The company announced that after a thorough review, it needs to adjust and update information in the issuance registration file and will proceed with the issuance at an appropriate time.

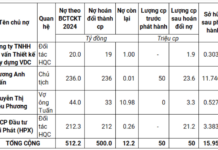

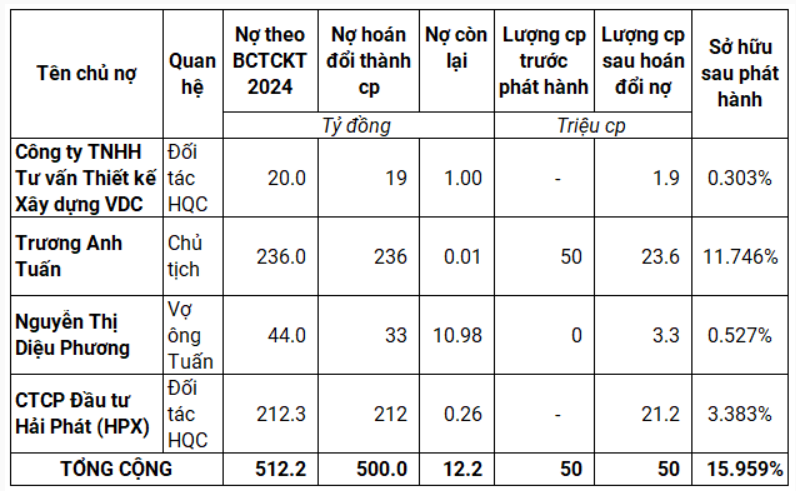

Previously, in August, HQC approved a plan to privately issue 50 million shares to swap VND 500 billion in debt. The swap ratio is VND 10,000 of debt for 1 new share, increasing the charter capital to approximately VND 6,266 billion. The issued shares will be restricted from transfer for a minimum of one year.

According to the previously announced list, there are 4 creditors eligible for the debt-to-equity swap, with Chairman Truong Anh Tuan and his spouse holding more than half.

|

List of creditors expected to receive shares in exchange for debt

Source: Author’s compilation

|

As of September 30, 2025, HQC‘s total assets reached nearly VND 9,872 billion, a slight 2% decrease from the beginning of the year. Liabilities totaled over VND 4,460 billion, down 5%, with financial loans of nearly VND 1.7 trillion, a 3% decrease, accounting for 38% of total debt.

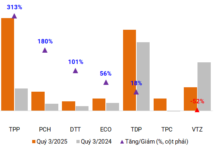

In terms of business results, net revenue for the first 9 months was VND 51 billion, up 13%, and after-tax profit was over VND 18 billion, down 32% year-on-year. Against a high target, HQC has only achieved 16% and 26% of its plan after 3 quarters, respectively.

HQC plans to issue 50 million shares to swap VND 500 billion in debt

New social housing project in Ca Mau

On November 14, HQC was approved by the Ca Mau Provincial People’s Committee as the investor for the social housing project in Khanh An commune.

The project covers nearly 15.8 hectares, including approximately 8.5 hectares of residential land, with 6.8 hectares for social housing apartments and 1.7 hectares for commercial housing.

The total investment is over VND 662 billion, with HQC‘s contribution being VND 133 billion. The project is scheduled for completion within 60 months. The investor is responsible for completing all land, construction, environmental procedures, and ensuring progress as committed.

Earlier, in late October, the Ca Mau Provincial People’s Committee approved the investment policy and designated HQC as the investor for the social housing project in An Xuyên ward, covering nearly 2 hectares.

The project is expected to construct 6 blocks, each 12 stories high, providing nearly 1,000 apartments. The total investment is over VND 1,215 billion, with the investor’s capital contribution exceeding VND 273 billion. The project is to be completed within 36 months, with a 49-year operation period for both projects.

– 1:07 PM, November 26, 2025