|

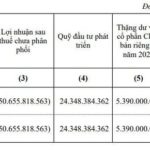

The assembly unanimously approved key resolutions, including the adjustment to increase the 2025 business plan compared to the previously presented plan at the Annual General Meeting. The specific adjusted plan includes pre-tax profit of 6,500 billion VND and post-tax profit of 5,200 billion VND, marking a 433% increase over the plan approved by the Annual General Meeting.

|

In addition to the plan adjustment, another notable resolution passed by the assembly was the capital increase plan, offering additional shares to existing shareholders at a ratio of 10:6. The expected number of additional shares to be issued is 918,857,914. The offering price is set at 12,000 VND per share. The total expected proceeds from this offering are 11,026,294,968,000 VND. Following the capital increase, the new projected capital will be 24.5 trillion VND.

The proceeds from the offering will be used to supplement operating capital, specifically to invest in the Cryptocurrency Asset Trading Platform Company VIX, and to enhance proprietary trading capabilities and margin lending activities.

The capital increase at this time is essential for the company to seize market opportunities, strengthen core business operations, meet the demands of a rapidly growing customer base, and position itself for market upgrades.

Furthermore, the assembly approved the resignation and replacement of one Board of Directors member for the 2025–2030 term. Specifically, the assembly accepted the resignation of Mr. Truong Ngoc Lan from his position as a Board member. This decision was made to allow him to focus on his role as CEO, ensuring a clear separation between the management functions of the Board and the executive functions of the CEO. Mr. Truong Ngoc Lan will continue to serve as CEO and the legal representative of VIX Securities. The newly elected member is Mr. Phan Duc Linh, who brings over 20 years of experience in technology and management.

Beyond the approved resolutions, the assembly’s presiding committee addressed shareholder inquiries. In response to questions about the feasibility of achieving the adjusted plan in the current market conditions, the committee expressed the Board and management’s commitment to meeting the plan approved at the assembly. Regarding the company’s involvement in the digital asset market and its preparedness, the committee confirmed that VIX will participate and has already selected a technology partner to enter this market.

Services

– 12:00 28/11/2025

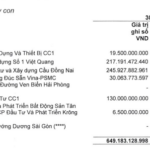

Consecutive Capital Injection Denials by CC1 for Subsidiary and Affiliated Companies

Leading construction conglomerate No. 1 Corporation – JSC (UPCoM: CC1) is demonstrating a clear strategic shift in its portfolio restructuring by halting further capital injections into several subsidiaries, despite their recent establishment.

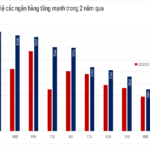

Dual Momentum: SHB’s Capital Raise Strategy and Foreign Investment Attraction Opportunities

SHB’s upcoming capital increase strategy is poised to propel the bank into the top 4 private banks by charter capital, solidifying its competitive edge through enhanced financial strength. Additionally, SHB is anticipated to join the FTSE Russell global equity index basket once Vietnam achieves its upgrade to emerging market status. These dual catalysts collectively fuel SHB’s potential for exceptional growth in the foreseeable future.

Unveiling the Two New ‘Capital Giants’ in the Banking Sector

In the coming period, two prominent banks are set to join the exclusive club of financial institutions with chartered capital surpassing the 50,000 billion VND threshold.