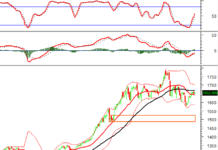

Technical Signals of VN-Index

During the morning trading session on November 20, 2025, the VN-Index continued to oscillate near the 50-day SMA. However, the index remains above the Middle line of the Bollinger Bands, and both the Stochastic Oscillator and MACD are signaling a buy, indicating a positive short-term outlook.

Technical Signals of HNX-Index

In the morning session on November 20, 2025, the HNX-Index adjusted, forming a Three Black Crows candlestick pattern. Currently, the HNX-Index is below the 100-day SMA, while the MACD indicator is narrowing its gap with the Signal line. If the MACD signals a sell, the short-term outlook may become more pessimistic.

AAA – An Phat Green Plastics Joint Stock Company

In the morning session on November 20, 2025, AAA shares surged, accompanied by a long-bodied candlestick pattern and a significant increase in trading volume, surpassing the 20-session average. This indicates heightened investor activity. Currently, AAA is retesting the September 2025 high (around 8,500-8,700), while the MACD continues to form higher highs and higher lows, signaling a buy. If technical indicators remain positive, the short-term uptrend is likely to gain further support.

FRT – FPT Digital Retail Joint Stock Company

In the morning session on November 20, 2025, FRT shares declined, forming a Black Marubozu candlestick pattern, reflecting investor pessimism. However, the Bollinger Bands are narrowing, and the ADX indicator remains weak, staying below the gray zone (20 < ADX < 25). Without improvement, FRT is likely to continue its sideways movement, with alternating up and down sessions.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning session. Therefore, signals and conclusions are for reference only and may change after the afternoon session concludes.

Technical Analysis Department, Vietstock Advisory Division

– 11:49 AM, November 20, 2025

Market Pulse November 20: Foreign Investors Return to Net Buying Amid Low Liquidity Session

At the close of trading, the VN-Index climbed 6.99 points (+0.42%) to reach 1,655.99, while the HNX-Index dipped 0.8 points (-0.30%), settling at 264.23. Market breadth tilted toward decliners, with 370 stocks falling and 298 advancing. The VN30 basket showed a balanced performance, featuring 13 decliners, 12 gainers, and 5 unchanged.

Vietstock Daily 21/11/2025: Cautious Sentiment Prevails?

The VN-Index remains in a tug-of-war along the middle line of the Bollinger Bands, with trading volume below the 20-day average, signaling investor caution. Despite this, both the Stochastic Oscillator and MACD continue to hold bullish signals, painting a positive short-term outlook. For the recovery to solidify, the index must break above the 50-day SMA, supported by improved liquidity in upcoming sessions.

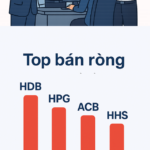

Proprietary Trading Firms Reverse Course, Offloading Hundreds of Billions in Vietnamese Stocks on November 18th: Which Stock Takes Center Stage?

Proprietary trading firms reversed their stance, shifting to net sellers with a total of VND 365 billion on the Ho Chi Minh Stock Exchange (HOSE).