Previously, TBX held an extraordinary general meeting to seek shareholder approval for delisting. The company currently has a chartered capital of VND 15 billion, which, including reserves and supplementary capital, totals approximately VND 20 billion—below the minimum threshold. The meeting approved the revocation of its public company status and agreed to delist from the HNX.

Post-delisting, the shareholder registry will be managed internally through a share register and ownership certificates. The company may also repurchase shares from retail investors upon transfer requests.

A plan to increase capital to over VND 30 billion was discussed by the leadership but remains unimplemented due to unresolved prerequisites, delaying the issuance.

Thai Binh Cement is among Vietnam’s earliest listed companies. Established in 1979 as Thai Binh Cement Enterprise, it was equitized in 2001 and listed on HNX in 2008. White cement is its flagship product, once dominating northern Vietnam and widely used in residential construction and materials like terrazzo tiles, block bricks, and floral tiles.

TBX‘s white cement product – Image: TBX

|

TBX shares were highly active in early listing years, peaking in 2011 at over five times their IPO price. This coincided with a prosperous period for the company and the construction sector before the real estate downturn.

Revenue peaked at approximately VND 85 billion in 2009-2010, with net profit nearing VND 6 billion. However, despite stable revenue, profits dwindled in subsequent years, with recent net profits only reaching a few hundred million dong.

In 2020, revenue halved to VND 20 billion, resulting in a VND 2 billion loss. The company attributed this to COVID-19 impacts and working capital shortages, forcing reliance on external investors for production funding. Competition from imported white cement further intensified pressure.

In Q3/2025, TBX reported VND 4 billion in revenue and VND 142 million in net profit. Nine-month totals reached VND 11 billion in revenue and VND 358 million in profit. Total assets stand at VND 26 billion with no outstanding debt. Staff numbers decreased to 52 by June-end from 67 previously.

Trading liquidity declined post-2012, with share prices hovering around VND 10,000 despite a brief surge above VND 20,000 in late 2019/early 2020.

TBX is developing a super-white quartz production facility in Tien Hai Industrial Park (Hung Yen), slated for Q3/2026 operation. Its existing Tien Phong plant (former Thai Binh Province) is relocating to accommodate new urban development.

The 2025 shareholder structure shows Chairwoman Bui Thi Nguyen Hanh holding 23.17%, Board Member Vu Tien Dung at 23.83%, with Treelife Architecture JSC (19.7%) and Thai Binh Cement Trading JSC (6.73%) as institutional investors.

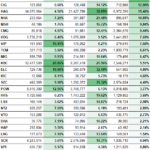

TBX was among the earliest listed stocks with vibrant trading activity

|

– 13:10 20/11/2025

HNX-Index Declines in Both Value and Liquidity in October

In October 2025, the HNX-Index experienced significant volatility. Closing the month at 265.85 points, it marked a nearly 3% decline compared to the previous month. Liquidity also trended downward during this period.

Which Stocks Typically Surge in November?

Following a dip in October, the VN-Index is poised to rally toward a critical threshold as stocks historically demonstrate robust performance in November.