to the promising recovery of its ICT segment and the profit-taking phase of the Bach Hoa Xanh retail chain.

MWG Aims to Transform Indonesian Electronics Chain into Southeast Asia’s New Retail Icon

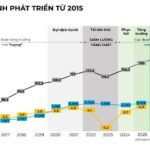

In the 2026–2030 strategic cycle, EraBlue aims to achieve sustainable growth, expand its regional footprint, and go public before 2030, solidifying its position as Southeast Asia’s emerging retail icon.

The Iron Fists of Nguyen Duc Tai

Following a period of quantitative growth, MWG has undergone a robust restructuring over the past two years and is now entering a new phase of growth driven by its enhanced “quality.” This momentum is fueled by the strategic and impactful initiatives led by Mr. Nguyễn Đức Tài.