With over 104.4 million outstanding shares, PRE is set to allocate approximately VND 130.5 billion for this interim dividend payment. The disbursement is scheduled to commence on December 22.

Source: VietstockFinance

|

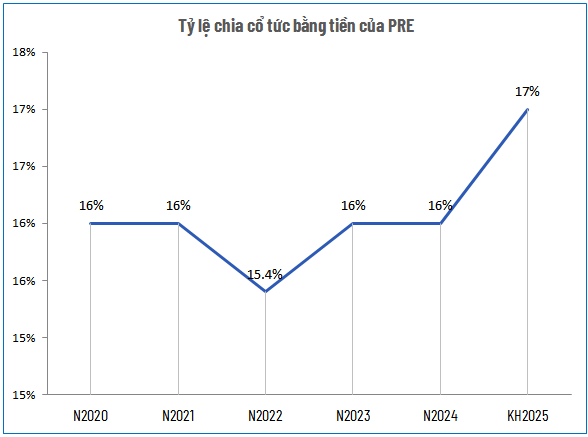

For 2025, PRE has outlined a revenue target of nearly VND 3,306 billion and pre-tax profit of over VND 244 billion, reflecting a 10% and 2% increase respectively compared to 2024. The company also plans to distribute a 17% dividend.

This suggests that the company is likely to execute one more dividend payout to meet its annual goal. If successful, 2025 will mark the highest cash dividend distribution in PRE‘s history, surpassing the 16% rate maintained in previous years.

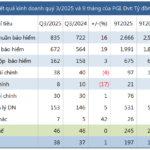

| PRE’s Net Profit Over the Past Nine Months |

2025 also marks a significant turnaround in PRE‘s business performance. In Q3, the company reported a net profit of VND 91 billion, a 3.5-fold increase year-on-year and the highest quarterly profit since its inception.

Consequently, PRE achieved a nine-month net profit of over VND 193 billion, a 62% increase compared to the same period last year and the highest ever recorded. This positive outcome is attributed to a 10% rise in reinsurance fee revenue, particularly from property insurance, and robust financial activities yielding a VND 173 billion profit, up 32% due to increased dividend income.

Source: VietstockFinance

|

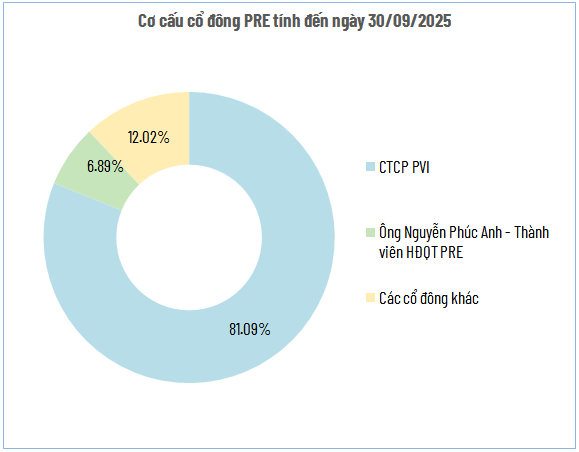

Hanoi Re, formerly known as PVI Re, was established in 2011 and rebranded in August 2023. Despite the name change, the company remains a subsidiary of PVI Holdings (HOSE: PVI).

As of Q3 2025, PVI holds an 81.09% stake in PRE, while Mr. Nguyễn Phúc Anh, a member of PRE‘s Board of Directors, owns 6.89% of the shares, entitling him to approximately VND 109 billion and VND 10 billion in dividends from this payout.

– 11:00 26/11/2025

Record Dividend Announced by 911 Taxi Following Challenging Q3 Performance

{“is_finished”:false,”event_type”:”stream-start”,”generation_id”:”f50c4c80-7464-4ba0-9282-a86153c6068a”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”9″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” Group”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” Corporation”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” (“}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”H”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”OSE”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”:”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” NO”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”)”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” has”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” announced”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” a”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 2″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”0″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”2″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”4″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” cash”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” dividend”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” payout”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” of”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 6″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”%”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” (“}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”6″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”0″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”0″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” V”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”ND”}

Unveiling the Hidden Buying Power in Investment Fund Transactions

During the week of November 17–21, 2025, investment funds predominantly shifted towards selling activities as the VN-Index fluctuated between 1,620 and 1,650 points, coinciding with the expiration of the VN30 futures contract. Trading volumes from these funds remained relatively low, with individual orders ranging from tens to hundreds of thousands of shares.

Coteccons to Distribute 10% Cash Dividend for 2025

Coteccons plans to allocate over 101.4 billion VND for its 2025 dividend payout, with a 10% execution rate. The final registration date for shareholders eligible to receive dividends is December 2, 2025.

Who Spent Over $56 Million to Acquire 24.5% Stake in Postal Insurance?

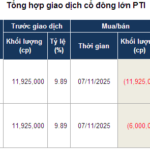

Over three consecutive trading sessions from November 6th to 10th, the market witnessed the transfer of 29.5 million shares of Post and Telecommunication Joint Stock Insurance Corporation (HNX: PTI) via negotiated transactions. This volume represents 24.5% of PTI’s outstanding shares, with a total value nearing VND 1,328 billion. The average negotiated price stood at approximately VND 45,000 per share.