Bitcoin, the leading cryptocurrency. (Image: Reuters/TTXVN)

|

In recent weeks, the cryptocurrency market has experienced a significant upheaval as Bitcoin, the most renowned digital currency, plummeted from its record high of $126,000 to below $80,500 on November 28th.

This marks a staggering loss of over one-third since its peak in October 2025, signaling a severe volatility cycle following months of meteoric price increases.

This is not the first time Bitcoin has shocked investors with its dramatic declines.

Previously, after Donald Trump’s inauguration as U.S. President, Bitcoin maintained levels above $100,000 but unexpectedly dropped to $80,000 in April 2025 following tariff announcements, before rebounding to reach its October peak.

This scenario echoes 2021, when Bitcoin surpassed $60,000 for the first time, only to crash to nearly $15,000 by late 2022 after the collapse of FTX, once a pillar in the crypto industry.

Experts suggest cryptocurrencies now serve as a “barometer” for investor risk sentiment. The recent downturn underscores the market’s vulnerability to economic instability and macroeconomic policy shifts.

Bitcoin now behaves like a highly speculative tech stock, reacting sharply to Federal Reserve announcements and Nasdaq fluctuations. During turmoil, investors swiftly exit risky assets, starting with cryptocurrencies.

Beyond Bitcoin, other digital currencies have also faced downward pressure. Ether, the second-most popular cryptocurrency and Ethereum’s backbone, has fallen 40% since its August 2015 peak. Solana is down 30% year-to-date, while Binance’s BNB has lost 35% since its October high.

Dogecoin, known for its extreme volatility, has dropped over 50% in 11 months, and Litecoin has shed 20% since September 2025. Ripple’s XRP has erased its 2025 gains. These coins typically surge in summer, peak in early fall, and correct sharply by late fall.

This decline coincides with global financial markets’ concerns about potential “bubbles” in tech stocks and artificial intelligence sectors. Investors, focusing on risk management, are reducing exposure to volatile assets like cryptocurrencies to safeguard portfolios.

The story of Bitcoin and other digital currencies highlights the crypto market’s inherent volatility and dependence on investor sentiment and macroeconomic factors. Investors must recognize that historic highs do not guarantee long-term stability, making risk management critical in this space.

By Đào Dũng

– 20:04 30/11/2025

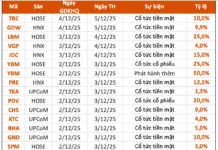

Gelex Shares Hit Upper Limit Post Major Announcement

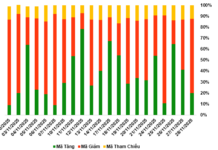

The market was awash with green today (26/11) as the VN-Index surged 20 points. A standout performance came from the Gelex group, whose shares skyrocketed to their daily limit following news of a subsidiary IPO.

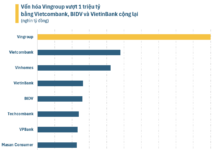

Digital Treasury Firms Struggle Amid Market Sell-Off

Amidst a market downturn that has wiped out $1 trillion from the cryptocurrency sector, companies holding digital assets are liquidating their portfolios in a desperate bid to stabilize plummeting stock prices. The once-booming trend of crypto asset treasuries is now unraveling as widespread sell-offs force firms to reevaluate their strategies.