Tan Van Real Estate

The Q4/2023 financial statements show that Construction Corporation No.1 – JSC (UPCoM: CC1) has completed the transfer of its entire investment capital in Tan Van Real Estate JSC. The book value at the beginning of 2023 is 36 billion VND, equal to the transfer price of 2 million shares that CC1 received in 2022. The company stated that due to its unlisted status, it cannot determine the reasonable value of this investment.

|

Regarding the Tan Van Tower project, the latest update in mid-2023 is the decision of the provincial People’s Committee allowing Tan Van Real Estate to change the land use purpose from commercial residential to high-rise condominium Tan Van Tower. At the same time, the company is permitted to change the land use purpose of over 7.8 thousand square meters of aquaculture land for the condominium project. The land use period is from 2019 to 2069. |

The transaction was carried out in January 2023 through CC1’s divestment of its subsidiary, CP1-Mekong Investment Construction JSC, thereby reducing CC1’s investment value in Tan Van Real Estate.

Tan Van Real Estate is the developer of the Tan Van Tower high-rise condominium (formerly known as Tan Van commercial residential area) with an area of 0.96 hectares in Tan Van Ward, Bien Hoa City. The company was established in 2019 as a limited liability company, headquartered in Tan Van Ward, Bien Hoa City, Dong Nai Province. The initial charter capital was 50 billion VND, contributed by two individuals: Mr. Pham Quang Minh (66%) and Mr. Nguyen Van Quan (who holds the position of Director and legal representative) (34%).

In May 2020, Mr. Minh divested all of his capital, and Mr. Pham Dinh Anh took his place. In December 2020, the company increased its charter capital to 100 billion VND, with Mr. Anh serving as Chairman and Director and legal representative. In January 2021, the company changed to JSC as it is known today, with Mr. Le Hong Nguyen holding the position of General Director and legal representative. The charter capital was raised to 356 billion VND, with the shareholders including Mr. Pham Dinh Anh (30%), Mr. Cao Trong Hoan (30%), Mr. Tran Hai Minh (20%), Mr. Tran Manh Hoan (10%), and Mr. Le Hong Nguyen (10%).

Divestment of related companies in the Saigon International Pediatric Hospital project

The resolution of CC1 on November 21, 2023 approved the transfer of its investment capital in Nhan Phuc Duc Investment JSC, CP1-Northern Construction and Investment JSC, and Vietnam Hoa Construction No.1 JSC.

As of December 31, 2023, CC1 has divested all of its 5.1 million shares in Nhan Phuc Duc (34% stake), with an original price of nearly 66 billion VND and an equity value of 62.3 billion VND; divested 24 million shares in CP1-Northern Construction, with an original price of 240 billion VND and an equity value of nearly 240 billion VND; divested 180 thousand shares in Vietnam Hoa Construction No.1, with a book value of over 2.1 billion VND.

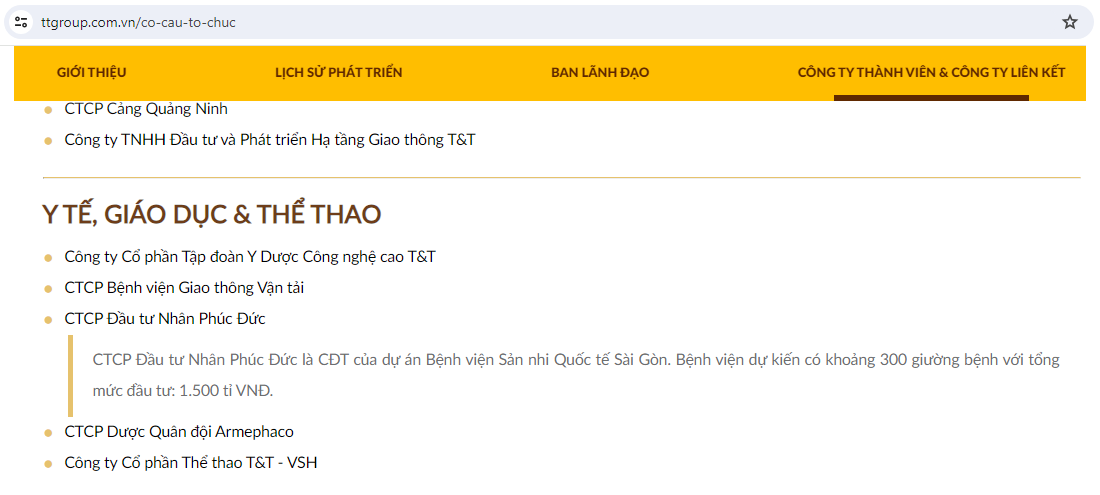

In this list, Nhan Phuc Duc is noteworthy, as it is a construction company involved in civil and medical projects. According to the official website of T&T Group, Nhan Phuc Duc is one of the group’s subsidiaries, with the introduction: “Nhan Phuc Duc Investment JSC is the investor of the Saigon International Pediatric Hospital project. The hospital is expected to have around 300 beds with a total investment of 1,500 billion VND.”

