The Vietnamese stock market witnessed a positive trading session on November 20th, 2023. However, the rally was primarily driven by two large-cap stocks, Vingroup (VIC) and Vietjet (VJC), with the broader market yet to fully participate. The VN-Index closed up nearly 7 points at 1,655.99. Trading volume on the Ho Chi Minh City Stock Exchange (HoSE) remained low, with order-matching value reaching a mere VND 16,775 billion.

A notable highlight was the return of foreign investors, who net bought VND 244 billion after 11 consecutive sessions of net selling. Here’s a breakdown:

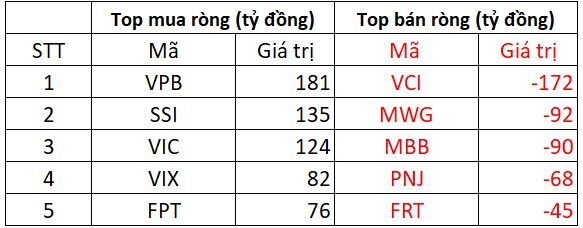

On HoSE, foreign investors net bought approximately VND 293 billion

On the buying side, VPB bank stocks saw the strongest foreign inflows, with a net value of nearly VND 181 billion. SSI and VIC followed closely, with net buying values of around VND 124-135 billion. Other stocks with notable foreign buying included VIX (+VND 82 billion) and FPT (+VND 76 billion).

Conversely, foreign investors heavily sold VCI, with a value of VND 172 billion. MWG and MBB were also among the top net-sold stocks, with values of around VND 90-92 billion. PNJ and FRT were also net sold, with values of VND 45 billion and VND 68 billion, respectively.

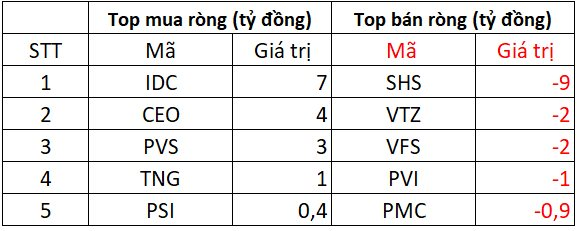

On HNX, foreign investors net sold approximately VND 4 billion

On the buying side, foreign investors heavily purchased IDC, PVS, and CEO stocks, with values of a few billion dong each. They also net bought TNG and PSI, with values ranging from a few hundred million to VND 1 billion.

Conversely, SHS stocks were net sold for VND 9 billion. VTZ and VFS were also net sold, with values of VND 2 billion each. PVI and PMC were among the top net-sold stocks on the HNX, albeit with smaller values.

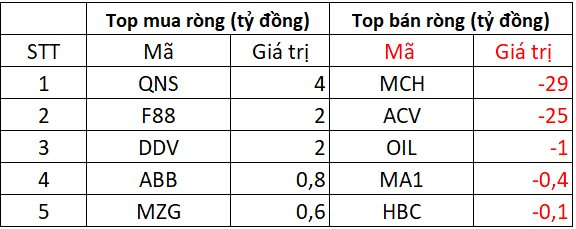

On UPCOM, foreign investors net sold approximately VND 46 billion

On the buying side, QNS, F88, and DDV stocks were net bought for around VND 2-4 billion. ABB and MZG were also net bought, with values of a few hundred million dong.

Conversely, MCH and ACV stocks were net sold for VND 25-29 billion. OIL was net sold for VND 1 billion, while HBC and MA1 saw insignificant net selling.

Market Pulse 21/11: Selling Pressure Intensifies as Capital Flees Financial Sector

Pessimism continues to weigh on large-cap stocks, driving major indices lower. As of 10:30 AM, the VN-Index has dropped over 16.58 points, trading around 1,640.75. Meanwhile, the HNX-Index is down 1.52 points, hovering near 262.71.