On November 24th, the Supreme People’s Procuracy of Vietnam finalized the indictment against 11 defendants involved in a high-profile case of “Smuggling and Violation of Accounting Regulations Causing Serious Consequences.” The case spans across Lao Cai Province, Vietnam Gold Investment and Trading Joint Stock Company, Hoan Hue Jewelry Company Limited, and related entities.

Among the defendants, Tran Thi Hoan (born 1985, CEO of Hoan Hue Company), Pham Tuan Hai (former Director of Thang Long Trading and Service Company), Tran Thanh Hieu (born 1987, Hoan Hue employee), Vang Thi Phuong (born 2000, freelance worker), Luong Thi Bich Ha (born 1994, Hoan Hue employee), Lieng Thi Thuc (born 2001, Hoan Hue employee), Nong Thi Thuy Linh (born 1985, Hoan Hue employee), and Nguyen Thi Phuong Nga (born 1977, freelance worker) face charges of “Smuggling.”

Tran Nhu My (born 1977, Chairwoman of Vietnam Gold Company), Phung Thi Thuyet (born 1981, Deputy CEO of Vietnam Gold Company), and Nguyen Thi Hop (born 1979, Chief Accountant of Vietnam Gold Company) are charged with “Violation of Accounting Regulations Causing Serious Consequences.”

According to the indictment, the defendants exploited the price gap between domestic and Chinese raw gold. From September 2, 2024, to December 2, 2024, Tran Thi Hoan colluded with an individual named Ba Beo (Chinese national) and Pham Tuan Hai to smuggle over 546 kg of raw gold from China into Vietnam, valued at more than VND 1,208 billion.

Specifically, Hoan purchased over 97 kg of gold from Ba Beo (worth VND 208 billion) and 449 kg from Pham Tuan Hai (worth VND 999 billion).

Employees of Hoan Hue Company and Hoan’s accomplices were responsible for transporting and handling the gold and cash. Notably, Tran Thanh Hieu is implicated in the smuggling of over 546 kg of gold, valued at over VND 1,208 billion.

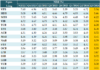

Defendants in the case.

Regarding the “Violation of Accounting Regulations Causing Serious Consequences,” the Supreme People’s Procuracy alleges that from 2023 to 2024, Tran Nhu My directed Phung Thi Thuyet and Nguyen Thi Hop to falsify accounting records, omit transactions from the books, and evade taxes on Vietnam Gold Company’s purchases and sales.

These actions reduced the company’s reported revenue, profits, and tax liabilities.

As a result, the state suffered tax losses exceeding VND 5 billion.

In addition to the indicted group, the Procuracy identified 30 individuals who lent their bank accounts to Vietnam Gold Company. These individuals are relatives or acquaintances of Tran Nhu My, Phung Thi Thuyet, and some company employees. They lent their accounts based on personal relationships without knowledge of the intended use.

Therefore, there is no basis for criminal liability against these individuals.

Five employees from Vietnam Gold Company’s accounting department were tasked with recording transactions in the Vacom accounting software for tax purposes. As they followed company instructions and used valid invoices, there is insufficient evidence to pursue criminal charges against them.

Small Businesses Avoiding Input Invoices May Face Tax Evasion Suspicion

The Tax Authority emphasizes that businesses failing to obtain input invoices for purchases will face significant legal and financial risks.

Tax Evasion in Tuyen Quang: Business Owner Charged for Evading $70,000 in Taxes

On October 25th, the Tuyen Quang Provincial Police Department announced that the Security Investigation Agency has issued an indictment resolution and arrest warrant for Tran Dinh Tho (born in 1986, residing in Tam Hong commune, Phu Tho province). Tho stands accused of tax evasion under Clause 3, Article 200 of the Penal Code.

Unveiling the Scheme: How Over 15,000 Taels of Smuggled Gold from China, Valued at Over 1.2 Trillion VND, Was “Transformed”

Seizing a loophole at the border crossing, a gold shop owner in Lao Cai successfully smuggled hundreds of kilograms of gold over a period of nearly three months.