A Stellar Q3 Performance

According to the General Statistics Office (Ministry of Finance), Q3 GDP surged by 8.23% year-on-year, marking the highest growth rate since the COVID-19 pandemic. This economic recovery has bolstered incomes, driving consumer demand, including the demand for non-life insurance to protect health and assets.

Source: VietstockFinance

|

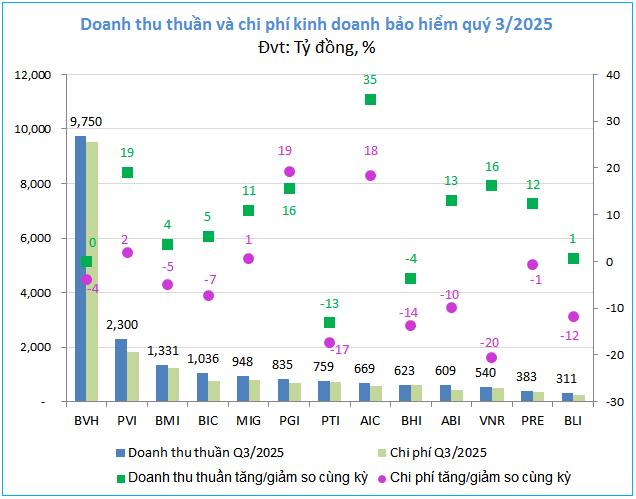

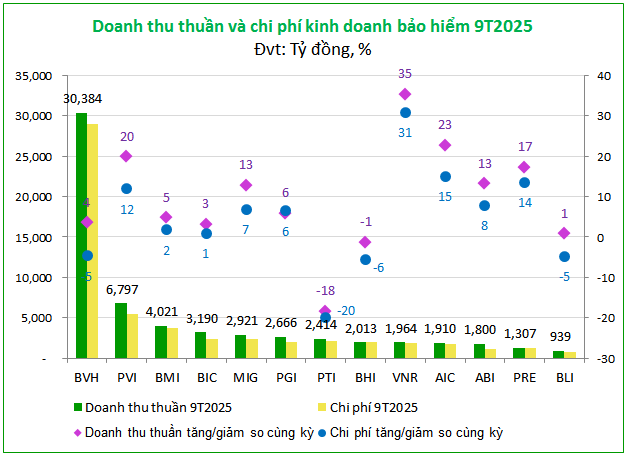

Data from VietstockFinance reveals that 13 listed non-life insurance companies recorded total gross written premiums and reinsurance accepted of VND 27,732 billion in Q3/2025, a 12% increase year-on-year. However, reinsurance expenses rose by 28% to VND 9,014 billion, resulting in a mere 5% growth in net premiums to VND 20,094 billion.

Source: VietstockFinance

|

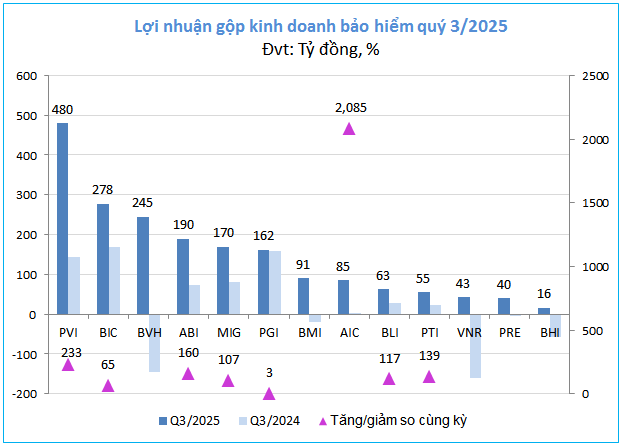

Claims expenses decreased by 6% to VND 11,864 billion, reducing total insurance business expenses by 4% year-on-year. Consequently, insurance gross profit reached VND 1,918 billion, a 6.5-fold increase compared to the same period last year.

Source: VietstockFinance

|

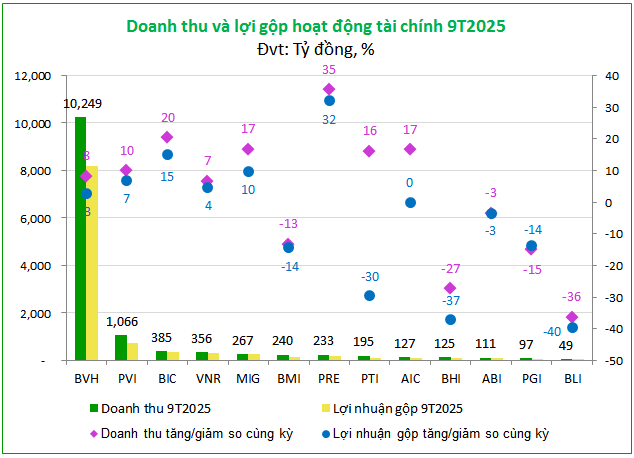

Financial activities yielded positive results, with revenue rising by 14% to VND 4,702 billion, contributing to a 12% increase in gross profit to VND 3,834 billion.

