By late 2025, the 12-month deposit interest rates offered by banks range from 5.5% to 6.5% per annum, while inflation is projected at 3.8% (according to the World Bank’s East Asia and Pacific Economic Update released on October 7, 2025). At first glance, the profit margin of 1.7% to 2.7% seems promising. However, this figure overlooks a critical factor: the opportunity cost of locking in funds.

To secure the 5.5% to 6.5% interest rate, depositors must commit their funds for 12 months. Any unexpected need for cash—whether for holiday expenses, family support, or sudden investment opportunities—would require early withdrawal, resulting in a loss of interest as only the non-term interest rate applies.

This 1.7% to 2.7% profit margin quickly turns into a financial gap many savers face. So, how can one enjoy high interest rates while maintaining liquidity? The solution lies in financial instruments that combine the benefits of term deposits with the flexibility to transfer, gift, or inherit funds on a secondary market with adaptable transfer fees.

From Young Professionals to Retirees: Locking Funds for High Interest Is No Longer Optimal

Meet Tuan, a 35-year-old tech company employee in Hanoi with 1 billion VND in savings. He plans to purchase an installment property within 12 to 24 months, awaiting market adjustments and the right project. His dilemma: investing carries risk, while locking funds in a 12- to 24-month term deposit for better interest means losing out if he finds his ideal property sooner. “With 1 billion VND sitting idle, inflation erodes its value daily,” Tuan notes.

In Ho Chi Minh City, Ha and Nam are building an education and healthcare fund for their daughter, with 2 billion VND saved for her study abroad plans in three years. Their challenge isn’t just finding a profitable investment but also managing unforeseen expenses like medical emergencies or additional courses. Term deposits mean forfeiting interest upon early withdrawal, and splitting funds into smaller accounts complicates management and tracking.

“We need a solution that grows our money without locking it in, allowing withdrawals or transfers without interest loss,” Ha explains.

Phuc, a 65-year-old retiree with 500 million VND in savings, prioritizes capital preservation over risky investments. Yet, life’s unpredictability—sudden medical expenses or family financial needs—poses challenges. A 12-month term deposit at 5.5% yields over 27 million VND, but early withdrawal for 50 to 100 million VND means losing accrued interest.

“I don’t want to burden my children. This money is for my later years, and I hesitate to lock it away, fearing interest loss during emergencies,” Phuc shares.

Despite their diverse circumstances, all three seek a solution: an investment that outpaces inflation while offering capital accessibility.

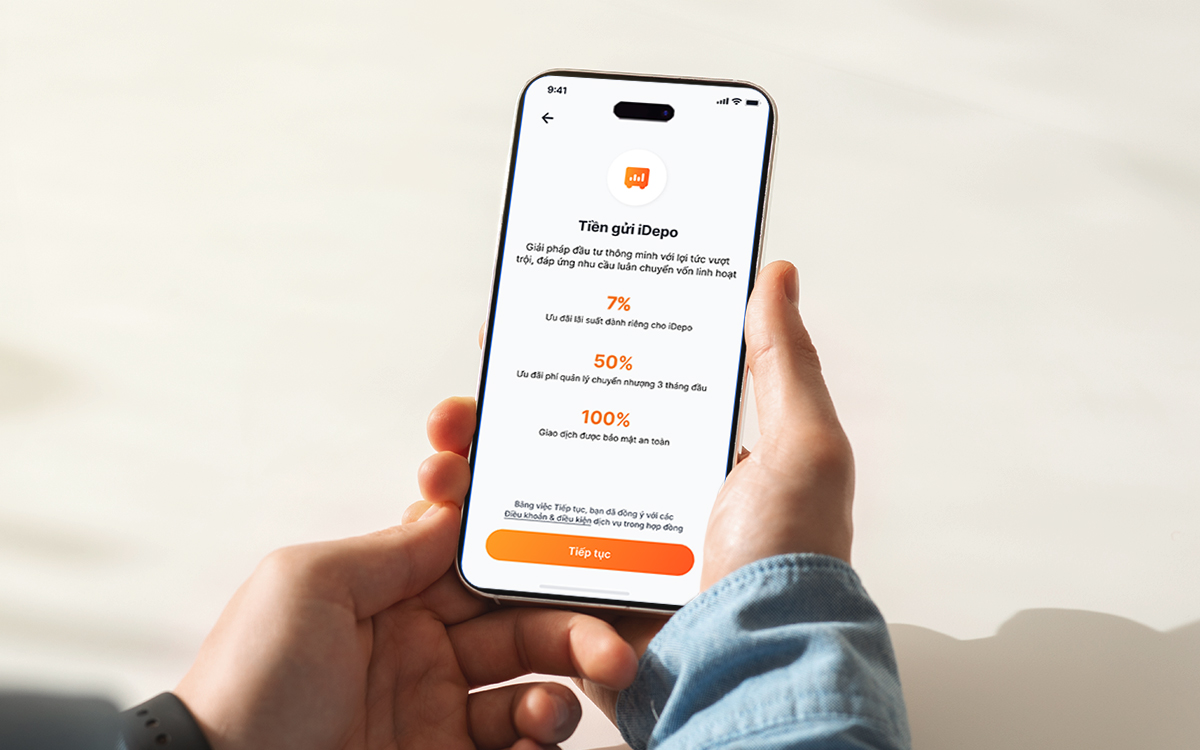

Enter products like VIB Bank’s iDepo, which blend competitive interest rates with transferability, addressing these needs effectively.

iDepo VIB – Smart Savings for Diverse Users: High Returns with Liquidity

Unlike traditional savings, iDepo eliminates the trade-off between interest and flexibility. It offers up to 7% interest per annum on 36-month deposits, with semi-annual interest payouts.

Its standout feature: early fund access via contract transfers, typically to family or friends, through the MyVIB platform. Depositors retain principal and accrued interest, while recipients continue earning interest for the remaining term.

For Tuan, iDepo offers the best of both worlds. If a property opportunity arises after 10 months, he can transfer his iDepo, accessing funds without losing accumulated interest—nearly 50 million VND on 1 billion VND.

Ha and Nam can partially transfer their iDepo for emergencies while reinvesting the remainder to maintain profitability.

Phuc can divide his savings into smaller iDepo amounts (50, 100, 200 million VND), transferring only what’s needed while preserving interest.

All iDepo actions—opening, tracking, transferring—are managed via the MyVIB app, combining bank reliability with digital convenience.

While iDepo requires thoughtful capital planning, its greatest advantage is choice—something traditional savings cannot offer.

Bank Deposits Surge, Reaching Nearly $16.2 Trillion by End of September 2025

As of September 2025, customer deposits in Vietnam reached nearly 16.2 quadrillion VND, marking a 3.2% increase compared to the latest figures reported in late July, according to data from the State Bank of Vietnam (SBV).

Deputy Prime Minister Ho Duc Phoc: Aiming for a 3.3% CPI Increase by 2025

On the afternoon of November 21st, Deputy Prime Minister Hồ Đức Phớc chaired a meeting of the Price Management Steering Committee.