On December 2, 2025, MB Securities Joint Stock Company (MBS) and Dragon Capital Vietnam Fund Management Joint Stock Company (DCVFM) officially signed a cooperation agreement to distribute Dragon Capital’s open-ended funds on the MFUND trading platform. This milestone marks a significant step in MBS’s strategy to expand its investment product ecosystem, while enabling investors to access professional, transparent, and long-term-oriented fund products more easily.

In recent years, open-ended funds have increasingly become a preferred investment channel for individual investors in Vietnam, offering a transparent and professional alternative to traditional savings or stock trading.

As of November 2025, the total assets under management (AUM) of fund management companies in Vietnam reached approximately 806 trillion VND (over 30 billion USD), equivalent to about 6% of GDP. This ratio remains modest compared to other Asian countries: over 40% in Malaysia, nearly 50% in South Korea, and around 30% in Thailand. The gap highlights significant growth potential for open-ended funds within individual investors’ asset portfolios.

Additionally, Vietnam currently has around 2.5 million fund accounts, representing only 2.5% of the population. This figure is significantly lower than mature markets such as China (~50%), South Korea (~20%), and the United States (~54% of households). This presents an opportunity for financial institutions to promote open-ended funds to a broader investor base.

Notably, the domestic fund segment has achieved a compound annual growth rate (CAGR) of over 30% in the past decade. Regulators have set an ambitious target: to increase the net asset value (NAV) of securities investment funds to 5% of GDP—equivalent to over 30 billion USD by 2030—and aim for double-digit growth by 2035.

With 25 years of experience in the securities market, MBS leverages its strengths in digital technology and investment advisory services. Partnering with Dragon Capital Vietnam, a leading asset manager with over 30 years of experience and nearly 6 billion USD in AUM, the collaboration is expected to drive new growth for Vietnam’s open-ended fund market.

The combination of Dragon Capital’s reputable fund management expertise and MBS’s advanced investment technology platform is crucial for bringing fund products closer to individual investors, thereby raising sustainable investment standards in the market.

Through this partnership, investors can trade Dragon Capital’s flagship open-ended funds on MBS’s MFUND platform, including:

Dynamic Securities Investment Fund (DCDS)

Dividend-Focused Equity Investment Fund (DCDE)

Fixed Income Enhanced Yield Bond Fund (DCIP)

Bond Investment Fund (DCBF)

These funds are well-suited for investors seeking long-term accumulation solutions, effective risk management, and sustainable growth.

MFUND is MBS’s new online fund certificate trading platform, offering a seamless investment experience from account opening and fund trading to performance tracking. Its intuitive interface, transparency, and multi-device accessibility enable investors to manage their portfolios anytime, anywhere (https://chungkhoanmb.go.link/fpFsc). The platform underscores MBS’s commitment to developing an intelligent investment ecosystem, leveraging technology to enhance customer experience and investment efficiency.

Ms. Lương Thị Mỹ Hạnh, Director of Domestic Asset Management at Dragon Capital, shared: “Collaborating with MBS is strategically significant for Dragon Capital Vietnam, both in terms of timing and partner positioning. The fund industry has seen robust growth in recent years, and we are at a golden moment for a breakthrough development phase. The partnership between Dragon Capital, with its long-standing fund management expertise, and MBS, with its billion-dollar capitalization and market-leading business potential, will deliver exceptional investment opportunities and experiences to customers within MBS’s extensive ecosystem. This will tangibly contribute to the growth of Vietnam’s financial market.”

At the signing ceremony, Ms. Phạm Thị Kim Ngân, Deputy CEO of MBS, emphasized: “Through this collaboration, Dragon Capital’s open-ended funds will be widely distributed on MBS’s MFUND platform. We believe the synergy between reputable fund management capabilities and technological prowess will create tangible value for our customers.”

The MBS-Dragon Capital partnership further strengthens their long-standing strategic relationship, opening opportunities for developing more specialized investment products in the future. Beyond open-ended funds, both parties plan to expand cooperation to ETF distribution, diversifying investor options and promoting long-term, sustainable investment strategies.

This collaboration is expected to deliver professional investment solutions, helping Vietnamese investors achieve long-term financial stability.

MB Securities Joint Stock Company (MBS)

Established in 2000, MBS—a subsidiary of Military Commercial Joint Stock Bank (MB)—has an equity capital of approximately 78 trillion VND. The company is among Vietnam’s billion-dollar market-cap securities firms, recognized by HNX as a top-performing listed company in corporate governance (2024–2025) and ranked by Forbes in the Top 50 Best Listed Companies in Vietnam 2025. MBS’s stock is also included in MSCI’s largest frontier index, reflecting its strong financial foundation and appeal to domestic and international investors.

Website: https://mbs.com.vn/

Dragon Capital Vietnam Fund Management Joint Stock Company

Dragon Capital Vietnam is Vietnam’s largest and most established fund management company, with over 30 years of experience managing and advising on nearly 6 billion USD in assets for individual investors, private equity funds, pension funds, and sovereign wealth funds.

Dragon Capital invests across various sectors, including securities, private equity, and renewable energy, supported by a skilled team of portfolio managers, economists, traders, legal experts, and investment researchers. Its open-ended funds consistently rank among the market’s top performers. Notably, Dragon Capital was the first Vietnamese fund manager to successfully launch a voluntary supplementary pension program for businesses and employees.

Website: https://www.dragoncapital.com.vn/.

Vietnam’s Recovery Phase: Corporate Profits Poised to Rise, Says Dominic Scriven (Dragon Capital)

At the Annual Listed Companies Conference held on the afternoon of December 3rd, Mr. Dominic Scriven, Chairman of the Board of Directors of Dragon Capital Fund Management JSC, delivered a keynote address. His presentation focused on assessing the global and Vietnamese macroeconomic landscape, emphasizing the critical roles of policy, public investment, and capital markets. Additionally, he provided insightful analysis and predictions regarding the Vietnamese stock market.

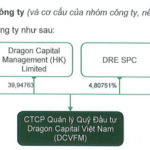

Dragon Capital Seeks to List Shares on UPCoM

On December 1st, Dragon Capital Vietnam Fund Management JSC (Dragon Capital – DCVFM) announced a Board of Directors resolution approving the registration of centralized custody of shares with the Vietnam Securities Depository (VSD). Simultaneously, the company has registered for trading its shares on the UPCoM system.

VIDEO: Dragon Capital Chairman Discusses Benefits of 5 Million Household Businesses Upgrading to Enterprises

The transformation of sole proprietorships into formal businesses has the potential to contribute a 1% annual increase to GDP over the next three years.

Prominent Investment Fund Movements in the Last Week of November

Last week (November 24-28, 2025), investment funds predominantly disclosed prior transactions, with selling activities taking the lead. Building on the upward momentum from the previous week, the VN-Index continued its ascent in the final week of November 2025, edging closer to the 1,700-point mark.