Source: VietstockFinance

|

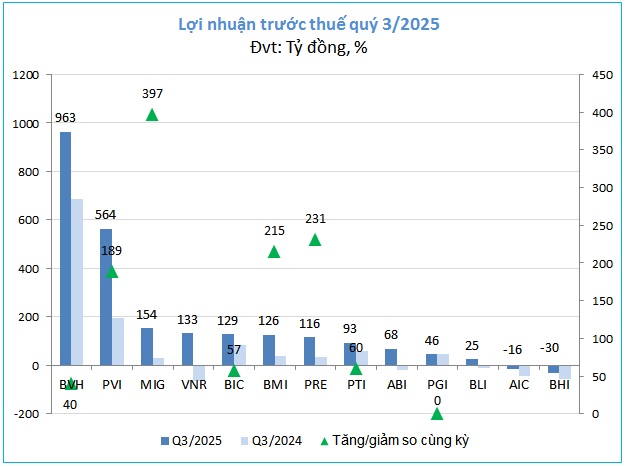

With both core segments benefiting from favorable conditions, pre-tax profit for the non-life insurance group in Q3 soared 2.4 times year-on-year to VND 2,371 billion, despite a 26% increase in management expenses to nearly VND 3,083 billion.

The industry’s pre-tax profit was dominated by leading players. BVH topped the list with VND 963 billion, a 40% increase, followed by PVI with VND 564 billion. Other companies with profits exceeding VND 100 billion included MIG (VND 154 billion), VNR (VND 133 billion), BIC (VND 129 billion), BMI (VND 126 billion), and PRE (VND 116 billion).

In terms of growth rate, MIG saw the most significant increase, with profits nearly five times higher than the previous year. PRE and BMI followed with 3.3 and 3.2 times growth, respectively. Notably, VNR, ABI, and BLI, which incurred losses in Q3 last year due to Typhoon Yagi, successfully turned their fortunes around, achieving substantial profits this quarter.

Amidst the overall positive picture, AIC and BHI continued to report losses, primarily due to thin profits from both insurance and financial operations, insufficient to cover high management expenses. Another common factor is that both companies are subsidiaries of the South Korean insurer DB Insurance (DBI), following DBI’s acquisition of 75% stakes in 2024.

A Surprising Race to the Finish Line

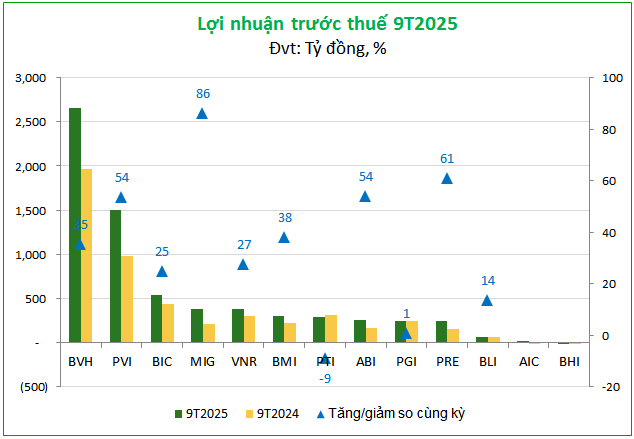

After a slow start in Q1 (6% profit growth), acceleration in Q2 (20% growth), and a breakthrough in Q3, the non-life insurance group’s 9-month pre-tax profit reached VND 6,866 billion, a 37% increase year-on-year.

Source: VietstockFinance

|

Source: VietstockFinance

|

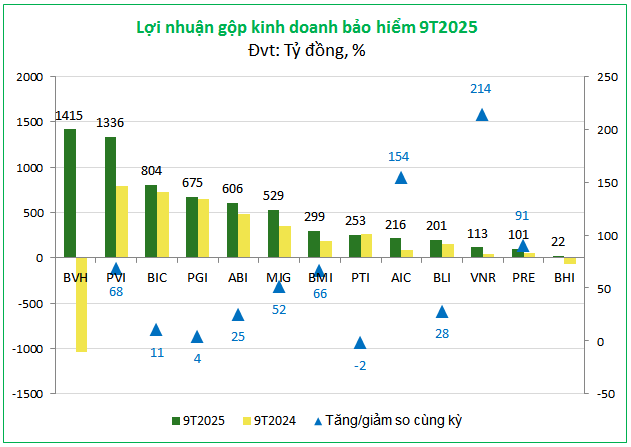

Insurance gross profit reached VND 6,570 billion, 2.5 times higher than the previous year, while financial profit increased slightly by 2% to VND 10,744 billion.

Source: VietstockFinance

|

Source: VietstockFinance

|

The top profit contributors for the non-life insurance industry in the first 9 months were BVH and PVI, with profits of VND 2,653 billion and VND 1,504 billion, respectively, representing 35% and 54% year-on-year growth. MIG led in growth rate, achieving an 86% increase over 9 months, thanks to its strong Q3 performance.

Source: VietstockFinance

|

BHI disappointed, having been the first company to exceed its full-year profit target after just 6 months, only to see its fortunes reverse in Q3, with losses surpassing the profits achieved in the first half. The 9-month result showed a pre-tax loss of VND 13 billion, requiring BHI to make a strong comeback in the final quarter to meet the profit target set by the Annual General Meeting.

In contrast, PVI, BLI, and BMI exceeded their profit targets after just 9 months, with results surpassing expectations.

– 10:00 28/11/2025

Banking Sector Profits Surge with Double-Digit Growth in First Nine Months of the Year

After the first nine months of 2025, most banks reported significant profit increases, even surpassing their targets, despite the pressure of narrowing net interest margins due to persistently low interest rates.