Screenshot

|

Nhan Phuc Duc first appeared in CC1’s 2016 financial statements with an initial original price of 64.4 billion VND, which slightly increased to nearly 66 billion VND in the following year, equivalent to a 34.51% ownership ratio. This figure remained unchanged until the end of 2017, and then the ratio decreased to 34% until CC1 divested. Reports show that despite holding for many years, this affiliate company did not contribute any dividends or profits to CC1.

According to research, Nhan Phuc Duc was established in 2010, headquartered in District 1, Ho Chi Minh City. If calculated based on the ownership ratio that CC1 has just divested, the company has a charter capital of 150 billion VND. Currently, Mr. Le Bao Anh (Vice Chairman of the Board of Directors and General Director of CC1) is the General Director and legal representative; Mr. Luong Tran Hoang Nhat is the Chairman of the Board of Directors.

Mr. Nhat is known as the founder of DIA-B Medical Technology JSC, a company specializing in diabetes solutions. In addition, he is also involved in several other companies such as Value Based Healthcare JSC, Healthcare Technology Investment JSC, and VBHC Investment JSC.

Mr. Luong Tran Hoang Nhat. Photo: TTO

|

Investment revenue reaches a record high in 2023

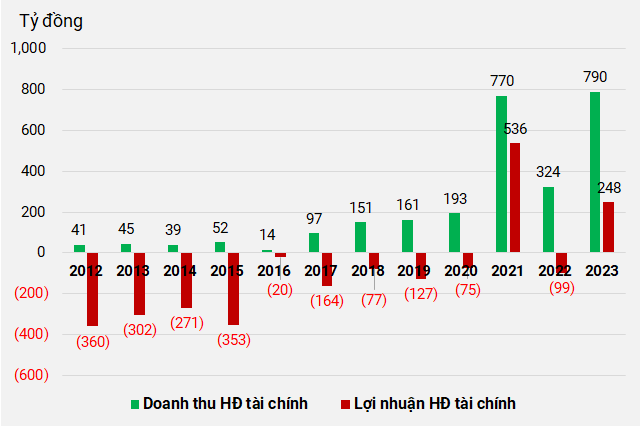

Thanks to the divestment of its subsidiaries, CC1 achieved a financial operating revenue of 790 billion VND in 2023, the highest in its history. Financial profit amounted to 248 billion VND, while the previous year had a financial loss of nearly a hundred billion VND. This is also the second year CC1 has had financial profit since 2012. The most recent profit was in 2021, when CC1 earned a significant amount from selling investments in affiliated companies and receiving increased dividends.

|

Financial activities of CC1 from 2012 to 2023 only recorded profits in 2021 and 2023, while other years suffered losses

Source: VietstockFinance

|

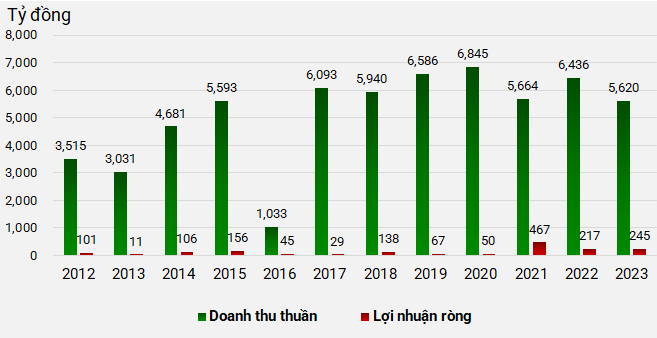

CC1 achieved a net profit of 245 billion VND in 2023, a 13% increase compared to the previous year, despite a 13% decrease in revenue. This is also the second-highest profit level after 2021, especially considering the challenges faced by the construction industry last year, with many companies experiencing losses or declining profits.

|

Business results of CC1 from 2012 to 2023

Source: VietstockFinance

|

By Thu Minh